HSBC 2002 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.75

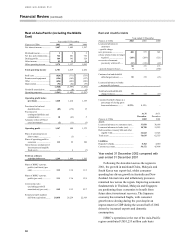

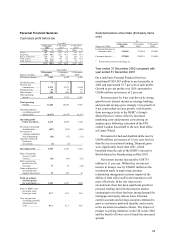

The charge for bad and doubtful debts of US$300

million was the same as for 2001. HSBC Bank

USA’s charge for bad and doubtful debts fell by

US$68 million, or 30 per cent, to US$160 million.

New specific provisions fell by US$38 million, as

credit quality improved in 2002 and the non-

recurrence of a specific provision against exposure to

a corporate customer in the energy sector that arose

in 2001. Releases and recoveries were US$26

million higher than in 2001, as restructuring and debt

reduction programs enabled a number of provisions

raised in previous years against corporate customers

to be released or recovered. The charge for bad and

doubtful debts in Canada of US$81 million was

US$22 million, or 37 per cent, higher than in 2001,

mainly reflecting a provision for an exposure in the

telecommunications sector.

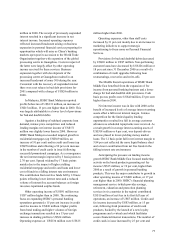

Provisions for contingent liabilities and

commitments were US$585 million lower than in

2001, due to the non-recurrence of the Princeton

Note settlement in 2001.

Gains on the disposal of fixed assets of US$125

million were in line with 2001, and reflected gains

on the disposal of mortgage-backed and South

American securities.

Year ended 31 December 2001 compared with

year ended 31 December 2000

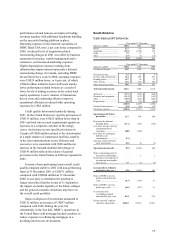

The United States economy continued to deteriorate

in 2001 with investment spending significantly

down, particularly in the technology sectors. Despite

rising unemployment, consumer spending remained

resilient, boosted by lower interest rates as the

Federal Reserve Bank cut short-term interest rates 11

times during the year. Although these sharply lower

interest rates led to rising consumer debt, demand for

corporate loans continued to weaken. For 2001 as a

whole, GDP growth slowed to 1.1 per cent compared

to growth of 4.1 per cent in 2000. Weaker growth

and lower oil prices resulted in a sustained decline in

inflation to just 1.5 per cent by the end of 2001. In

New York State, unemployment has risen from a

cyclical low of 4 per cent early in 2001 to 6 per cent

by the end of 2001.

The year was marked by the tragic events on 11

September. In New York City, HSBC responded

immediately to the tragedy with a number of

donations and programs to assist with the rebuilding

of the community. Although HSBC Bank USA’ s

branch at Five World Trade Center was destroyed we

were fortunate that none of our employees was killed

or injured. As contingency plans were activated,

communications and business activities were

resumed and the resilience of New York as a city and

its inhabitants was awe inspiring to observe.

Although the direct impact on HSBC’s profitability

was small the effect of 11 September will remain

with our staff and the Group owes a large debt of

gratitude for the exemplary way they have continued

to deal with our customers and the broader

community in New York.

Unsurprisingly, given Canada’s extremely high

dependence on the US economy for trade and

investment flows, Canada also registered weaker

activity in 2001. Aggressive interest rate cuts limited

the extent of the downturn but rising unemployment

fed through into weaker consumer spending and poor

corporate profits which kept investment spending

weak. The Canadian dollar was slightly weaker

relative to the US dollar at the end 2001.

HSBC’s operations in North America

contributed US$1,535 million to cash basis profit

before tax; US$377 million, or 33 per cent, higher

than in 2000. Non trading items most notably the

cost of the Princeton Note settlement and

development costs of US$164 million incurred on

HSBC’s ‘e’ commerce platform hsbc.com in its

development centre in New York caused reported

profit before tax to fall by US$357 million, or 42 per

cent, to US$503 million.

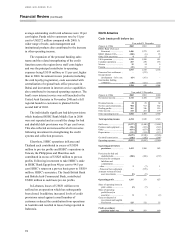

HSBC Bank USA’ s operations in the United

States reported an increase of US$402 million, or 46

per cent, in cash basis profit before tax (excluding

the provision for Princeton Note settlement) in 2001,

due largely to increased levels of net interest income

and gains on disposal of securities, principally

mortgage backed. HSBC’s Canadian operations cash

basis pre-tax profit of US$230 million in 2001 was

US$6 million lower compared with 2000. At

constant exchange rates, HSBC’s Canadian

operations cash basis pre-tax profits were US$3

million higher than in 2000 as increased levels of net

interest income offset higher charges for bad and

doubtful debts and the losses incurred by the

Canadian operations of the Merrill Lynch HSBC

joint venture.

Net interest income increased by US$265

million, or 12 per cent to US$2,450 million when

compared to 2000. In the United States net interest

income was US$222 million higher than in 2000.