HSBC 2002 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329

|

|

HSBC HOLDINGS PLC

Financial Review (continued)

52

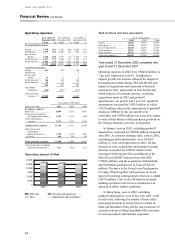

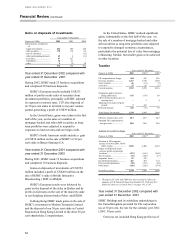

Asset deployment

At 31 December 2002 At 31 December 2001

US$m % US$

m

%

Loans and

advances to

customers ........ 352,344 47.1 308,649 44.9

Loans and

advances to

b

anks............... 95,496 12.7 104,641 15.2

Debt securities ..... 175,730 23.4 160,579 23.4

Treasury bills an

d

other eligible

b

ills ................. 18,141 2.4 17,971 2.6

Equity shares........ 8,213 1.1 8,057 1.2

Intangible fixed

assets................. 17,163 2.3 14,564 2.1

Othe

r

................... 82,714 11.0 73,147 10.6

749,801 100.0 687,608 100.0

Hong Kong SAR

Government

certificates of

indebtedness.... 9,445 8,637

Total assets .......... 759,246 696,245

Loans and advances to

customers include:

- reverse repos..... 12,545 14,823

- settlement

accounts .......... 8,385 11,761

Loans and advances to banks

include:

- reverse repos...... 18,736 10,926

- settlement

accounts .......... 4,717 4,433

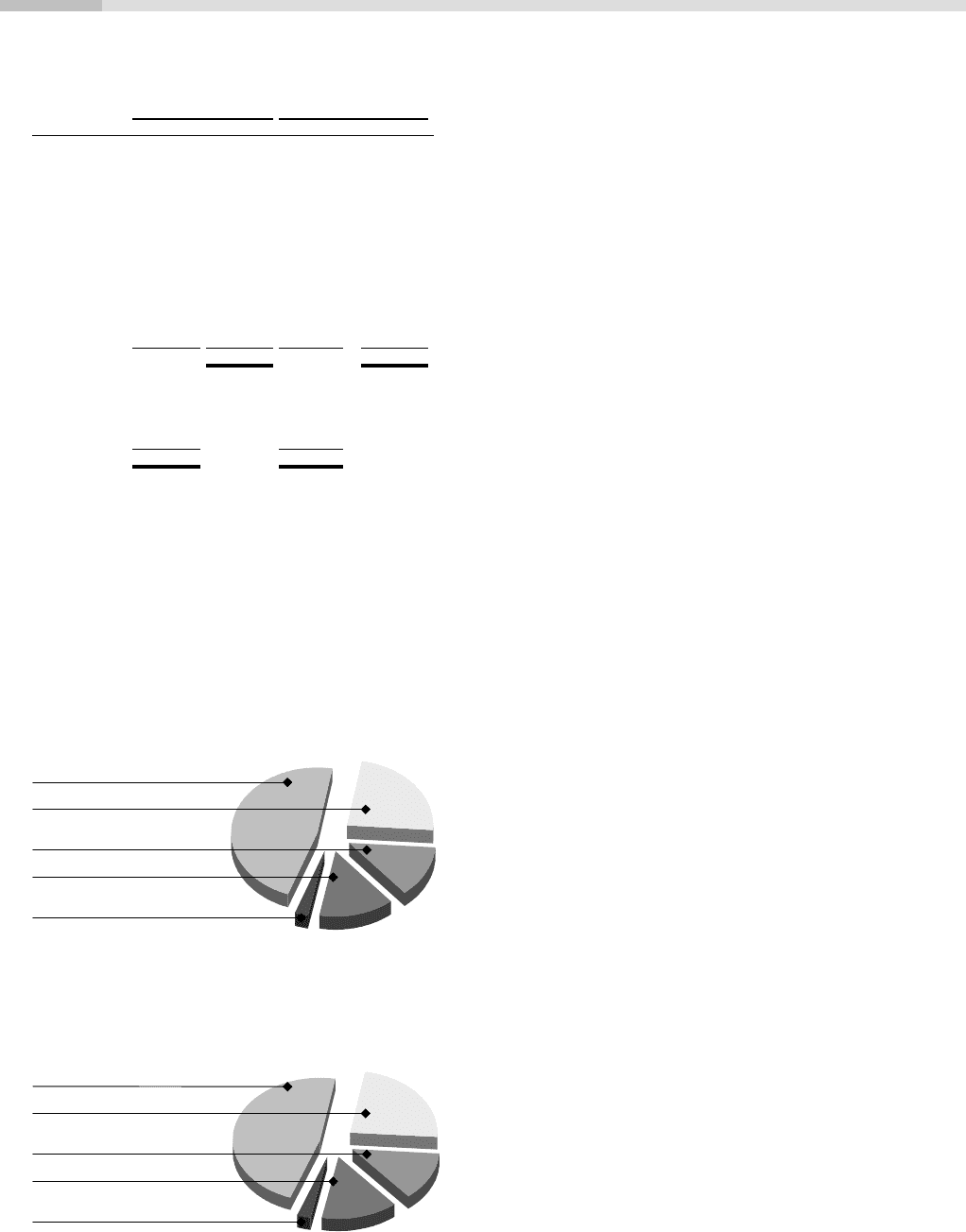

Asset 2002 (excluding Hong Kong Government

certificates of indebtedness)

%

US$b

Loans and advances

to Customers 47.1 352.3

Debt Securities 23.4 175.7

Loans and Advances

to Banks 12.7 95.5

Other 14.4 108.2

Treasury and other

eligible bills 2.4 18.1

Total 100 749.8

Assets 2001 (excluding Hong Kong Government

certificates of indebtedness)*

%US$b

Loans and advances

to Customers 44.9 308.6

Debt Securities 23.4 160.6

Loans and Advances

to Banks 15.2 104.6

Other 13.9 95.8

Treasury and other

eligible bills 2.6 18.0

Total 100 687.6

* The figures for 2001 have been restated to reflect the

adoption of UK Financial Reporting Standard 19

‘Deferred Tax’, details of which are set out in Note 1 on

pages 195 to 197.

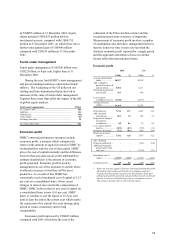

31 December 2002 compared with 31

December 2001

HSBC’s total assets at 31 December 2002 were

US$759 billion, an increase of US$63 billion, or 9

per cent, since 31 December 2001; at constant

exchange rates, the increase was US$29 billion, or 4

per cent. US$23 billion or 74 per cent of this growth

was attributable to acquisitions, of which US$22

billion resulted from the acquisition of GFBital.

HSBC’s balance sheet remained highly liquid,

reflecting further strong growth in customer deposits

and limited credit demand in some countries.

Approximately 47 per cent of the balance sheet was

deployed in customer loans and advances which was

2 per cent higher than as at 31 December 2001.

At constant exchange rates, gross loans and

advances to customers (excluding loans to the

financial sector) at 31 December 2002 were US$32

billion, or 11 per cent, higher than at 31 December

2001. Of this growth US$9.7 billion reflected the

acquisition of GFBital. Excluding the impact of

GFBital, personal lending grew by 15 per cent and

constituted 88 per cent of the organic growth in

lending outside the financial sector, with strong

organic growth in the UK, United States, Malaysia,

Taiwan, Korea, Singapore and India. Personal

lending now constitutes 42 per cent of gross

customer lending at 31 December 2002, compared

with 39 per cent at 31 December 2001. Loans and

advances to the commercial and corporate customer

base (excluding Governments) grew by 3 per cent

and reflected muted loan demand from this sector.

At 31 December 2002, assets held by the Group

as custodian amounted to US$1,350 billion. Custody

is the safe-keeping and administration of securities

and financial instruments on behalf of others. Funds

under management amounted to US$306 billion at

31 December 2002.

Debt securities and equity shares

Continuing reductions in interest rates, particularly in

the United States have contributed to debt securities

held in the accruals book at 31 December 2002 being

recognised in the accounts at an amount net of off-

balance-sheet hedges, of US$1,278 million less than

market value, compared with an unrecognised gain