HSBC 2002 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

131

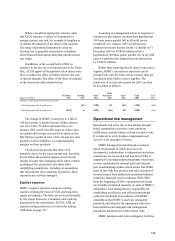

In the rest of Asia-Pacific, non-performing loans

decreased by US$668 million during 2002 due

mainly to the combination of write-offs, recoveries

and a return to performing status of exposures in

Indonesia, Malaysia, Singapore and mainland China.

The level of non-performing loans in North

America increased by US$1,101 million. The

underlying level of non-performing loans, excluding

the increase of the US$1,224 million on the

acquisition of GFBital, fell by US$123 million

during 2002 due mainly to the write-offs of a few

customer accounts.

In South America, there was an increase in non-

performing loans in local terms in Argentina where

74 per cent of the non-government loan book is now

classified as non-performing. In Brazil, the level of

non-performing loans reduced slightly.

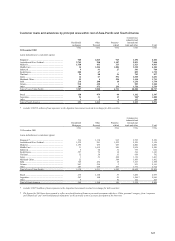

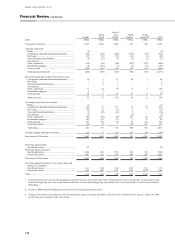

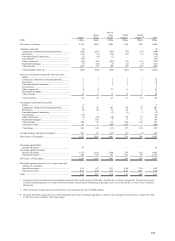

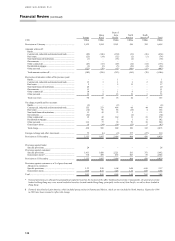

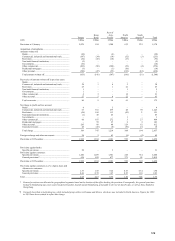

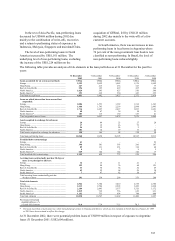

The following table provides an analysis of risk elements in the loan portfolios as at 31 December for the past five

years:

31 December

2002

31 Decembe

r

2001

31 Decembe

r

2000

31 Decembe

r

1999

31 Decembe

r

1998

Loans accounted for on a non-accrual basis: US$m US$

m

US$

m

US$

m

US$

m

Europe........................................................................ 2,393 2,052 1,985 1,176 1,092

Hong Kong................................................................. 247 213 236 163 77

Rest of Asia-Pacific.................................................... 294 195 429 435 344

North America............................................................ 1,624 593 627 550 546

South America*.......................................................... 293 429 550 447 355

Total non-accrual loans .............................................. 4,851 3,482 3,827 2,771 2,414

Loans on which interest has been accrued but

suspended:

Europe........................................................................ 2,086 1,553 1,389 1,514 1,243

Hong Kong................................................................. 1,460 1,795 2,259 2,898 2,443

Rest of Asia-Pacific.................................................... 1,714 2,497 2,627 3,097 2,691

North America............................................................ 48 67 39 34 31

South America*.......................................................... 183 115 160 133 41

Total suspended interest loans .................................... 5,491 6,027 6,474 7,676 6,449

Assets acquired in exchange for advances:

Europe........................................................................ 26 84 25 27 28

Hong Kong................................................................. 17 19 26 72

–

Rest of Asia-Pacific.................................................... 54 32 24 2

–

North America............................................................ 101 14 19 17 22

Total assets acquired in exchange for advances .......... 198 149 94 118 50

Total non-performing loans ........................................ 10,540 9,658 10,395 10,565 8,913

Troubled debt restructurings:

Europe........................................................................ 41

–

–

–

22

Hong Kong................................................................. 396 381 395 266 187

Rest of Asia-Pacific ................................................... 89 131 231 138 68

North America............................................................ 437 92

South America*.......................................................... 669 144 142 146 17

Total troubled debt restructurings............................... 1,199 659 775 559 296

Accruing loans contractually past due 90 days or

more as to principal or interest:

Europe........................................................................ 16 15 11 21 1

Hong Kong................................................................. 193 98 76 84 121

Rest of Asia-Pacific.................................................... 33 38 66 54 69

North America ........................................................... 42 52 64 59 30

South America*.......................................................... 747 82 58 67

Total accruing loans contractually past due

90 days or more .................................................... 291 250 299 276 288

Total risk elements:

Europe........................................................................ 4,562 3,704 3,410 2,738 2,386

Hong Kong................................................................. 2,313 2,506 2,992 3,483 2,828

Rest of Asia-Pacific.................................................... 2,184 2,893 3,377 3,726 3,172

North America............................................................ 1,819 729 756 669 631

South America*.......................................................... 1,152 735 934 784 480

Total risk elements ..................................................... 12,030 10,567 11,469 11,400 9,497

Provisions for bad and

doubtful debts as a %

of total risk elements .............................................. 76.0 77.4 71.5 70.3 70.1

* Formerly described as Latin America, which included group entities in Panama and Mexico, which are now included in North America. Figures for 1998

to 2001 have been restated to reflect this change.

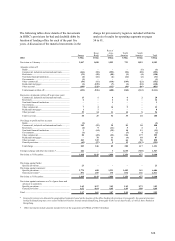

At 31 December 2002, there were potential problem loans of US$599 million in respect of exposure to Argentine

loans (31 December 2001: US$2,604 million).