The Hartford 2011 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118

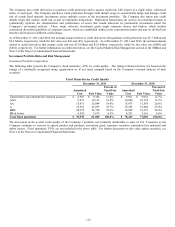

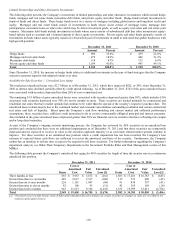

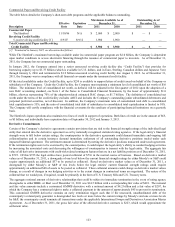

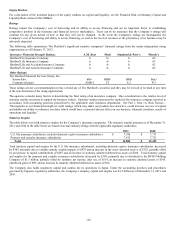

Limited Partnerships and Other Alternative Investments

The following table presents the Company’ s investments in limited partnerships and other alternative investments which include hedge

funds, mortgage and real estate funds, mezzanine debt funds, and private equity and other funds. Hedge funds include investments in

funds of funds and direct funds. These hedge funds invest in a variety of strategies including global macro and long/short credit and

equity. Mortgage and real estate funds consist of investments in funds whose assets consist of mortgage loans, mortgage loan

participations, mezzanine loans or other notes which may be below investment grade, as well as equity real estate and real estate joint

ventures. Mezzanine debt funds include investments in funds whose assets consist of subordinated debt that often incorporates equity-

based options such as warrants and a limited amount of direct equity investments. Private equity and other funds primarily consist of

investments in funds whose assets typically consist of a diversified pool of investments in small to mid-sized non-public businesses with

high growth potential.

December 31, 2011

December 31, 2010

Amount

Percent

Amount

Percent

Hedge funds

$

896

35.4%

$

439

22.8%

Mortgage and real estate funds

479

18.9%

406

21.2%

Mezzanine debt funds

118

4.7%

132

6.9%

Private equity and other funds

1,039

41.0%

941

49.1%

Total

$

2,532

100.0%

$

1,918

100.0%

Since December 31, 2010, the increase in hedge funds relates to additional investments in the type of fund strategies that the Company

expects to generate superior risk-adjusted returns over time.

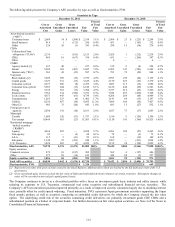

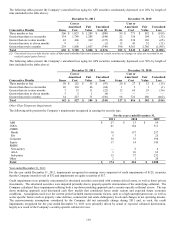

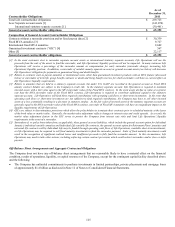

Available-for-Sale Securities — Unrealized Loss Aging

The total gross unrealized losses were $2.7 billion as of December 31, 2011, which have improved $822, or 24%, from December 31,

2010 as interest rates declined, partially offset by credit spread widening. As of December 31, 2011, $743 of the gross unrealized losses

were associated with securities depressed less than 20% of cost or amortized cost.

The remaining $1.9 billion of gross unrealized losses were associated with securities depressed greater than 20%, which includes $156

associated with securities depressed over 50% for twelve months or more. These securities are backed primarily by commercial and

residential real estate that have market spreads that continue to be wider than the spreads at the security’ s respective purchase date. The

unrealized losses remain largely due to the continued market and economic uncertainties surrounding residential and certain commercial

real estate and lack of liquidity. Based upon the Company’ s cash flow modeling and current market and collateral performance

assumptions, these securities have sufficient credit protection levels to receive contractually obligated principal and interest payments.

Also included in the gross unrealized losses depressed greater than 20% are financial services securities that have a floating-rate coupon

and/or long-dated maturities.

As part of the Company’ s ongoing security monitoring process, the Company has reviewed its AFS securities in an unrealized loss

position and concluded that there were no additional impairments as of December 31, 2011 and that these securities are temporarily

depressed and are expected to recover in value as the securities approach maturity or as real estate related market spreads continue to

improve. For these securities in an unrealized loss position where a credit impairment has not been recorded, the Company’ s best

estimate of expected future cash flows are sufficient to recover the amortized cost basis of the security. Furthermore, the Company

neither has an intention to sell nor does it expect to be required to sell these securities. For further information regarding the Company’ s

impairment analysis, see Other-Than-Temporary Impairments in the Investment Portfolio Risks and Risk Management section of this

MD&A.

The following table presents the Company’ s unrealized loss aging for AFS securities by length of time the security was in a continuous

unrealized loss position.

December 31, 2011 December 31, 2010

Items

Cost or

Amortized

Cost

Fair

Value

Unrealized

Loss [1]

Items

Cost or

Amortized

Cost

Fair

Value

Unrealized

Loss [1]

Three months or less

855

$

3,933

$

3,672

$

(261)

1,503

$

17,431

$

16,783

$

(643)

Greater than three to six months

485

2,617

2,517

(100)

115

732

690

(42)

Greater than six to nine months

224

1,181

1,097

(84)

91

438

397

(41)

Greater than nine to eleven months

42

106

95

(11)

42

185

169

(16)

Greater than twelve months

943

11,613

9,324

(2,218)

1,231

15,599

12,811

(2,754)

Total

2,549

$

19,450

$

16,705

$

(2,674)

2,982

$

34,385

$

30,850

$

(3,496)

[1] Unrealized losses exclude the fair value of bifurcated embedded derivative features of certain securities as changes in value are recorded in net

realized capital gains (losses).