HSBC 2002 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329

|

|

163

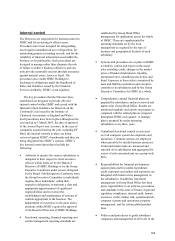

Internal control

The Directors are responsible for internal control in

HSBC and for reviewing its effectiveness.

Procedures have been designed for safeguarding

assets against unauthorised use or disposition; for

maintaining proper accounting records; and for the

reliability of financial information used within the

business or for publication. Such procedures are

designed to manage rather than eliminate the risk

of failure to achieve business objectives and can

only provide reasonable and not absolute assurance

against material errors, losses or fraud. The

procedures also enable HSBC Holdings to

discharge its obligations under the Handbook of

Rules and Guidance issued by the Financial

Services Authority, HSBC’ s lead regulator.

The key procedures that the Directors have

established are designed to provide effective

internal control within HSBC and accord with the

Internal Control Guidance for Directors on the

Combined Code issued by the Institute of

Chartered Accountants in England and Wales.

Such procedures have been in place throughout the

year and up to 3 March 2003, the date of approval

of the Annual Report and Accounts. In the case of

companies acquired during the year, including GF

Bital, the internal controls in place are being

reviewed against HSBC’ s benchmarks and they are

being integrated into HSBC’ s systems. HSBC’ s

key internal control procedures include the

following:

• Authority to operate the various subsidiaries is

delegated to their respective chief executive

officers within limits set by the Board of

Directors of HSBC Holdings or by the Group

Executive Committee under powers delegated

by the Board. Sub-delegation of authority from

the Group Executive Committee to individuals

requires these individuals, within their

respective delegation, to maintain a clear and

appropriate apportionment of significant

responsibilities and to oversee the

establishment and maintenance of systems of

controls appropriate to the business. The

appointment of executives to the most senior

positions within HSBC requires the approval

of the Board of Directors of HSBC Holdings.

• Functional, operating, financial reporting and

certain management reporting standards are

established by Group Head Office

management for application across the whole

of HSBC. These are supplemented by

operating standards set by the local

management as required for the type of

business and geographical location of each

subsidiary.

• Systems and procedures are in place in HSBC

to identify, control and report on the major

risks including credit, changes in the market

prices of financial instruments, liquidity,

operational error, unauthorised activities and

fraud. Exposure to these risks is monitored by

asset and liability committees and executive

committees in subsidiaries and by the Group

Executive Committee for HSBC as a whole.

• Comprehensive annual financial plans are

prepared by subsidiaries and are reviewed and

approved at Group Head Office. Results are

monitored regularly and reports on progress as

compared with the related plan are prepared

throughout HSBC each quarter. A strategic

plan is prepared by major operating

subsidiaries every three years.

• Centralised functional control is exercised

over all computer system developments and

operations. Common systems are employed

where possible for similar business processes.

Credit and market risks are measured and

reported on in subsidiaries and aggregated for

review of risk concentrations on a group-wide

basis.

• Responsibilities for financial performance

against plans and for capital expenditure,

credit exposures and market risk exposures are

delegated with limits to line management in

the subsidiaries. In addition, functional

management in Group Head Office has been

given responsibility to set policies, procedures

and standards in the areas of finance; legal and

regulatory compliance; internal audit; human

resources; credit; market risk; operational risk;

computer systems and operations; property

management; and for certain global product

lines.

• Policies and procedures to guide subsidiary

companies and management at all levels in the