HSBC 2002 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

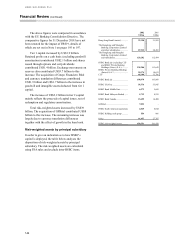

Financial Review (continued)

138

affected by movements in the exchange rates

between these functional currencies and the US

dollar. These currency exposures are referred to as

structural currency exposures. Translation gains and

losses arising from these exposures are recognised in

the statement of total consolidated recognised gains

and losses. These exposures are represented by the

net asset value of the foreign currency equity and

subordinated debt investments in subsidiaries,

branches and associated undertakings.

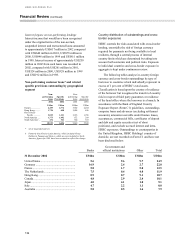

HSBC’s structural foreign currency exposures

are managed with the primary objective of ensuring,

where practical, that HSBC’s and individual banking

subsidiaries’ tier 1 capital ratios are protected from

the effect of changes in exchange rates. This is

usually achieved by holding qualifying tier 1 capital

broadly in proportion to the corresponding foreign-

currency-denominated risk-weighted assets at a

subsidiary bank level. HSBC considers hedging

structural foreign currency exposures only in limited

circumstances, to protect the tier 1 capital ratio or the

US dollar value of capital invested. Such hedging

would be undertaken using forward foreign exchange

contracts or by financing with borrowings in the

same currencies as the functional currencies

involved.

As subsidiaries are generally able to balance

adequately foreign currency tier 1 capital with

foreign currency risk-weighted assets, HSBC’ s

foreign currency structural exposures are usually

unhedged, including exposures due to foreign-

currency-denominated profits arising during the year.

Selective hedges were, however, transacted during

2002.

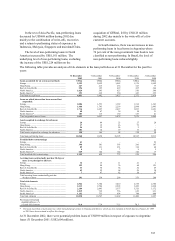

There was no material effect from foreign

currency exchange rate movements on HSBC or,

outside of Argentina, subsidiary tier 1 capital ratios

during the year. The Government of Argentina is still

deliberating on compensation for structural losses

arising from the pesification of formerly US dollar

denominated assets and liabilities that occurred.

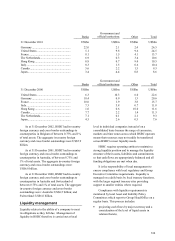

Details of HSBC’s structural foreign currency

exposures are given in Note 40(d) in the ‘Notes on

the Financial Statements’ .

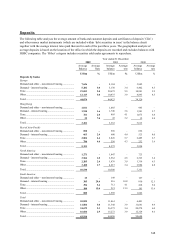

Interest rate exposures

HSBC’s interest rate exposures comprise those

originating in its treasury trading activities and

structural interest rate exposures; both are managed

under limits described on page 136. Interest rate risk

arises on both trading positions and accrual books.

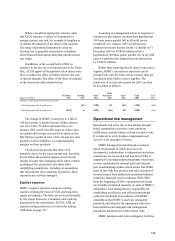

The average daily revenues earned from treasury-

related interest rate activities for 2002 were US$10.7

million compared with US$10.3 million for 2001.

The interest rate risk on interest rate trading positions

is set out in the trading VAR table on page 137.

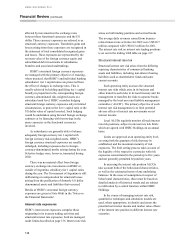

Structural interest rate risk

Structural interest rate risk arises from the differing

repricing characteristics of commercial banking

assets and liabilities, including non-interest bearing

liabilities such as shareholders’ funds and some

current accounts.

Each operating entity assesses the structural

interest rate risks which arise in its business and

either transfers such risks to its local treasury unit for

management or transfers the risks to separate books

managed by the local asset and liability management

committee (‘ALCO’ ). The primary objective of such

interest rate risk management is to limit potential

adverse effects of interest rate movements on net

interest income.

Local ALCOs regularly monitor all such interest

rate risk positions, subject to interest rate risk limits

which are agreed with HSBC Holdings on an annual

basis.

Limits are approved at an operating entity level,

covering both the quantum of risk that may be

established, and the maximum maturity of risk

exposures. The limit setting process takes account of

the liquidity of the respective currencies with risk

exposures concentrated in the period up to five years,

and not generally permitted beyond ten years.

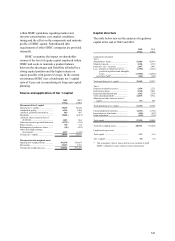

In assessing the interest risk position ALCOs

take account both of the behavioural characteristics,

as well as the contractual terms of any underlying

balances. In the cases of assumptions in respect of

behavioural characteristics, these must be based on

detailed analysis of historical trends and are subject

to ratification by a central function within HSBC

Holdings.

In the course of managing interest rate risk,

quantitative techniques and simulation models are

used, where appropriate, to identify and assess the

potential net interest income and market value effects

of the interest rate position in different interest rate

scenarios.