The Hartford 2011 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.38

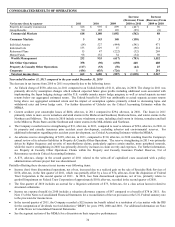

Wealth Management

Wealth Management currently focuses on driving profitable growth through innovation, product diversification and multichannel

distribution. Additionally, management is focused on improving profit margins and generating statutory surplus in each of its operating

segments. Individual Annuity continues to build out a portfolio of solutions to meet the needs of consumers planning for and living in

retirement. In 2011, several of these solutions were incorporated in the Personal Retirement Manager II (“PRM II”). While initial

indicators of sales activity have improved, the product's ultimate success in contributing to Individual Annuity growth will depend on,

among other things, our ability to market and distribute the product through new and existing distribution channels and market

receptivity to the new product features. Further, Individual Annuity diversified its suite of product solutions through the introduction of

a new fixed indexed annuity product. In addition, the Individual Annuity hedge program may contribute to earnings volatility since the

program generates mark to market gains and losses, while not all the underlying liabilities being hedged are marked to market.

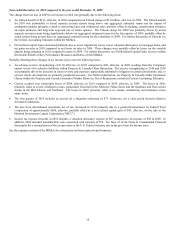

Individual Life continues to differentiate itself through the creative offering of riders. The recently launched LongevityAccess rider,

which allows policyholders to begin taking income from a policy at age 90, in tandem with the increasingly popular LifeAccess rider,

which allows policyholders to take distributions from their policies in cases of chronic illness, gives The Hartford an ability to help

people protect against premature death, outliving one's assets, or deteriorating health. In addition to building out distribution through

property & casualty agents, the Company continues to expand its distribution into career life insurance professionals through the

Monarch program. The Retirement Plans business continues to experience strong sales. In addition to our core 401(k) market, we have

seen growth in larger ($5-$25) corporate plans. The property & casualty channel will become an increasingly important area of focus

for us given our conviction that this channel is underpenetrated and well suited for this business. In the fourth quarter, we introduced

The Hartford Lifetime Income product, a patented income solution delivered through 401(k) plans, which provides a guaranteed

paycheck for life and has been a major catalyst for growth in this business. Our Mutual Fund business has been offering new funds to

improve our participation in asset classes where we see potential growth opportunities. In addition, the Company announced in the

fourth quarter of 2011 that Wellington Management Company, LLP (“Wellington Management”) will serve as the sole sub-advisor for

The Hartford’ s mutual funds, including equity and fixed income funds, pending a fund-by-fund review by The Hartford’ s mutual funds

board of directors.

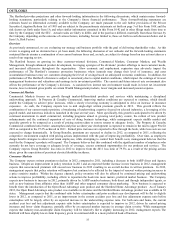

Runoff Operations

In the fourth quarter of 2011, The Hartford established a new Runoff Operations division consisting of Life Other Operations and

Property & Casualty Other Operations in order to better differentiate between our ongoing and runoff businesses. The objective of the

Runoff Operations division is to focus on managing profitability, improving capital efficiency and effectiveness, and limiting and

managing risk associated with the businesses residing in the division. Life Other Operations consists of the Hartford’ s international

variable annuity business, institutional annuities business and Private Placement Life Insurance business. The international variable

annuity business within Life Other Operations will continue to be a significant driver of earnings and earnings variability as a result of

the hedge program associated with the Company’ s international annuities. This hedge program generates mark to market gains and

losses while the underlying liabilities being hedged are primarily not marked to market resulting in unpredictable earnings volatility

period to period. Property & Casualty Other Operations, is focused on managing our asbestos environmental and other legacy

liabilities. The results of the annual ground up study of asbestos reserves and the annual environmental reserve update will be the

primary driver impacting the results for this business.