HSBC 2002 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.67

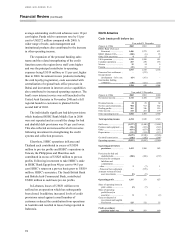

operating profit before provisions, an increase of

3 per cent compared with 2001. In constant currency

terms the growth was 2 per cent. Cash basis profit

before tax of US$1,293 million was 18 per cent

higher than 2001. The increase in profit before tax

resulted largely from lower bad debt charges,

particularly in the Middle East and Indonesia.

Net interest income of US$1,607 million was

US$125 million, or 8 per cent, higher than in 2001.

The increase was driven by strong growth in credit

card and personal lending across the region,

particularly in Taiwan, Singapore, India, the

Philippines and Australia, the latter supported by

HSBC’s acquisition of NRMA Building Society in

2001. Overall, average loans and advances to

customers in the rest of Asia-Pacific increased by 14

per cent compared with 2001.

Other operating income increased by US$37

million, or 3 per cent, compared with 2001. Net fee

income increased by US$43 million, or 6 per cent,

compared with 2001. There was a 30 per cent

increase in credit card income, mainly focused in

Taiwan, Malaysia, Indonesia and the Middle East.

There was also good growth in account service and

credit-related fee income. Dealing profits fell by

US$31 million, or 8 per cent, to US$364 million.

The reduction resulted principally from lower

interest rate derivatives and debt securities trading

income in Singapore and the Philippines.

Total operating expenses excluding goodwill

increased by US$131 million, or 9 per cent, to

US$1,528 million. This included an increase of

US$26 million resulting from the further expansion

of HSBC’s processing facilities in mainland China

and India, along with significant business expansion,

particularly in the Middle East and Taiwan. In

addition, an increase in costs in Australia resulted

from the acquisition of NRMA Building Society at

the end of 2001. Staff costs increased by US$55

million, or 7 per cent, to US$826 million. Of the

increase, US$13 million relates to the processing

centres in India and mainland China. There was also

a significant increase in staff costs in the Middle East

as a result of increased headcount to support the

expansion of personal and commercial banking.

This was offset by savings in Singapore due to lower

headcount and lower levels of voluntary severance

costs. Other administrative expenses increased by

US$76 million, particularly due to the expansion of

personal financial services in Taiwan, Singapore and

mainland China, one-off IT costs in the Middle East,

and higher costs in Australia arising from the

acquisition of NRMA Building Society in 2001.

The charge for bad and doubtful debts of US$89

million was US$83 million lower than in 2001.

There was a significant reduction in the bad debt

charges in Indonesia, the Middle East and mainland

China. In Indonesia, there were significantly lower

new provisions raised, particularly against

commercial and corporate sectors, along with higher

levels of releases against commercial and corporate

customers. Strengthened credit control procedures in

the Middle East led to lower requirements for new

specific provisions against both personal and

corporate customers, along with releases in the UAE

and Lebanon. In mainland China, there were various

recoveries of provisions against corporate customers.

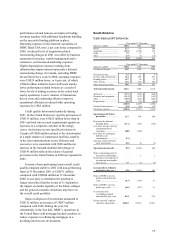

HSBC’s operations in Singapore reported an

increase in operating profit before provisions of

US$22 million, or 12 per cent to US$213 million.

Profit before tax fell by 17 per cent to US$223

million, as 2001 benefited from the release of

provisions held against the historic Olympia and

York exposure. Net interest income increased by

US$20 million, or 8 per cent, to US$272 million

driven mainly by increased volumes of car loans and

a strong treasury performance, partly offset by

narrower spreads and subdued demand in the

commercial and corporate sector. Dealing profits fell

by US$17 million, or 29 per cent, due to lower

profits from interest rate derivatives and debt

securities trading resulting from interest rate

movements and wider credit spreads. Fee income

remained flat with growth in income from the sale of

HSBC’s capital guaranteed funds offset by

reductions in broking income. Operating expenses

fell by US$16 million, or 7 per cent to US$204

million. Staff costs fell by US$24 million, or 17 per

cent as a result of lower headcount and lower

voluntary separation costs. Other administrative

expenses increased by US$8 million including higher

marketing costs relating to personal financial

services. There was a net release of US$6 million of

bad debts, compared with a net release of US$94

million in 2001 which benefited from the recovery

made against the historic Olympia and York

exposure. New provisions were US$22 million lower

than in 2001, particularly relating to exposures in the

corporate sector, and there were further recoveries

from commercial and corporate customers.

HSBC’s operations in India reported operating

profit before provisions of US$111 million, an