The Hartford 2011 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-54

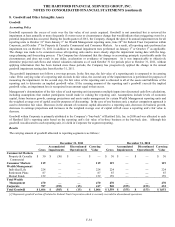

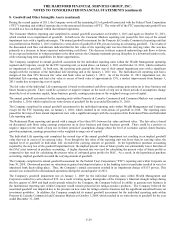

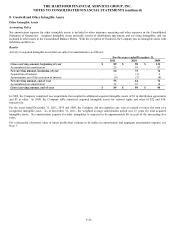

8. Goodwill and Other Intangible Assets

Goodwill

Accounting Policy

Goodwill represents the excess of costs over the fair value of net assets acquired. Goodwill is not amortized but is reviewed for

impairment at least annually or more frequently if events occur or circumstances change that would indicate that a triggering event for a

potential impairment has occurred. During the fourth quarter of 2011, the Company changed the date of its annual impairment test for all

reporting units to October 31st from January 1st for Wealth Management reporting units, June 30th for Federal Trust Corporation within

Corporate, and October 1st for Property & Casualty Commercial and Consumer Markets. As a result, all reporting units performed an

impairment test on October 31, 2011 in addition to the annual impairment tests performed on January 1st or October 1st as applicable.

The change was made to be consistent across all reporting units and to more closely align the impairment testing date with the long-

range planning and forecasting process. The Company has determined that this change in accounting principle is preferable under the

circumstances and does not result in any delay, acceleration or avoidance of impairment. As it was impracticable to objectively

determine projected cash flows and related valuation estimates as of each October 31 for periods prior to October 31, 2011, without

applying information that has been learned since those periods, the Company has prospectively applied the change in the annual

goodwill impairment testing date from October 31, 2011.

The goodwill impairment test follows a two-step process. In the first step, the fair value of a reporting unit is compared to its carrying

value. If the carrying value of a reporting unit exceeds its fair value, the second step of the impairment test is performed for purposes of

measuring the impairment. In the second step, the fair value of the reporting unit is allocated to all of the assets and liabilities of the

reporting unit to determine an implied goodwill value. If the carrying amount of the reporting unit’ s goodwill exceeds the implied

goodwill value, an impairment loss is recognized in an amount equal to that excess.

Management’ s determination of the fair value of each reporting unit incorporates multiple inputs into discounted cash flow calculations,

including assumptions that market participants would make in valuing the reporting unit. Assumptions include levels of economic

capital, future business growth, earnings projections and assets under management for certain Wealth Management reporting units and

the weighted average cost of capital used for purposes of discounting. In the case of one business unit, a market comparison approach is

used to determine fair value. Decreases in the amount of economic capital allocated to a reporting unit, decreases in business growth,

decreases in earnings projections and increases in the weighted average cost of capital will all cause a reporting unit’ s fair value to

decrease.

Goodwill within Corporate is primarily attributed to the Company’ s “buy-back” of Hartford Life, Inc. in 2000 and was allocated to each

of Hartford Life’ s reporting units based on the reporting unit’ s fair value of in-force business at the buy-back date. Although this

goodwill was allocated to each reporting unit, it is held in Corporate for segment reporting.

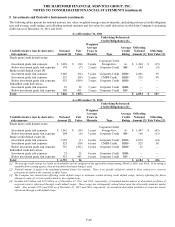

Results

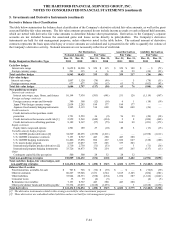

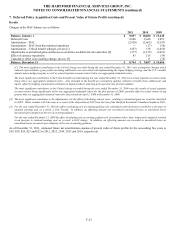

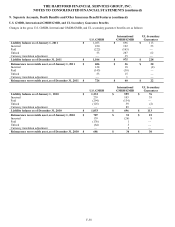

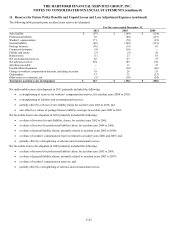

The carrying amount of goodwill allocated to reporting segments is as follows:

December 31, 2011

December 31, 2010

Gross

Accumulated

Impairments

Discontinued

Operations[1]

Carrying

Value

Gross

Accumulated

Impairments

Discontinued

Operations[1]

Carrying

Value

Commercial Markets

Property & Casualty

Commercial

$

30

$

(30)

$

—

$

—

$

30

$

—

$

—

$

30

Consumer Markets

119

—

—

119

119

—

—

119

Wealth Management

Individual Life

224

––

—

224

224

––

—

224

Retirement Plans

87

—

—

87

87

—

—

87

Mutual Funds

159

—

—

159

159

—

—

159

Total Wealth

Management

470

––

—

470

470

––

—

470

Corporate

787

(355)

(15)

417

940

(355)

(153)

432

Total Goodwill

$

1,406

$

(385)

$

(15)

$

1,006

$

1,559

$

(355)

$

(153)

$

1,051

[1] Represents goodwill written off related to Federal Trust Corporation which is currently recorded in discontinued operations.