The Hartford 2011 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-10

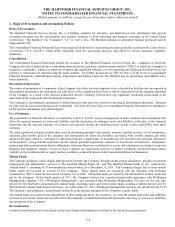

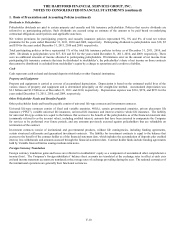

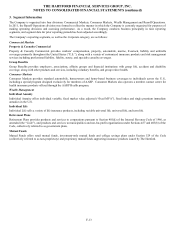

1. Basis of Presentation and Accounting Policies (continued)

Dividends to Policyholders

Policyholder dividends are paid to certain property and casualty and life insurance policyholders. Policies that receive dividends are

referred to as participating policies. Such dividends are accrued using an estimate of the amount to be paid based on underlying

contractual obligations under policies and applicable state laws.

Net written premiums for participating property and casualty insurance policies represented 9%, 8% and 8% of total net written

premiums for the years ended December 31, 2011, 2010 and 2009, respectively. Participating dividends to policyholders were $18, $5

and $10 for the years ended December 31, 2011, 2010 and 2009, respectively.

Total participating policies in-force represented 1% of the total life insurance policies in-force as of December 31, 2011, 2010, and

2009. Dividends to policyholders were $17, $21 and $13 for the years ended December 31, 2011, 2010, and 2009, respectively. There

were no additional amounts of income allocated to participating policyholders. If limitations exist on the amount of net income from

participating life insurance contracts that may be distributed to stockholder’ s, the policyholder’ s share of net income on those contracts

that cannot be distributed is excluded from stockholder’ s equity by a charge to operations and a credit to a liability.

Cash

Cash represents cash on hand and demand deposits with banks or other financial institutions.

Property and Equipment

Property and equipment is carried at cost net of accumulated depreciation. Depreciation is based on the estimated useful lives of the

various classes of property and equipment and is determined principally on the straight-line method. Accumulated depreciation was

$2.1 billion and $1.9 billion as of December 31, 2011 and 2010, respectively. Depreciation expense was $216, $276, and $253 for the

years ended December 31, 2011, 2010, and 2009, respectively.

Other Policyholder Funds and Benefits Payable

Other policyholder funds and benefits payable consist of universal life-type contracts and investment contracts.

Universal life-type contracts consist of fixed and variable annuities, 401(k), certain governmental annuities, private placement life

insurance (“PPLI”), variable universal life insurance, universal life insurance and interest sensitive whole life insurance. The liability

for universal life-type contracts is equal to the balance that accrues to the benefit of the policyholders as of the financial statement date

(commonly referred to as the account value), including credited interest, amounts that have been assessed to compensate the Company

for services to be performed over future periods, and any amounts previously assessed against policyholders that are refundable on

termination of the contract.

Investment contracts consist of institutional and governmental products, without life contingencies, including funding agreements,

certain structured settlements and guaranteed investment contracts. The liability for investment contracts is equal to the balance that

accrues to the benefit of the contract holder as of the financial statement date, which includes the accumulation of deposits plus credited

interest, less withdrawals and amounts assessed through the financial statement date. Contract holder funds include funding agreements

held by Variable Interest Entities issuing medium-term notes.

Foreign Currency Translation

Foreign currency translation gains and losses are reflected in stockholders’ equity as a component of accumulated other comprehensive

income (loss). The Company’ s foreign subsidiaries’ balance sheet accounts are translated at the exchange rates in effect at each year

end and income statement accounts are translated at the average rates of exchange prevailing during the year. The national currencies of

the international operations are generally their functional currencies.