HSBC 2002 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

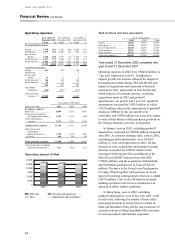

39

15,460

14,725 13,723

0

3,000

6,000

9,000

12,000

15,000

18,000

2002 2001 2000

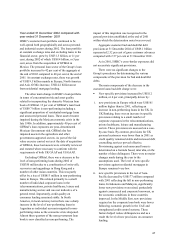

Year ended 31 December 2001 compared with

year ended 31 December 2000

In the sections which follow, analysis of these results

highlights the contribution from CCF, acquired on 28

July 2000, and the impact of a stronger US dollar on

translating revenues and costs arising in other

currencies, each of which is significant to an

understanding of HSBC’s performance in 2001.

HSBC made a profit on ordinary activities

before tax of US$8,000 million in 2001, a decrease

of US$1,775 million, or 18 per cent, compared with

2000. On a cash basis, profit before tax decreased by

US$1,493 million, or 14 per cent, compared with

2000. At constant exchange rates, cash basis profit

before tax was 12 per cent lower than 2000.

Net interest income of US$14,725 million in

2001 was US$1,002 million, or 7 per cent, higher

than 2000, with a large part of this increase due to

the inclusion of CCF for a full year. Net interest

income in North America was US$265 million, or 12

per cent, higher than 2000 mainly reflecting growth

in average interest-earning assets and the benefit of

lower funding costs.

Other operating income rose by US$313 million,

or 3 per cent, to US$11,163 million compared with

2000. This increase was primarily driven by the

acquisition of CCF and by growth in wealth

management income which offset falls in securities-

related fee and commission income.

Operating expenses, excluding goodwill

amortisation, were US$1,028 million, or 8 per cent,

higher than 2000. This increase principally reflected

recent acquisitions.

HSBC’s cost: income ratio, excluding goodwill

amortisation, increased to 56.4 per cent compared

with 55.3 per cent in 2000, reflecting the cost

structures of new acquisitions and investment in the

expanding wealth management business and IT.

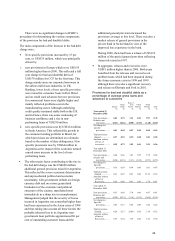

The charge for bad and doubtful debts was

US$2,037 million in 2001, which was US$1,105

million higher than in 2000. This mainly reflected

the US$600 million general provision against

Argentine exposure and specific provisions made

against a small number of corporate borrowers.

Other provisions included a loss of US$520 million

arising from the foreign currency redenomination in

Argentina and a charge of US$575 million for the

Princeton Note matter.

The US$91 million share of operating losses in

joint ventures principally reflected continuing start-

up costs of Merrill Lynch HSBC, now operational in

the UK, Canada and Australia.

The charge for amounts written-off fixed asset

investments arose mainly from venture capital

investments and holdings of emerging technology

stocks.

Gains on disposal of investments of US$754

million included profit on the sale of HSBC’s 20 per

cent stake in British Interactive Broadcasting and the

investment in Modern Terminals Limited. In

addition, disposal gains of US$170 million were

realised from sales of investment debt securities to

adjust to changes in interest rate conditions.

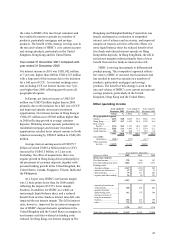

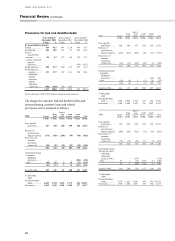

Net interest income

Year ended 31

December 2002

Year ended 31

December 2001

Year ended 31

December 2000

US$m % US$

m

%US$

m

%

Europe................ 6,343 41.0 5,563 37.8 4,988 36.4

Hong Kong......... 4,133 26.7 4,165 28.3 3,997 29.1

Rest of Asia-

Pacific ...........

1,607 10.4 1,482 10.1 1,367 10.0

North America ... 2,732 17.7 2,450 16.6 2,185 15.9

South America ... 645 4.2 1,065 7.2 1,186 8.6

Net interest

income........... 15,460 100.0 14,725 100.0 13,723 100.0

Net interest income (US$m)

Year ended 31 December

Figures in US$m 2002 2001 2000

Net interest income ............... 15,460 14,725 13,723

Average interest-earning

assets................................ 608,749 579,665 516,185

Gross interest yield

(per cent)1........................ 4.70 6.08 7.31

Net interest spread

(per cent) 2........................ 2.27 2.09 2.10

Net interest margin

(per cent)3 ........................ 2.54 2.54 2.66

1Gross interest yield is the average interest rate earned on average

interest-earning assets (AIEA).

2Net interest spread is the difference between the average interest

rate earned on average interest-earning assets and the average

interest rate paid on average interest-bearing funds.

3Net interest margin is net interest income expressed as a percentage

of average interest-earning assets.