HSBC 2002 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Financial Review (continued)

56

during the first half of 2003.

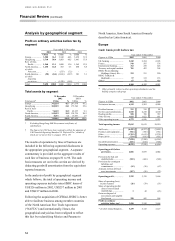

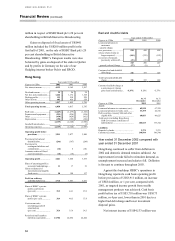

European operations contributed US$3,500

million to HSBC’s profits before tax in 2002 and

represented 36.3 per cent of pre-tax profits. On a

cash basis, Europe’s pre-tax profits were US$4,160

million, and represented 39.5 per cent of HSBC’s

profits on this basis. Operating performance was

strong with pre-provision profit rising 9 per cent to

US$4,737 million on a cash basis. In constant

currency terms, the growth was 6 per cent. This

growth was driven essentially by the core personal

and commercial banking businesses in the UK and

France and by Treasury and Capital Markets

performance. There was no material benefit in 2002

from disposal gains as after making provisions for

amounts to be written off fixed asset investments the

net gain was only US$21 million. The comparable

figure in 2001 was US$351 million, a result

dominated by the sale of the Group’ s stake in British

Interactive Broadcasting.

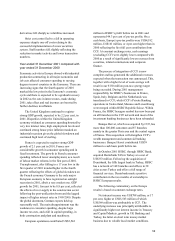

The impact of acquisitions on 2002 profit before

tax was modest at US$51 million. The acquisitions

of Demirbank in October 2001 and Benkar in

September 2002, however, represented a major

expansion of HSBC’s business in Turkey. These

businesses have been successfully integrated during

2002, and now over 500,000 customers in Turkey are

served through a combination of call centres, internet

banking and a network of 163 branches.

A number of other internal restructurings took

place to enhance operational efficiency. In June

2002, HSBC acquired Merrill Lynch’s 50 per cent

share of the Merrill Lynch HSBC joint venture. The

business was integrated into HSBC Bank in

December.

HSBC continued to restructure and strengthen

its private banking operations with the integration of

HSBC Guyerzeller and CCF’ s private banking

operations outside France with HSBC Republic

Holdings (Suisse). The comments below on HSBC

Republic (Suisse) assume that this structure was in

place during 2001.

The following commentary on the Europe

results is based on constant exchange rates.

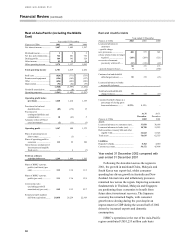

Net interest income at US$6,343 million was

US$558 million, or 10 per cent, higher than in 2001,

principally attributable to growth in mortgage

lending in the UK and increased spreads as funding

costs reflected the low interest rate environment

across Europe.

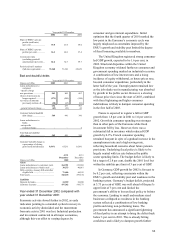

In UK Banking, net interest income at US$3,469

million was US$312 million, or 10 per cent, higher

than in 2001, driven by strong growth in mortgages

and personal lending, and the benefits of lower cost

of funds. Mortgage balances increased by US$5.4

billion, or 24 per cent, and gross new lending by 57

per cent as HSBC Bank increased its market share

from 4 per cent to 6 per cent in a buoyant housing

market. Personal current account balances were up

11 per cent on 2001 as customers preferred to hold

cash in the uncertain investment climate. The launch

of a new Bonus Savings Account and improved

utilisation of customer relationship management

systems contributed to growth of 19 per cent in

personal savings balances and 16 per cent in personal

lending balances in 2002. Business current account

balances grew by 14 per cent, helped by HSBC

Bank’s increased profile in the market place and its

‘Start up Stars’ advertising campaign. The bank

increased its share of business start-ups and opened

more than 87,000 new business accounts in 2002.

Corporate current account balances improved by 9

per cent compared with 2001 although this was

partly offset by a narrowing of spreads on deposit

accounts.

In Treasury and Capital Markets net interest

income increased by US$141 million, or 32 per cent,

compared with 2001. The increase was primarily due

to earnings on money market business, which

benefited from reduced funding costs and the

deployment of surplus liquidity in higher yielding

investment grade corporate and institutional bonds.

In France, CCF’s net interest income of

US$1,022 million was US$95 million, or 10 per cent,

higher than for 2001. Net interest income in the

branch network grew strongly, driven by growth both

in personal lending and in sight deposits as

customers preferred liquidity and security in the face

of falling equity markets. CCF’s treasury operation

benefited from a lower cost of funds and spreads

widened offsetting a reduction in benefit from net

free funds.

HSBC Republic (Suisse)’s net interest income