The Hartford 2011 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

124

Insurance Operations

Current and expected patterns of claim frequency and severity or surrenders may change from period to period but continue to be within

historical norms and, therefore, the Company’ s insurance operations’ current liquidity position is considered to be sufficient to meet

anticipated demands over the next twelve months, including any obligations related to the Company’ s restructuring activities. For a

discussion and tabular presentation of the Company’ s current contractual obligations by period, refer to Off-Balance Sheet

Arrangements and Aggregate Contractual Obligations within the Capital Resources and Liquidity section of the MD&A.

The principal sources of operating funds are premiums, fees earned from assets under management and investment income, while

investing cash flows originate from maturities and sales of invested assets. The primary uses of funds are to pay claims, claim

adjustment expenses, commissions and other underwriting expenses, to purchase new investments and to make dividend payments to the

HFSG Holding Company.

The Company’ s insurance operations consist of property and casualty insurance products (collectively referred to as “Property &

Casualty Operations”) and life insurance products (collectively referred to as “Life Operations”).

Property & Casualty Operations

Property & Casualty Operations holds fixed maturity securities including a significant short-term investment position (securities with

maturities of one year or less at the time of purchase) to meet liquidity needs.

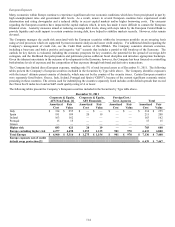

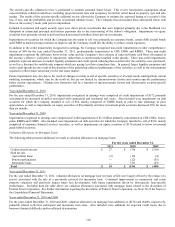

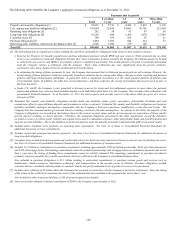

The following table summarizes Property & Casualty Operations’ fixed maturities, short-term investments, and cash, as of December

31, 2011:

Fixed maturities

$

26,034

Short-term investments

658

Cash

203

Less: Derivative collateral

(222)

Total

$

26,673

Liquidity requirements that are unable to be funded by Property & Casualty Operation’ s short-term investments would be satisfied with

current operating funds, including premiums received or through the sale of invested assets. A sale of invested assets could result in

significant realized losses.

Life Operations

Life Operations’ total general account contractholder obligations are supported by $76 billion of cash and total general account invested

assets, excluding equity securities, trading, which includes a significant short-term investment position to meet liquidity needs.

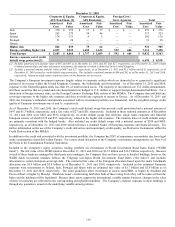

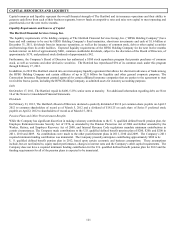

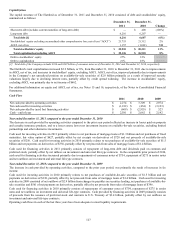

The following table summarizes Life Operations’ fixed maturities, short-term investments, and cash, as of December 31, 2011:

Fixed maturities

$

56,950

Short-term investments

5,641

Cash

2,377

Less: Derivative collateral

(2,836)

Cash associated with Japan variable annuities

(684)

Total

$

61,448

Capital resources available to fund liquidity, upon contract holder surrender, are a function of the legal entity in which the liquidity

requirement resides. Generally, obligations of Group Benefits will be funded by Hartford Life and Accident Insurance Company;

obligations of Individual Annuity, Individual Life and private placement life insurance products will be generally funded by both

Hartford Life Insurance Company and Hartford Life and Annuity Insurance Company; obligations of Retirement Plans and institutional

investment products will be generally funded by Hartford Life Insurance Company; and obligations of the Company’ s international

annuity subsidiaries will be generally funded by the legal entity in the country in which the obligation was generated.

Hartford Life Insurance Company (“HLIC”), an indirect wholly owned subsidiary, became a member of the Federal Home Loan Bank

of Boston (“FHLBB”) in May 2011. Membership allows HLIC access to collateralized advances, which may be used to support various

spread-based business and enhance liquidity management. The Connecticut Department of Insurance (“CTDOI”) will permit HLIC to

pledge up to $1.48 billion in qualifying assets to secure FHLBB advances for 2012. The amount of advances that can be taken are

dependent on the asset types pledged to secure the advances. The pledge limit is recalculated annually based on statutory admitted

assets and capital and surplus. HLIC would need to seek the prior approval of the CTDOI if there were a desire to exceed these limits.

As of December 31, 2011, HLIC had no advances outstanding under the FHLBB facility.