HSBC 2002 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329

|

|

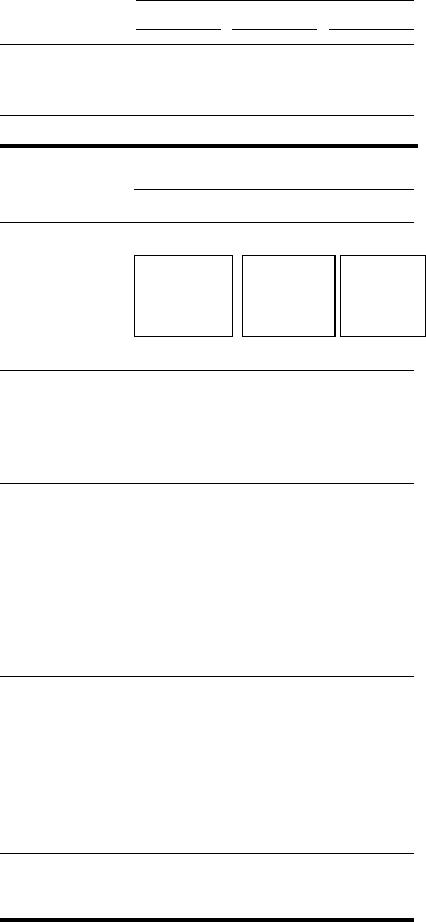

87

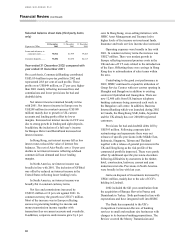

exceptional provision taken against 2001 results

following the formal default of sovereign debt and

the pesification of the banking system. Brazil’s

growing provisioning requirements reflected

planned expansion of the personal lending portfolio

in 2000.

Provisions for contingent liabilities and

commitments saw a US$17 million charge in the

year, compared with US$31 million in 2000, all of

which arose in Europe. The 2001 charge included

US$13 million relating to CCF.

Losses from joint ventures and associates

reduced by US$40 million, mainly reflecting the

sale of British Interactive Broadcasting which also

contributed US$202 million to profit on disposal of

fixed asset investments. In other associates and

joint ventures, an improved performance in Cyprus

partly offset higher losses in Merrill Lynch HSBC

and lower profits in the personal banking business

of Saudi British Bank.

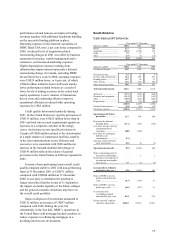

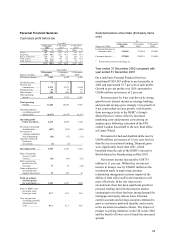

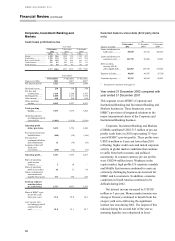

Commercial

Cash basis profit before tax

Year ended

31 December

2002

31 December

2001

31 December

2000

US$m % US$m % US$m %

Europe................................ 1,344 44.3 986 41.4 1,139 41.0

Hong Kong......................... 733 24.2 726 30.4 781 28.1

Rest of Asia-Pacific ............ 423 13.9 277 11.6 376 13.5

North America.................... 455 15.0 410 17.2 387 13.9

South America.................... 79 2.6 (14 ) (0.6 ) 97 3.5

3,034 100.0 2,385 100.0 2,780 100.0

Year ended

Figures in US$m 31 December

2002

31 December

2001*

31 December

2000*

Net interest income 3,855 3,821 3,541

Dividend income.... 673

Net fees and

commissions...... 1,934 1,751 1,681

Dealing profits ....... 107 103 82

Other income.......... 463 422 368

Other operating

income............... 2,510 2,283 2,134

Total operating

income .............. 6,365 6,104 5,675

Operating expenses

(excluding goodwill

amortisation) ..... (3,153 ) (3,116 ) (2,738)

Operating profit

before provisions 3,212 2,988 2,937

Provisions for bad and

doubtful debts.... (269) (662) (202 )

Provisions for

contingent liabilities

and commitments 19 16 5

Amounts written off

fixed asset

investments ....... 3(1) 2

Operating profit ... 2,965 2,341 2,742

Share of operating

profit in joint

ventures............. 26

–

Share of operating

profit in associates 16 28 26

Gains on disposal of

investments and

tangible fixed assets 51 10 12

Profit on ordinary

activities before

tax (cash basis). 3,034 2,385 2,780

Share of HSBC’ s pre-

tax profits (cash

basis) (per cent). 28.8 27.1 27.0

Cost: income ratio

(excluding goodwill

amotisation) (per

cent) .................. 49.5 51.0 48.2

*Restatement consistent with page 81