HSBC 2002 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

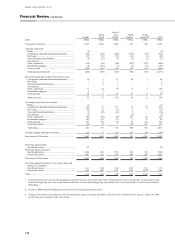

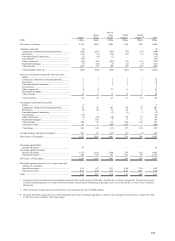

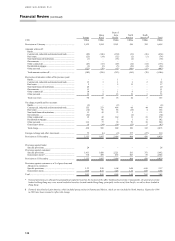

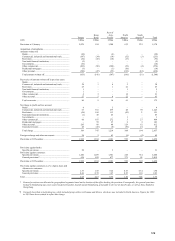

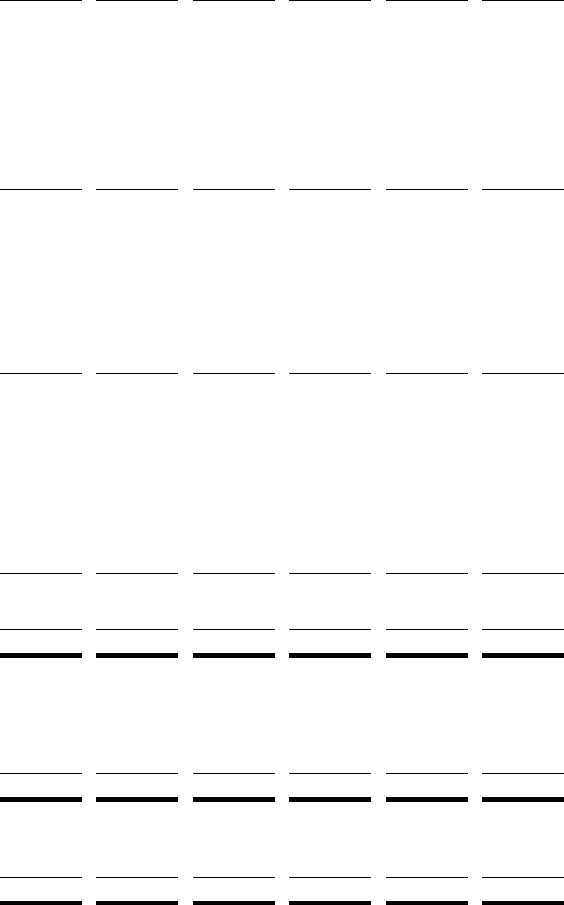

127

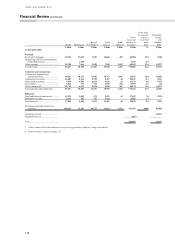

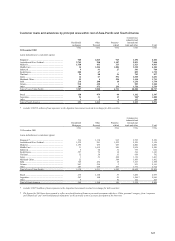

Europe

Hong

Kong

Rest o

f

Asia-

Pacific

Nort

h

America

Sout

h

America

¶

Total

2000 US$

m

US$

m

US$

m

US$

m

US$

m

US$

m

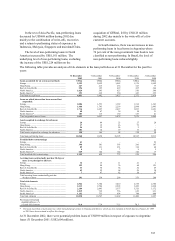

Provisions at 1 Januar

y

..................................................... 2,153 1,887 2,686 864 430 8,020

Amounts written off: (9 )

–

–

–

–

(9)

Commercial, industrial and international trade.............. (154) (202) (191) (97) (36) (680)

Real estate..................................................................... (27 ) (9) (58) (13 ) (3) (110)

Non-bank financial institutions ..................................... (2) (8) (3)

–

–

(13)

Governments................................................................. (37)

–

–

–

–

(37)

Other commercial.......................................................... (68 ) (68) (149) (97) (15) (397)

Residential mortgages................................................... (5) (82) (5) (4) (7) (103)

Other personal............................................................... (181 ) (73) (88) (90) (30) (462)

Total amounts written of

f

.............................................. (483) (442) (494) (301) (91) (1,811)

Recoveries of amounts written off in previous years:

Banks ............................................................................

–

–

–

–

–

–

Commercial, industrial and international trade.............. 4 3 3 1 2 13

Real estate..................................................................... 7

–

23

–

12

Non-bank financial institutions ..................................... 3

–

21

–

6

Governments................................................................. 3

–

–

–

–

3

Other commercial.......................................................... 4 4 23 11 1 43

Residential mortgages ................................................... 1 1

–

–

13

Other personal............................................................... 32 8 19 15 6 80

Total recoveries............................................................. 54 16 49 31 10 160

Net charge to profit and loss account:

Banks ............................................................................ 2

–

–

–

–

2

Commercial, industrial and international trade.............. 87 81 107 89 43 407

Real estate..................................................................... (9) 40 19 10 5 65

Non-bank financial institutions ..................................... 1

–

(3 ) (2 ) 2 (2 )

Governments................................................................. (19)

–

–

–

–

(19)

Other commercial.......................................................... (3) (30) (18) 80 21 50

Residential mortgages................................................... 1 101 5 9 12 128

Other personal............................................................... 245 55 63 109 109 581

General provisions ........................................................ 43 1 (188) (138) 2 (280)

Total charge .................................................................. 348 248 (15) 157 194 932

Foreign exchange and other movements# ........................ 953 93 (135) (12) (3) 896

Provisions at 31 Decembe

r

................................................ 3,025 1,802 2,091 739 540 8,197

Provisions against banks:

Specific provisions........................................................ 30

–

–

–

–

30

Provisions against customers:

Specific provisions........................................................ 2,135 1,241 1,929 278 482 6,065

General provisions* ...................................................... 860 561 162 461 58 2,102

Provisions at 31 Decembe

r

................................................ 3,025 1,802 2,091 739 540 8,197

Provisions against customers as a % of gross loans and

Advances to customers:

Specific provisions........................................................ 1.61 1.87 6.23 0.44 7.54 2.03

General provisions ........................................................ 0.65 0.84 0.53 0.74 0.91 0.70

Total ................................................................................. 2.26 2.71 6.76 1.18 8.45 2.73

*General provisions are allocated to geographical segments based on the location of the office booking the provision. Consequently, the general provision

booked in Hong Kong may cover assets booked in branches located outside Hong Kong, principally in the rest of Asia-Pacific, as well as those booked in

Hong Kong.

# Other movements include amounts transferred in on the acquisition of CCF of US$882 million.

¶ Formerly described as Latin America, which included group entities in Panama and Mexico, which are now included in North America. Figures for 1998

to 2001 have been restated to reflect this change.