HSBC 2002 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329

|

|

139

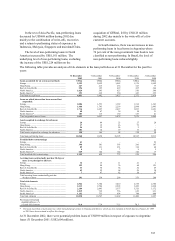

Where considered appropriate, treasury units

and ALCO may use a variety of instruments to

manage interest rate risk, for example to lengthen or

to shorten the duration of the interest risk position.

The range of permitted instruments varies by

location, but is generally restricted to on-balance

sheet financial instruments and plain vanilla interest

rate swaps.

In addition, in the second half of 2002, in

response to the low level of interest rates in the Asian

bloc, ALCO approved the purchase of an interest rate

floor to reduce the effect of further interest rate cuts

to interest margins. The effect of the floor is included

in the sensitivity tables shown below.

Assuming no management action in response to

interest rate movements, an immediate hypothetical

100 basis points parallel fall in all yield curves

worldwide on 1 January 2003 would decrease

planned net interest income for the 12 months to 31

December 2003 by US$690 million while a

hypothetical 100 basis points parallel rise in all yield

curves would decrease planned net interest income

by US$252 million.

Rather than assuming that all interest rates move

together, HSBC’s interest rate exposures can be

grouped into currency blocs whose interest rates are

considered more likely to move together. The

sensitivity of net interest income for 2003 can then

be described as follows:

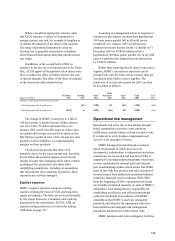

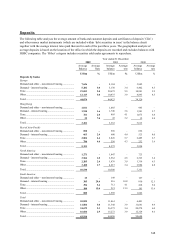

Figures in US$ m

US dollar

bloc

Sterling

bloc

Asian

bloc

Latin

American

bloc

Euro

bloc

Total

2003

Total

2002

Change in 2003 projected net interest income

+100 basis points shift in yield curves

–

(

47)

(

225)69

(

49)

(

252)(200)

−100 basis points shift in yield curves

(

243)6

(

437)

(

66)50

(

690)(196)

The change in HSBC’s sensitivity to a fall of

100 basis points is mainly because further interest

rate cuts in the US dollar and Asian blocs at 1

January 2003 would not offer scope to reduce rates

on current and savings accounts by as much as the

full 100 basis points in view of the already low rates

payable on these liabilities, so compressing the

margins on these products.

The projections assume that rates of all

maturities move by the same amount and, therefore,

do not reflect the potential impact on net interest

income of some rates changing while others remain

unchanged. The projections also make other

simplifying assumptions, including an assumption

that all positions run to maturity. In practice, these

exposures are actively managed.

Equities exposure

HSBC’s equities exposure comprises trading

equities, forming the basis of VAR, and long-term

equity investments. The latter are reviewed annually

by the Group Executive Committee and regularly

monitored by the subsidiaries’ ALCOs. VAR on

equities trading positions is set out in the trading

VAR table on page 137.

Operational risk management

Operational risk is the risk of loss arising through

fraud, unauthorised activities, error, omission,

inefficiency, systems failure or from external events.

It is inherent to every business organisation and

covers a wide spectrum of issues.

HSBC manages this risk through a controls-

based environment in which processes are

documented, authorisation is independent and where

transactions are reconciled and monitored. This is

supported by an independent programme of periodic

reviews undertaken by internal audit and internal

peer benchmarking studies which ensure that HSBC

stays in line with best practice and takes account of

lessons learned from publicised operational failures

within the financial services industry. With effect

from the beginning of 2001, operational risk losses

are formally monitored quarterly. In each of HSBC’s

subsidiaries local management is responsible for

establishing an effective and efficient operational

control environment in accordance with HSBC

standards so that HSBC’s assets are adequately

protected, and whereby the operational risks have

been identified and adequate risk management

procedures maintained to control those risks.

HSBC maintains and tests contingency facilities