HSBC 2002 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Financial Review (continued)

78

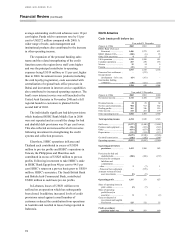

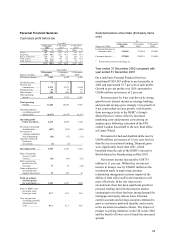

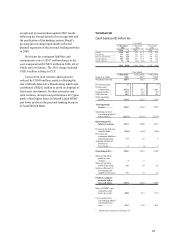

Bad and doubtful debts

Year ended 31 December

Figures in US$m 2002 2001 2000

Loans and advances to

customers

- specific charge

new provisions ...................... 388 346 232

release of provisions no

longer require

d

................. (48 ) (35 ) (28)

recoveries of amounts

p

reviously written of

f

....... (10 ) (8 ) (9)

330 303 195

- additional general charge

against Argentine

exposure........................... (196 )600

–

- general charge/(release) ...... (17) 24 (1)

Customer bad and doubtful

debt charge....................... 117 927 194

Total bad and doubtful debt

charge............................... 117 927 194

Customer bad debt charge as

a percentage of closing

gross loans and advances.. 3.27% 17.80% 3.04%

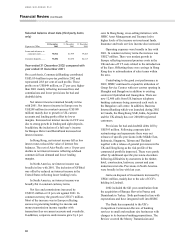

Figures in US$m

At 31

December

2002

At 31

Decembe

r

2001

Assets

Loans and advances to customers (net) ...... 3,028 4,156

Loans and advances to banks (net) ............. 1,665 2,252

Debt securities, treasury bills and other

eligible bills........................................... 1,450 3,386

Total assets ................................................ 8,491 13,097

Liabilities

Deposits by banks ...................................... 661 1,338

Customer accounts..................................... 4,863 7,523

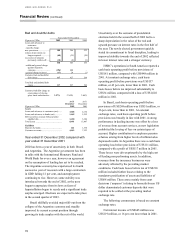

Year ended 31 December 2002 compared with

year ended 31 December 2001

2002 has been a year of uncertainty in both Brazil

and Argentina. The Argentine government has been

in talks with the International Monetary Fund and

World Bank for over a year, however an agreement

on the resumption of lending has yet to be reached.

The Argentine economy has experienced its fourth

successive year of recession with a large contraction

in GDP, falling 12 per cent, and unemployment

continuing to rise. However, some stability was

introduced towards the end of 2002, as the peso

began to appreciate from its lows as fears of

hyperinflation began to recede and a significant trade

surplus emerged. Elections are expected to take place

in the second quarter of 2003.

Brazil skillfully avoided major fall-out from the

collapse of the Argentine economy and steadily

improved its current account position through

growing its trade surplus with the rest of the world.

Uncertainty over the outcome of presidential

elections held in the second half of 2002 led to a

sharp depreciation in the value of the real and

upward pressure on interest rates in the first half of

the year. The newly elected government quickly

stated its commitment to fiscal discipline, leading to

improved stability towards the end of 2002 reflected

in lower interest rates and a stronger currency.

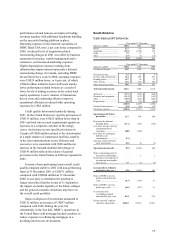

HSBC’s operations in South America reported a

cash basis operating profit before provisions of

US$181 million, compared with US$448 million in

2001. At constant exchange rates, cash basis

operating profit before provisions was US$137

million, or 43 per cent, lower than in 2001. Cash

basis losses before tax improved substantially to

US$34 million, compared with a loss of US$1,002

million in 2001.

In Brazil, cash basis operating profit before

provisions of US$268 million was US$51 million, or

16 per cent, lower than in 2001. At constant

exchange rates, cash basis operating profit before

provisions was broadly in line with 2001. A strong

performance in dealing income was offset by a loss

of revenue from account services, as new legislation

prohibited the levying of fees on certain types of

account. Higher contributions to employee pension

schemes arising from higher levels of inflation also

depressed results. In Argentina there was a cash basis

operating loss before provisions of US$111 million,

compared with a profit of US$117 million in 2001.

These losses were driven primarily by the high cost

of funding non performing assets. In addition,

revenues from the insurance businesses were

adversely affected by the prevailing market

conditions. Cash basis losses before tax of US$210

million included further losses relating to the

mandatory pesification of assets and liabilities of

US$68 million. These arose mainly from court

decisions (‘amparos’ ) relating to formerly frozen US

dollar denominated customer deposits that were

required to be settled at the prevailing market

exchange rate.

The following commentary is based on constant

exchange rates.

Net interest income of US$645 million was

US$119 million, or 16 per cent lower than in 2001.