HSBC 2002 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329

|

|

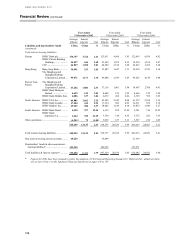

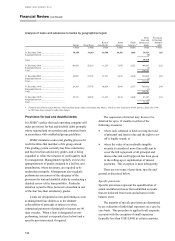

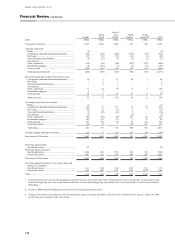

HSBC HOLDINGS PLC

Financial Review (continued)

116

Such audits include consideration of the

completeness and adequacy of credit manuals and

lending guidelines, together with an in-depth analysis

of a representative sample of accounts in the

portfolio to assess the quality of the loan book and

other exposures. Individual accounts are reviewed to

ensure that the facility grade is appropriate, that

credit procedures have been properly followed and

that where an account is non-performing, provisions

raised are adequate. Internal Audit will discuss any

facility grading they consider should be revised at

the end of the audit and their subsequent

recommendations for revised grades must then be

assigned to the facility.

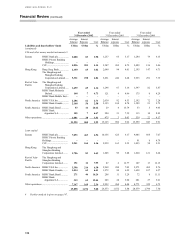

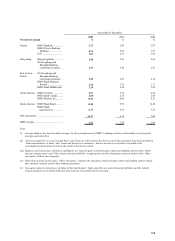

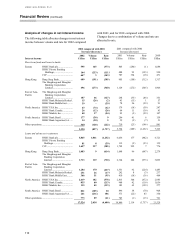

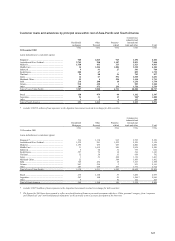

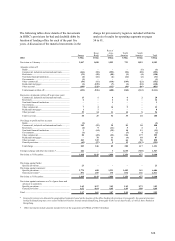

Loan portfolio

Loans and advances to customers are spread across

the various industrial sectors, as well as

geographically.

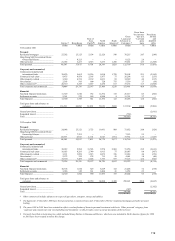

At constant exchange rates, loans and advances

to customers (excluding the finance sector and

settlement accounts) grew by US$31.5 billion, or

10.7 per cent during 2002 of which US$9.7 billion,

or 3.2 per cent, related to the acquisition of GFBital

in Mexico. Excluding the impact of GFBital,

personal lending grew by 14.9 per cent and loans and

advances to the commercial and corporate customer

base grew by 1.6 per cent.

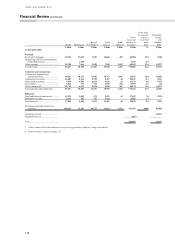

Figures in US$m 2001

Exchange

variance

Under-

lying

change

GF

Bital 2002

Personal:

Residential mortgages 78,215 3,339 14,227 1,203 96,984

Hong Kong SAR

Government

Home Ownership

Scheme ................. 8,123 (1 ) (867 ) – 7,255

Other personal............ 39,125 2,101 6,142 1,194 48,562

Total personal............. 125,463 5,439 19,502 2,397 152,801

Corporate and

commercial:

Commercial,

industrial and

international trade . 70,158 5,219 1,953 1,685 79,015

Commercial real

estate .................... 26,315 1,471 1,394 87 29,267

Other property-related 14,594 519 (17 ) 251 15,347

Government ............... 5,339 (37 ) (476 ) 4,127 8,953

Other commercial....... 37,265 2,812 (292) 889 40,674

Total Corporate and

commercial........... 153,671 9,984 2,562 7,039 173,256

Financial:

Non-bank financial

institutions ............ 26,473 1,473 (733 ) 274 27,487

Settlement accounts.... 11,761 260 (3,636 ) – 8,385

Total financial............ 38,234 1,733 (4,369 )274 35,872

Total gross loans and

advances to

customers.............. 317,368 17,156 17,695 9,710 361,929

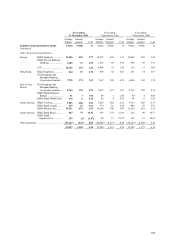

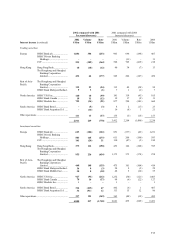

The commentary below excludes the impact of

foreign exchange transaction movements and the

acquisition of GFBital except where stated.

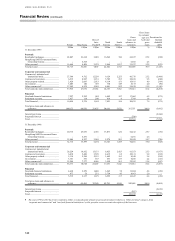

Residential mortgages increased by US$14.2

billion, or 18 per cent and including GFBital

comprised 26.8 per cent of total gross loans to

customers at 31 December 2002. Residential

mortgages in Europe increased by US$8.2 billion of

which US$8.0 billion arose in UK Banking as market

initiatives, including First Direct’s smart mortgage,

and competitive pricing resulted in improved

mortgage retention rates and increased share of the

remortgage market. Residential mortgage lending in

Hong Kong was slightly higher than 2001 against a

background of intense mortgage price competition as

HSBC increased its share of the remortgaging

market. This growth was more than offset by a

reduction in loans made under the Hong Kong SAR

Government Home Ownership Scheme (‘GHOS’ ).

At US$7.3 billion residential mortgage loans under

GHOS were US$0.9 billion lower than at 31

December 2001 and resulted from the suspension of

the sale of new homes under this scheme by the

Hong Hong SAR Government in the second half of

2001. In the rest of Asia-Pacific, residential

mortgages grew by US$2.1 billion with strong

growth in Singapore, Malaysia, South Korea, India

and Taiwan. In North America, residential mortgage

lending grew strongly by US$3.3 billion due to

strong mortgage origination as interest rates

remained low.

Including GFBital other personal lending

increased to approximately 13.4 per cent of total

gross loans to customers. Personal lending grew by

US$3.2 billion in Europe. Strong organic growth

was achieved in consumer lending in the UK with an

increase of 10 per cent in credit card advances at 31

December 2002.

Corporate commercial lending grew modestly,

less than 2 per cent, reflecting muted corporate loan

demand and cautious risk appetite.