The Hartford 2011 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

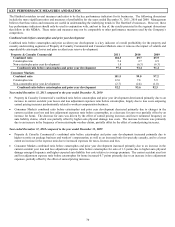

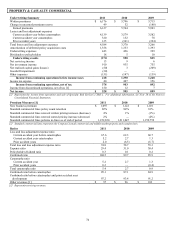

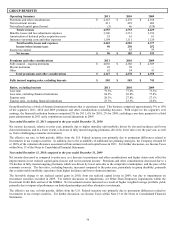

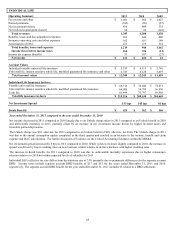

GROUP BENEFITS

Operating Summary

2011

2010

2009

Premiums and other considerations

$

4,147

$

4,278

$

4,350

Net investment income

411

429

403

Net realized capital gains (losses)

(3)

46

(124)

Total revenues

4,555

4,753

4,629

Benefits, losses and loss adjustment expenses

3,306

3,331

3,196

Amortization of deferred policy acquisition costs

55

61

61

Insurance operating costs and other expenses

1,104

1,111

1,120

Total benefits, losses and expenses

4,465

4,503

4,377

Income before income taxes

90

250

252

Income tax expense

—

65

59

Net income

$

90

$

185

$

193

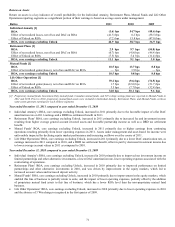

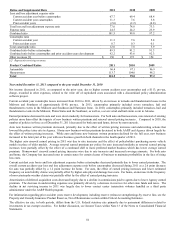

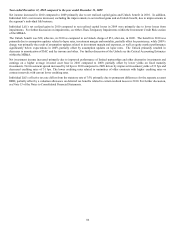

Premiums and other considerations

2011

2010

2009

Fully insured – ongoing premiums

$

4,036

$

4,166

$

4,309

Buyout premiums

49

58

—

Other

62

54

41

Total premiums and other considerations

$

4,147

$

4,278

$

4,350

Fully insured ongoing sales, excluding buyouts

$

505

$

583

$

741

Ratios, excluding buyouts

2011

2010

2009

Loss ratio

79.5%

77.6%

73.5%

Loss ratio, excluding financial institutions

84.5%

82.8%

77.8%

Expense ratio

28.3%

27.8%

27.1%

Expense ratio, excluding financial institutions

23.7%

23.3%

22.6%

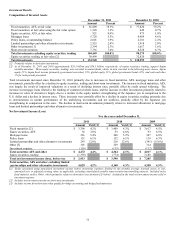

Group Benefits has a block of financial institution business that is experience rated. This business comprised approximately 9% to 10%

of the segment’ s 2011, 2010 and 2009 premiums and other considerations (excluding buyouts). With respect to the segment’ s core

earnings, the financial institution business comprised 2% for 2011, 6% for 2010, 2% for 2009, excluding a one-time payment to a third

party administrator in 2011 and a commission accrual adjustment in 2009.

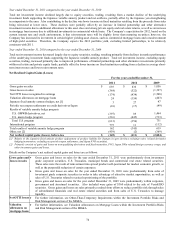

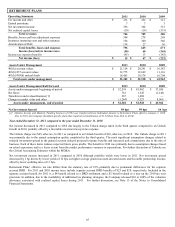

Year ended December 31, 2011 compared to the year ended December 31, 2010

Net income decreased, relative to prior year, primarily due to higher mortality and morbidity driven by elevated incidence and lower

claim terminations, and to a lesser extent, a decrease in fully insured ongoing premiums, driven by lower sales over the past year, as well

as, from a challenging economic environment.

The effective tax rate, in both periods, differs from the U.S. Federal statutory rate primarily due to permanent differences related to

investments in tax exempt securities. In addition, due to the availability of additional tax planning strategies, the Company released $5

or 100% of the valuation allowance associated with investment realized capital losses in 2011. For further discussion, see Income Taxes

within Note 13 of the Notes to Consolidated Financial Statements.

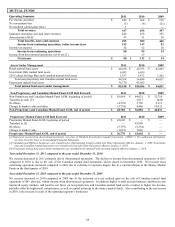

Year ended December 31, 2010 compared to the year ended December 31, 2009

Net income decreased as compared to prior year, as a decrease in premiums and other considerations and higher claim costs offset the

improvements in net realized capital gains (losses) and net investment income. Premiums and other considerations decreased due to a

3% decline in fully insured ongoing premiums which was driven by lower sales due to the competitive marketplace, and the pace of the

economic recovery. The loss ratio, excluding buyouts, increased compared to the prior year, particularly in group disability, primarily

due to unfavorable morbidity experience from higher incidence and lower claim terminations.

The favorable change to net realized capital gains in 2010, from net realized capital losses in 2009, was due to impairments on

investment securities recorded in 2009. For further discussion on impairments, see Other-Than-Temporary Impairments within the

Investment Credit Risk section of the MD&A. Net investment income increased as a result of higher weighted average portfolio yields

primarily due to improved performance on limited partnerships and other alternative investments.

The effective tax rate, in both periods, differs from the U.S. Federal statutory rate primarily due to permanent differences related to

investments in tax exempt securities. For further discussion, see Income Taxes within Note 13 of the Notes to Consolidated Financial

Statements.