The Hartford 2011 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-40

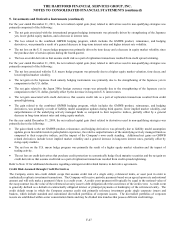

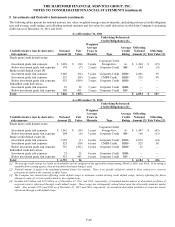

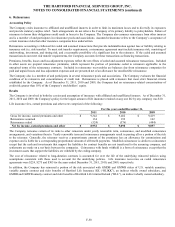

5. Investments and Derivative Instruments (continued)

Variable Interest Entities

The Company is involved with various special purpose entities and other entities that are deemed to be VIEs primarily as a collateral

manager and as an investor through normal investment activities, as well as a means of accessing capital. A VIE is an entity that either

has investors that lack certain essential characteristics of a controlling financial interest or lacks sufficient funds to finance its own

activities without financial support provided by other entities.

The Company performs ongoing qualitative assessments of its VIEs to determine whether the Company has a controlling financial

interest in the VIE and therefore is the primary beneficiary. The Company is deemed to have a controlling financial interest when it has

both the ability to direct the activities that most significantly impact the economic performance of the VIE and the obligation to absorb

losses or right to receive benefits from the VIE that could potentially be significant to the VIE. Based on the Company’ s assessment, if

it determines it is the primary beneficiary, the Company consolidates the VIE in the Company’ s Consolidated Financial Statements.

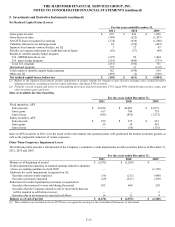

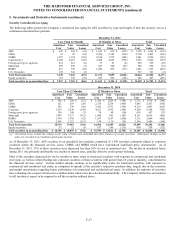

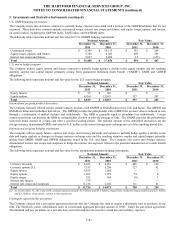

Consolidated VIEs

The following table presents the carrying value of assets and liabilities, and the maximum exposure to loss relating to the VIEs for

which the Company is the primary beneficiary. Creditors have no recourse against the Company in the event of default by these VIEs

nor does the Company have any implied or unfunded commitments to these VIEs. The Company’ s financial or other support provided

to these VIEs is limited to its investment management services and original investment.

December 31, 2011

December 31, 2010

Total

Assets

Total

Liabilities [1]

Maximum

Exposure

to Loss [2]

Total

Assets

Total

Liabilities [1]

Maximum

Exposure

to Loss [2]

CDOs [3]

$

491

$

471

$

29

$

729

$

393

$

289

Limited partnerships

7

—

7

14

1

13

Total

$

498

$

471

$

36

$

743

$

394

$

302

[1] Included in other liabilities in the Company’s Consolidated Balance Sheets.

[2] The maximum exposure to loss represents the maximum loss amount that the Company could recognize as a reduction in net investment income or

as a realized capital loss and is the cost basis of the Company’s investment.

[3] Total assets included in fixed maturities, AFS, and fixed maturities, FVO, in the Company’s Consolidated Balance Sheets.

CDOs represent structured investment vehicles for which the Company has a controlling financial interest as it provides collateral

management services, earns a fee for those services and also holds investments in the securities issued by these vehicles. Limited

partnerships represent one hedge fund for which the Company holds a majority interest in the fund as an investment.

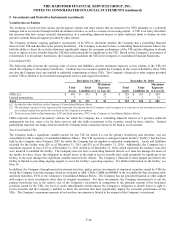

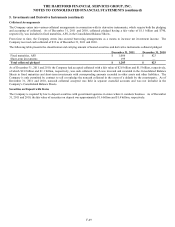

Non-Consolidated VIEs

The Company holds a significant variable interest for one VIE for which it is not the primary beneficiary and, therefore, was not

consolidated on the Company’ s Consolidated Balance Sheets. This VIE represents a contingent capital facility (“facility”) that has been

held by the Company since February 2007 for which the Company has no implied or unfunded commitments. Assets and liabilities

recorded for the facility were $28 as of December 31, 2011 and $32 as of December 31, 2010. Additionally, the Company has a

maximum exposure to loss of $3 as of December 31, 2011 and $4 as of December 31, 2010, which represents the issuance costs that

were incurred to establish the facility. The Company does not have a controlling financial interest as it does not manage the assets of

the facility nor does it have the obligation to absorb losses or the right to receive benefits that could potentially be significant to the

facility, as the asset manager has significant variable interest in the vehicle. The Company’ s financial or other support provided to the

facility is limited to providing ongoing support to cover the facility’ s operating expenses. For further information on the facility, see

Note 14.

In addition, the Company, through normal investment activities, makes passive investments in structured securities issued by VIEs for

which the Company is not the manager which are included in ABS, CDOs, CMBS and RMBS in the Available-for-Sale Securities table

and fixed maturities, FVO, in the Company’ s Consolidated Balance Sheets. The Company has not provided financial or other support

with respect to these investments other than its original investment. For these investments, the Company determined it is not the

primary beneficiary due to the relative size of the Company’ s investment in comparison to the principal amount of the structured

securities issued by the VIEs, the level of credit subordination which reduces the Company’ s obligation to absorb losses or right to

receive benefits and the Company’ s inability to direct the activities that most significantly impact the economic performance of the

VIEs. The Company’ s maximum exposure to loss on these investments is limited to the amount of the Company’ s investment.