The Hartford 2011 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

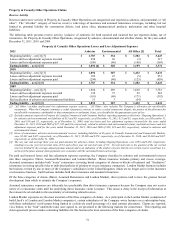

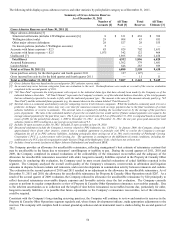

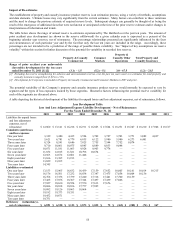

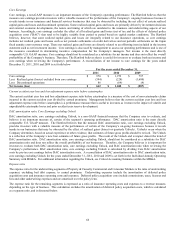

As of December 31, 2011, goodwill has been allocated to the following reporting units:

Segment

Goodwill

Goodwill in

Corporate

Total

Group Benefits

$

—

$

138

$

138

Consumer Markets

119

—

119

Individual Life

224

118

342

Retirement Plans

87

69

156

Mutual Funds

159

92

251

Total

$

589

$

417

$

1,006

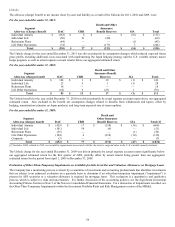

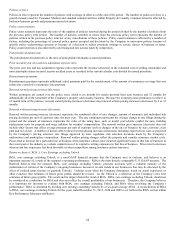

As of December 31, 2010, goodwill has been allocated to the following reporting units:

Segment

Goodwill

Goodwill in

Corporate

Total

Hartford Financial Products within Property & Casualty Commercial

$

30

$

—

$

30

Group Benefits

—

138

138

Consumer Markets

119

—

119

Individual Life

224

118

342

Retirement Plans

87

69

156

Mutual Funds

159

92

251

Federal Trust Corporation within Corporate

—

15

15

Total

$

619

$

432

$

1,051

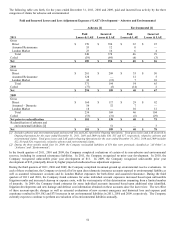

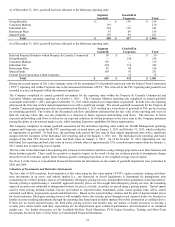

During the second quarter of 2011, the Company wrote off the remaining $15 of goodwill associated with the Federal Trust Corporation

(“FTC”) reporting unit within Corporate due to the announced divestiture of FTC. The write-off of the FTC reporting unit goodwill was

recorded as a loss on disposal within discontinued operations.

The Company completed its annual goodwill assessment for the reporting units within the Property & Casualty Commercial and

Consumer Markets operating segments on October 1, 2011. The Consumer Markets reporting unit completed its annual goodwill

assessment on October 1, 2011 and again on October 31, 2011 which resulted in no impairment of goodwill. In both tests, the reporting

unit passed the first step of their annual impairment tests with a significant margin. The annual goodwill assessment for the Property &

Casualty Commercial reporting unit that was performed on October 1, 2011 resulted in a write-down of goodwill of $30, pre-tax leaving

no remaining goodwill. The results of the discounted cash flow calculations indicated that the fair value of the reporting unit was less

than the carrying value; this was due primarily to a decrease in future expected underwriting cash flows. The decrease in future

expected underwriting cash flows is driven by an expected reduction in written premium in the short term as the Company maintains

pricing discipline in a downward market cycle, while retaining long term capabilities for future opportunities.

The Company completed its annual goodwill assessment for the individual reporting units within the Wealth Management operating

segment and Corporate, except for the FTC reporting unit, as noted above, on January 1, 2011 and October 31, 2011, which resulted in

no impairment of goodwill. In both tests, the reporting units passed the first step of their annual impairment tests with a significant

margin with the exception of the Individual Life reporting unit at the January 1, 2011 test. The Individual Life reporting unit had a

margin of less than 10% between fair value and book value on January 1, 2011. As of the October 31, 2011 impairment test, the

Individual Life reporting unit had a fair value in excess of book value of approximately 15%, a modest improvement from the January 1,

2011 results due to improving cost of capital.

The fair value of the Individual Life reporting unit is based on discounted cash flows using earnings projections on in force business and

future business growth. There could be a positive or negative impact on the result of step one in future periods if assumptions change

about the level of economic capital, future business growth, earnings projections or the weighted average cost of capital.

See Note 8 of the Notes to Consolidated Financial Statements for information on the results of goodwill impairment tests performed in

2010 and 2009.

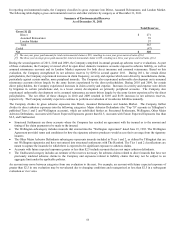

Valuation of Investments and Derivative Instruments

The fair value of AFS securities, fixed maturities, at fair value using the fair value option (“FVO”), equity securities, trading, and short-

term investments in an active and orderly market (i.e., not distressed or forced liquidation) is determined by management after

considering one of three primary sources of information: third-party pricing services, independent broker quotations or pricing matrices.

Security pricing is applied using a “waterfall” approach whereby prices are first sought from third-party pricing services, the remaining

unpriced securities are submitted to independent brokers for prices, or lastly, securities are priced using a pricing matrix. Typical inputs

used by these pricing methods include, but are not limited to, reported trades, benchmark yields, issuer spreads, bids, offers, and/or

estimated cash flows, prepayments speeds and default rates. Based on the typical trading volumes and the lack of quoted market prices

for fixed maturities, third-party pricing services will normally derive the security prices through recent reported trades for identical or

similar securities making adjustments through the reporting date based upon available market observable information as outlined above.

If there are no recent reported trades, the third party pricing services and brokers may use matrix or model processes to develop a

security price where future cash flow expectations are developed based upon collateral performance and discounted at an estimated

market rate. For further discussion, see the Available-for-Sale, Fixed Maturities, FVO, Equity Securities, Trading, and Short-Term

Investments Section in Note 4 of the Notes to Consolidated Financial Statements.