HSBC 2002 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Financial Review (continued)

48

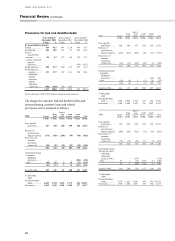

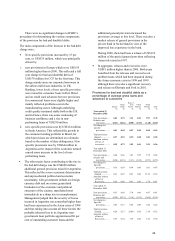

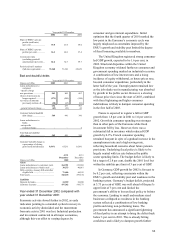

iii. new corporate provisions in Hong Kong

declined by US$48 million reflecting a

reduction in non-performing loans. As the

economy remained in deflation, high levels of

unemployment and the impact of new

bankruptcy laws significantly increased the

incidence of personal bankruptcy filings leading

to an increase of US$127 million in new

provisions against personal lending, principally

on credit cards.

• In aggregate, releases and recoveries decreased

by US$96 million compared with 2001. 2001

benefited from exceptional recoveries against an

historical Olympia and York exposure and from

successful restructuring and recoveries achieved

in Malaysia on corporate and commercial loans

impaired during the Asian economic crisis in the

late 1990s.

• Excluding Argentina, there was a net release of

general provisions of US$155 million compared

with a release of US$27 million in 2001. There

was a release of US$97 million in Hong Kong

reflecting a reduction in estimated latent loan

losses at 31 December 2002. The estimate of

these latent losses reflects the group’ s historical

experience of the rate at which such losses

occur and are identified, on the structure of the

credit portfolio and the economic and credit

conditions prevailing at the balance sheet date.

In the UK there was a release of some US$50

million of general provisions as a number of

corporate borrowers which had been causing

concern at the 2001 year end were specifically

provisioned against in 2002. In Argentina, an

additional general provision of US$600 million

(at constant exchange rates, US$292 million)

was raised at the end of 2001. In 2002, US$196

million of specific impairments were raised and

the general provision requirement was reduced

accordingly. As individual loans have become

impaired, this has caused an underlying increase

in the level of non-performing loans in South

America. The loss experience on corporate

credit in Argentina during 2002 has confirmed

that the level of general provisions established

in 2001 was appropriate. At the end of 2002,

specific and general provisions together

continued to cover about 60 per cent of non-

government loans in Argentina.

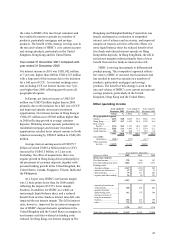

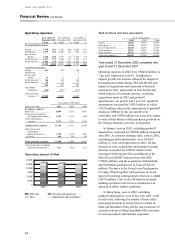

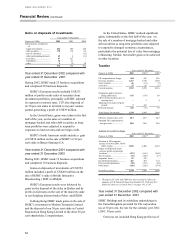

Year ended 31 December 2001 compared with

year ended 31 December 2000

HSBC’s loans and advances to customers were

spread across the various industrial sectors, as well

as geographically. At constant exchange rates, the

loan portfolio (excluding the financial sector and

settlement accounts) grew by US$16.4 billion, or 6

per cent, during 2001. Within this growth, personal

lending grew by US$11.5 billion, or 10 per cent, and

loans to the commercial and corporate customer base

grew by US$4.9 billion, or 3 per cent. The personal

loan sector of the Group’s loan portfolio increased to

40 per cent at the end of 2001 compared to 39 per

cent at the end of 2001. Residential mortgage lending

and other personal lending contributed US$6.5

billion and US$3.4 billion respectively to this

growth.

The main change in HSBC’s loan portfolio in

terms of concentration risk related to the expansion

of the personal lending portfolio. In terms of asset

quality, the main change was the substantially

increased risk within the portfolio subsequent to the

collapse in economic conditions in Argentina

following its default on sovereign debt.

There was a decrease in non-performing loans of

US$723 million during 2001 due to a combination of

write-offs and recoveries in Hong Kong and in the

rest of Asia-Pacific, including the recoveries against

a historical Olympia and York exposure. In South

America, there was an increase in the level of non-

performing loans in local currency terms in Brazil

reflecting both targeted growth in consumer lending

and a weaker economy. In Argentina, there was an

increase in non-performing loans during the year due

to the economic deterioration although this was

offset by all fully provided loans being written-off.

As at 31 December 2001, the impact of the economic

crisis had not yet caused individual accounts to

become non-performing against contractual terms.

In terms of non-performing loans, overall credit

quality in North America remained stable in 2001.

Aggregate customer bad and doubtful debt

provisions at 31 December 2001 were in line with 31

December 2000 and at US$8.2 billion represented

2.57 per cent of gross customer advances compared

with 2.73 per cent at 31 December 2000.

During 2001, HSBC’ s cross-border exposures

did not necessitate significant provisions.