HSBC 2002 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.79

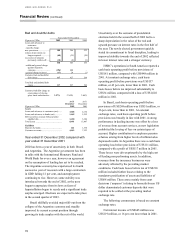

In Brazil, net interest income was US$14 million, or

2 per cent, lower than in 2001. Customer lending,

particularly overdrafts, term lending and credit cards

grew strongly in 2002 in response to targeted

marketing campaigns. Yield on customer lending

was slightly higher than in 2001 as a result of higher

pricing of term lending and instalment finance. The

increases in customer lending were more than offset

by a significant reduction in investment securities, as

HSBC sought to minimise its exposure in the

uncertain economic climate. In Argentina, net

interest expense was US$16 million, compared with

net interest income of US$85 million in 2001. HSBC

Bank Argentina’s margin worsened from 5.65 per

cent in 2001 to negative 2.71 per cent in 2002,

mainly as a result of the high cost of funding the

non-performing loan portfolio. In addition, the

reduction in net interest income reflected the fact that

pesified mortgages and personal loans are

specifically excluded from CER, an inflation

adjustment applied to all pesified sovereign debt,

deposit balances and certain (primarily commercial

and corporate) customer loans.

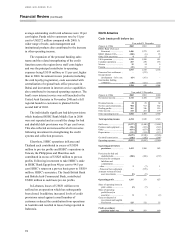

Other operating income of US$596 million was

US$24 million, or 4 per cent higher than in 2001.

Fee income fell by US$27 million, or 8 per cent, but

dealing profits increased by US$133 million to

US$147 million as a result of the volatile economic

conditions. In Brazil, other operating income

increased by US$47 million, or 11 per cent, to

US$489 million. Dealing profits increased by US$74

million on strong interest rate derivatives trading and

foreign exchange trading. Fee income fell by US$22

million to US$281 million, reflecting a loss of

revenue from account fees, as the Brazilian

government outlawed the levying of fees on certain

accounts. Fees were also lower from investment

banking services. However, the above factors were

partly offset by strong growth in credit-related fee

income. Income from insurance business fell 4 per

cent compared with 2001. In Argentina, other

operating income of US$70 million was US$39

million, or 36 per cent lower, than in 2001. The

reduction was principally as a result of considerably

lower net revenues from the insurance businesses.

HSBC was obliged to renegotiate a number of

contracts as a result of the mismatch between

premiums and claims arising from the pesification of

assets and liabilities. In addition, HSBC’s pension

fund administrator suffered reduced revenues due to

increased levels of unemployment. Foreign exchange

dealing profits improved as some resumption in

activity was permitted.

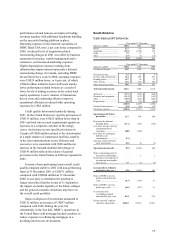

Cash operating expenses rose by US$39 million,

or 4 per cent, to US$1,060 million. In response to the

difficult economic conditions in South America, the

full time equivalent number of staff has been reduced

by 2,000. However, staff costs in 2002 rose by

US$16 million to US$572 million. In Brazil,

operating expenses of US$873 million were US$32

million, or 4 per cent higher than in 2001. Staff costs

increased by US$17 million driven mainly by higher

pension contributions required as a result of higher

levels of inflation, and an industry-wide union-

agreed salary increase. Other administrative expenses

increased by US$15 million as a result of an increase

in the levels of transactional taxation imposed by the

government. In Argentina, operating expenses on a

cash basis rose by US$13 million to US$165 million.

The reduction of 1,000 in headcount reduced costs

by US$2 million, however this saving was offset by

severance payments made. There was further

additional expense resulting from transactional

taxation, including an additional tax imposed on

foreign companies. HSBC wrote off during 2002 the

remaining goodwill of US$20 million that arose on

the purchase of its insurance subsidiaries.

The provision for bad and doubtful debts of

US$117 million was US$361 million lower than in

2001. In 2001, a special general provision of US$292

million (at constant exchange rates) was raised to

provide a coverage ratio of 63 per cent against

Argentina’s non-government loan book. In 2002,

US$196 million of bad debts arising have been

specifically provided and the general provision

requirement was reduced accordingly. The remaining

US$96 million of general provisions has been

critically reviewed and is believed to be sufficient to

cover remaining credit risk in the loan portfolio. In

Brazil, the bad debt charge of US$139 million was

US$10 million, or 7 per cent lower than in 2001.

New provisions against customers increased by

US$29 million, as a result of a specific corporate

exposure and as a result of the increasing level of

personal lending, including credit cards, term lending

and overdrafts. However, pro-active management of

the personal loan portfolio has enabled a number of

provisions, particularly in the cards portfolio, to be

released. In addition, further releases have been

made of provisions raised against the commercial

sector.

In the first half of 2002, HSBC realised a gain of

US$38 million on the sale of its 6.99 per cent