HSBC 2002 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329

|

|

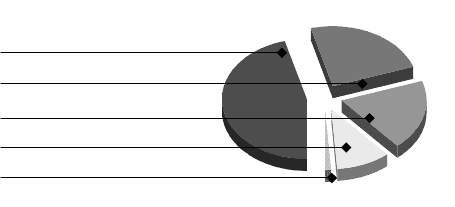

15

Total assets* split by geographical region

As at 31 December 2002

%

Europe 45.7

Hong Kong 24.1

North America 18.9

Rest of Asia Pacific 10.2

South America† 1.1

*excludes Hong Kong SAR Government certificates of

indebtedness

†Formerly described as Latin America, which included

Group entities in Panama and Mexico, which are now

included in North America

Europe

Europe contributed US$3,500 million, or 36.3 per

cent, to HSBC’s profit on ordinary activities before

tax in 2002 compared with US$3,542 million in

2001. The UK contributed US$3,176 million in 2002

compared with US$3,147 million in 2001.

HSBC’s main subsidiaries in Europe are HSBC

Bank plc, CCF S.A., HSBC Private Banking

Holdings (Suisse) S.A., HSBC Trinkaus & Burkhardt

KGaA and HSBC Bank A.S..

HSBC Bank plc

Headquartered in London, HSBC Bank services

over 6 million personal current accounts, inter alia,

through a network of 1,633 branches in the UK,

including 42 outlets in supermarkets. Customers also

have access to approximately 3,000 HSBC Bank

ATM machines, over 42,000 cash machines through

the UK LINK network and over 835,000 ATM

machines worldwide. HSBC Bank serves

approximately 14 per cent of the personal current

account market in England and Wales. At 31

December 2002, on a consolidated basis, HSBC

Bank’s total assets were US$352 billion, total

customer balances were US$211 billion and total net

customer loans were US$169 billion.

HSBC Bank’s strategy is to build long-term

customer relationships by listening to customers,

understanding their needs and delivering the most

effective solutions.

In following this strategy during 2002, the bank

continued to invest in improving customer

relationship management systems, in creating more

convenient service channels ranging from

conventional branches to the internet and mobile

phones, in developing innovative and flexible

products and in building a reputation for fair pricing.

Evidencing customers’ continuing response to

easier access to banking services, 5 million calls per

month are now answered across HSBC call centres

(excluding First Direct). Matching customer

preference, over 50 per cent of all telephone calls are

handled through automated systems, providing a

more efficient and cost effective service. This has

allowed call centres to be used for more outward

bound calls leading to more customers purchasing

financial products and services over the telephone.

Over 780,000 sales, including personal loans

totalling over US$1.2 billion, were made through

Direct Financial Services in 2002, an increase of

over 280,000 sales on 2001.

Demand for remote services continues to grow

and HSBC Bank is responding with continued

investment in internet banking, TV banking and

ATMs. Some 1.2 million customers are now

registered for personal internet banking with a

further 177,000 customers registered for TV

Banking. These customers access their bank account

details around one million times weekly via personal

internet banking, and over half of all payments on

demand are made online.

Global processing, through the establishment of

Group Service Centres (GSCs), continued to play an

important role in HSBC’s strategic aim of pursuing

economies of scale in order to increase productivity

and achieve a competitive and economic advantage.

Since their introduction in 1996, the GSCs have

progressively fulfilled more of the back office

functions previously undertaken by HSBC’s

principal members, including HSBC Bank. The

centres provide a wide range of activities for a

growing number of business areas, including cards,

mortgage processing, investment products and retail

banking.

The HSBC Premier customer account base in

the UK has grown by 44 per cent during 2002. The

Premier telephone service has been enhanced to

include the opening of personal loans, credit cards

and savings accounts. 22 per cent of Premier

customers have registered for personal internet

banking.