HSBC 2002 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329

|

|

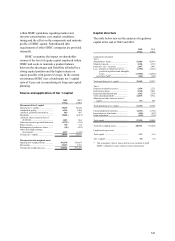

135

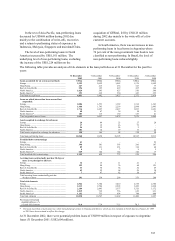

Customer accounts and deposits by banks 2002

% US$bn

Deposits by banks 9.7 52.9

Current 38.8 213.0

Savings and

other deposits 51.5 282.4

Total 100.0 548.3

Customer accounts and deposits by banks 2001

% US$bn

Deposits by banks 10.7 53.6

Current 34.1 171.8

Savings and

other deposits 55.2 278.2

Total 100.0 . 503.6

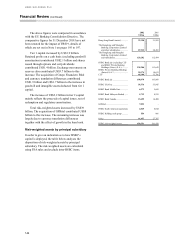

HSBC Holdings

HSBC Holdings' primary source of cash is dividends

from its directly and indirectly held subsidiaries.

The ability of these subsidiaries to pay dividends or

loan or advance monies to HSBC Holdings depends,

among other things, on their respective regulatory

capital requirements, statutory reserves, and their

financial and operating performance. The diversity of

HSBC’s activities means that HSBC Holdings is not

dependent on a single source of profits to generate

dividends. HSBC Bank and The Hongkong and

Shanghai Banking Corporation, which currently

provide most of the cash paid up to HSBC Holdings,

are themselves diversified banking businesses.

HSBC Holdings also periodically issues capital

securities and subordinated debt which provides both

regulatory capital for HSBC and funding for HSBC

Holdings. During 2002, HSBC Holdings issued

US$3.4 billion of subordinated debt.

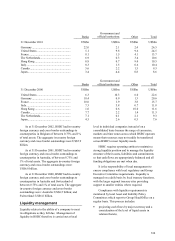

At 31 December 2002, the short term liabilities

of HSBC Holdings plc totalled US$5.0 billion,

including US$3.1 billion in respect of the proposed

second interim dividend for 2002. In practice,

shareholders may elect to receive their dividend

entitlement in scrip rather than cash so that the full

amount of the proposed dividend is not paid out.

Short term assets of US$9.3 billion, consisting

mainly of cash at bank and money market deposits of

US$6.6 billion, and other amounts due from HSBC

undertakings (including dividends) of US$1.6

billion, exceeded short term liabilities.

HSBC Holdings actively manages the cash

flows from its subsidiaries to maximise the amount

of cash held at the holding company and non-trading

subsidiary levels and expects to continue to do so in

the future. With its accumulated liquid assets, HSBC

Holdings believes that dividends from subsidiaries,

coupled with debt and equity financing, will enable it

to meet anticipated cash obligations.

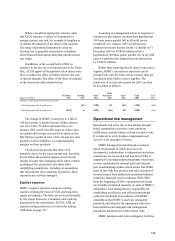

Market risk management

Market risk is the risk that foreign exchange rates,

interest rates or equity and commodity prices will

move and result in profits or losses to HSBC. Market

risk arises on financial instruments which are valued

at current market prices (mark-to-market basis) and

those valued at cost plus any accrued interest

(accruals basis).

Trading positions are valued on a mark-to-

market basis.

In liquid portfolios, market values are

determined by reference to independently

sourced mid-market prices where it is reasonable

to assume the positions could be sold at that

price. In those instances where markets are less

liquid and/or where positions have been held for

extended periods, portfolios are valued by

reference to bid or offer prices as appropriate.

In relation to certain products, such as over-

the counter derivative instruments, there are no

independent prices quoted in the markets. In

these circumstances market values are

determined by reference to standard industry

models, which typically utilise discounted cash

flow techniques to derive the market value. The

models may be in-house developed or software

vendor packages.

In valuing transactions, prices may be

amended in respect of those positions considered

illiquid, having recognition of the size of the

position vis-a-vis the normal market trading

volume in that product.

The main valuation sources are securities

prices, foreign exchange rates, and interest rate

yield curves.

In excess of 95 per cent of HSBC’s

derivative transactions are in plain vanilla