The Hartford 2011 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.36

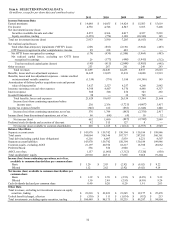

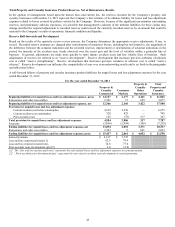

Income Taxes

The effective tax rates for 2011, 2010 and 2009 were (150%), 26%, and 49%, respectively. The differences between the effective rate

and the U.S. statutory rate of 35% for 2011, 2010 and 2009 were due principally to tax-exempt interest earned on invested assets and the

DRD. These items decreased tax expense on the 2011 and 2010 pre-tax income and increased the tax benefit on the 2009 pre-tax loss.

The 2011 effective tax rate also includes a deferred tax asset valuation allowance decrease, and the 2010 and 2009 effective tax rates

include a deferred tax asset valuation allowance increase. The 2009 effective tax rate also includes the tax effect of non-deductible costs

associated with warrants.

The separate account DRD is estimated for the current year using information from the most recent return, adjusted for current year

equity market performance and other appropriate factors, including estimated levels of corporate dividend payments and level of policy

owner equity account balances. The actual current year DRD can vary from estimates based on, but not limited to, changes in eligible

dividends received in the mutual funds, amounts of distributions from these mutual funds, amounts of short-term capital gains at the

mutual fund level and the Company’ s taxable income before the DRD. The Company recorded benefits of $201, $145 and $181 related

to the DRD in the years ended December 31, 2011, 2010 and 2009, respectively. These amounts included benefits (charges) related to

prior years' tax returns of $3, $(3) and $29 in 2011, 2010 and 2009, respectively.

In Revenue Ruling 2007-61, issued on September 25, 2007, the IRS announced its intention to issue regulations with respect to certain

computational aspects of the DRD on separate account assets held in connection with variable annuity contracts. Revenue Ruling 2007-

61 suspended Revenue Ruling 2007-54, issued in August 2007 that purported to change accepted industry and IRS interpretations of the

statutes governing these computational questions. No regulations have been issued to date. Any regulations that the IRS may ultimately

propose for issuance in this area will be subject to public notice and comment, at which time insurance companies and other members of

the public will have the opportunity to raise legal and practical questions about the content, scope and application of such regulations.

As a result, the ultimate timing and substance of any such regulations are unknown, but they could result in the elimination of some or

all of the separate account DRD tax benefit that the Company receives. Management believes that it is highly likely that any such

regulations would apply prospectively only.

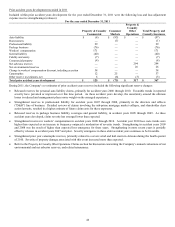

The Company receives a foreign tax credit for foreign taxes paid including payments from its separate account assets. This credit

reduces the Company’ s U.S. tax liability. The separate account foreign tax credit is estimated for the current year using information

from the most recent filed return, adjusted for the change in the allocation of separate account investments to the international equity

markets during the current year. The actual current year foreign tax credit can vary from the estimates due to actual foreign tax credits

passed through from the mutual funds. The Company recorded benefits of $11, $4 and $16 related to the separate account foreign tax

credit in the years ended December 31, 2011, 2010 and 2009, respectively. These amounts included benefits (charges) related to prior

years’ tax returns of $2, $(4) and $3 in 2011, 2010 and 2009, respectively.

The Company’ s unrecognized tax benefits were unchanged during 2011 and 2010, remaining at $48 as of December 31, 2011, 2010 and

2009. This entire amount, if it were recognized, would affect the effective tax rate in the period it is released.