HSBC 2002 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

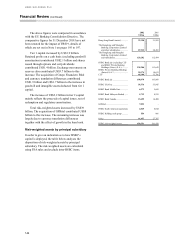

Financial Review (continued)

140

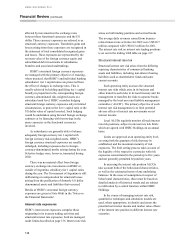

to support operations in the event of disasters.

Additional reviews and tests were conducted

following the terrorist events of 11 September 2001

to incorporate lessons learned in the operational

recovery from those circumstances. Insurance cover

is arranged to mitigate potential losses associated

with certain operational risk events.

Capital management and allocation

Capital measurement and allocation

The Financial Services Authority (‘FSA’ ) is the

supervisor of HSBC on a consolidated basis and, in

this capacity, receives information on the capital

adequacy of, and sets capital requirements for,

HSBC as a whole. Individual banking subsidiaries

are directly regulated by the appropriate local

banking supervisors, which set and monitor capital

adequacy requirements for them. Similarly, non-

banking subsidiaries may be subject to supervision

and capital requirements of relevant local regulatory

authorities. Since 1988, when the governors of the

Group of Ten central banks agreed to guidelines for

the international convergence of capital measurement

and standards, the banking supervisors of HSBC’s

major banking subsidiaries have exercised capital

adequacy supervision in a broadly similar

framework.

Under the European Union’s Banking

Consolidation Directive, the FSA requires each bank

and banking group to maintain an individually

prescribed ratio of total capital to risk-weighted

assets. The method the FSA uses to assess the capital

adequacy of banks and banking groups has been

modified as a result of its implementation of the

European Union’s Amending Directive (Directive

98/31/EC) to the Capital Adequacy Directive

(‘CAD2’ ). This modification allows banks to

calculate capital requirements for market risk in the

trading book using VAR techniques.

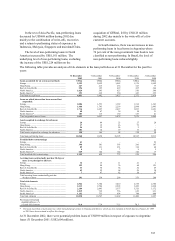

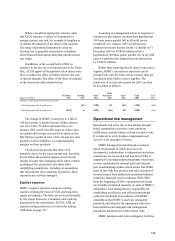

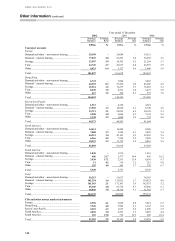

Capital adequacy is measured by the ratio of

HSBC’s capital to risk-weighted assets, taking into

account both balance sheet assets and off-balance-

sheet transactions.

HSBC’s capital is divided into two tiers: tier 1,

comprising shareholders’ funds excluding

revaluation reserves, innovative tier 1 securities and

minority interests in tier 1 capital; and tier 2,

comprising general loan loss provisions, property

revaluation reserves, qualifying subordinated loan

capital and minority and other interests in tier 2

capital. The amount of qualifying tier 2 capital

cannot exceed that of tier 1 capital, and term

subordinated loan capital may not exceed 50 per cent

of tier 1 capital. There are also limitations on the

amount of general provisions which may be included

in tier 2 capital. Deductions in respect of goodwill

and intangible assets are made from tier 1 capital,

and in respect of unconsolidated investments,

investments in the capital of banks and other

regulatory deductions are made from total capital.

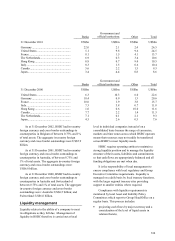

Under CAD2, banking operations are

categorised as either trading book (broadly, marked-

to-market activities) or banking book (all other

activities) and risk-weighted assets are determined

accordingly. Banking book risk-weighted assets are

measured by means of a hierarchy of risk weightings

classified according to the nature of each asset and

counterparty, taking into account any eligible

collateral or guarantees. Banking book off-balance-

sheet items giving rise to credit, foreign exchange or

interest rate risk are assigned weights appropriate to

the category of the counterparty, taking into account

any eligible collateral or guarantees. Trading book

risk-weighted assets are determined by taking into

account market-related risks, such as foreign

exchange, interest rate and equity position risks, as

well as counterparty risk.

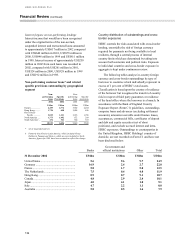

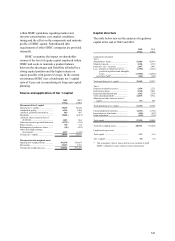

HSBC capital management

It is HSBC’s policy to maintain a strong capital base

to support the development of HSBC’s business.

HSBC seeks to maintain a prudent balance between

the different components of its capital and, in HSBC

Holdings, between the composition of its capital and

that of its investment in subsidiaries. This is achieved

by each subsidiary managing its own capital within

the context of an approved annual plan which

determines the optimal amount and mix of capital to

support planned business growth and to meet local

regulatory capital requirements. Capital generated in

excess of planned requirements is paid up to HSBC

Holdings normally by way of dividends and

represents a source of strength for HSBC.

It is HSBC policy that HSBC Holdings is

primarily a provider of equity capital to its

subsidiaries with such equity investment

substantially funded by HSBC Holdings own equity

issuance and profit retentions. Non-equity tier 1 and

subordinated debt requirements of major subsidiaries

are normally met by their own market issuance