The Hartford 2011 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

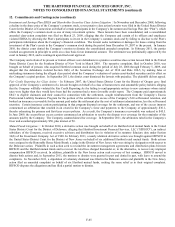

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-69

13. Income Tax (continued)

The Company has recorded a deferred tax asset valuation allowance that is adequate to reduce the total deferred tax asset to an amount

that will be more likely than not realized. The deferred tax asset valuation allowance was $95, relating mostly to foreign net operating

losses as of December 31, 2011 and was $173 as of December 31, 2010. In assessing the need for a valuation allowance, management

considered future taxable temporary difference reversals, future taxable income exclusive of reversing temporary differences and

carryforwards, taxable income in open carry back years, as well as other tax planning strategies. These tax planning strategies include

holding a portion of debt securities with market value losses until recovery, altering the level of tax exempt securities, selling

appreciated securities to offset capital losses, business considerations such as asset-liability matching, and the sales of certain corporate

assets. Management views such tax planning strategies as prudent and feasible, and would implement them, if necessary, to realize the

deferred tax asset. Based on the availability of additional tax planning strategies identified in the second quarter of 2011, the Company

released $86, or 100% of the valuation allowance associated with investment realized capital losses. Future economic conditions and

debt market volatility, including increases in interest rates, can adversely impact the Company’ s tax planning strategies and in particular

the Company’ s ability to utilize tax benefits on previously recognized realized capital losses.

Included in the Company's December 31, 2011 $1.4 billion net deferred tax asset is $1.8 billion relating to items treated as ordinary for

federal income tax purposes, and a $361 net deferred tax liability for items classified as capital in nature. The $361 capital items are

comprised of $847 of gross deferred tax assets related to realized capital losses and $1,208 of gross deferred tax liabilities related to net

unrealized capital gains.

As of December 31, 2011 the Company had a current income tax receivable of $459, which is net of a $46 payable related to Japan and

due to a foreign jurisdiction. As of December 31, 2010 the company had a current income tax payable of $78, of which $30 was related

to Japan and payable to a foreign jurisdiction.

The Company or one or more of its subsidiaries files income tax returns in the U.S. federal jurisdiction, and various state and foreign

jurisdictions. The Company is no longer subject to U.S. federal, state and local, or non-U.S. income tax examinations for years prior to

2007. The audit of the years 2007-2009 commenced during 2010 and is expected to conclude by the end of 2012, with no material

impact on the consolidated financial condition or results of operations. In addition, in the second quarter of 2011 the Company recorded

a tax benefit of $52 as a result of a resolution of a tax matter with the IRS for the computation of the dividends-received deduction

(“DRD”) for years 1998, 2000 and 2001. Management believes that adequate provision has been made in the financial statements for

any potential assessments that may result from tax examinations and other tax-related matters for all open tax years.

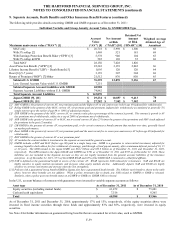

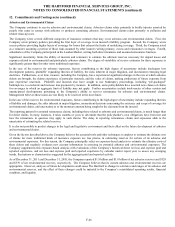

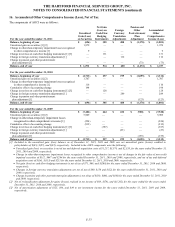

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows:

For the years ended December 31,

2011

2010

2009

Balance, at January 1

$

48

$

48

$ 91

Additions based on tax positions related to the current year

—

—

—

Additions for tax positions for prior years

—

—

—

Reductions for tax positions for prior years

—

—

(35)

Settlements

—

—

(8)

Balance, at December 31

$

48

$

48

$ 48

The entire balance of the unrecognized tax benefit, if it were recognized, would affect the effective tax rate in the period it is released.

The Company classifies interest and penalties (if applicable) as income tax expense in the financial statements. During the year ended

December 31, 2011, the Company recognized interest income of $5, and during the years ended December 31, 2010 and 2009, the

Company recognized interest expense of $2 and $7, respectively. The Company had approximately $6 and $1 of interest receivable

accrued at December 31, 2011 and 2010, respectively. The Company does not believe it would be subject to any penalties in any open

tax years and, therefore, has not booked any accrual for penalties.

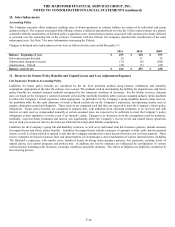

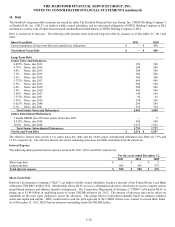

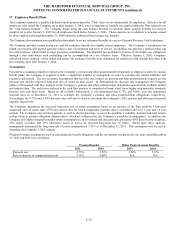

A reconciliation of the tax provision at the U.S. Federal statutory rate to the provision for income taxes is as follows:

For the years ended December 31,

2011

2010

2009

Tax provision at U.S. Federal statutory rate

$

81

$

825

$

(602)

Tax-exempt interest

(148)

(152)

(149)

Dividends received deduction

(206)

(154)

(188)

Nondeductible costs associated with warrants

—

—

78

Valuation allowance

(78)

87

30

Goodwill

—

—

12

Other

5

6

(19)

Provision for income taxes

$

(346)

$

612

$

(838)