HSBC 2002 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329

|

|

HSBC HOLDINGS PLC

Description of Business (continued)

14

Financing and Advisory Services. These comprise

capital raising, including debt and equity capital,

structured finance, and syndicated finance,

leveraging links with other areas of the business to

provide full distribution for these instruments;

corporate finance and advisory services including

those in connection with mergers and acquisitions,

asset disposals, stock exchange listings,

privatisations and capital restructurings; project and

export finance services providing non-recourse

finance to exporters, importers and financial

institutions, working closely with all major export

credit agencies; aviation and structured finance for

complex and tax efficient investment facilities; and

Amanah finance which provides structured products

that are consistent with Islamic laws.

Investor services. These comprise treasury and

capital markets services for supranationals, central

banks, corporations, institutional and private

investors, financial institutions and other market

participants. Products include foreign exchange;

currency, interest rate, bond and other specialised

derivatives; government and non-government fixed

income and money market instruments; precious

metals and exchange traded futures. Equity services,

including research, sales and trading for institutional,

corporate and private clients and asset management

services, including global investment advisory and

fund management services, are also offered.

Insurance services. These comprise a narrow range

of specialist insurance services for major corporate

and institutional customers.

Private Banking

Private Banking provides world class financial

services to high net worth individuals and their

families, through four distinct businesses:

• HSBC Republic, HSBC’ s principal international

private banking division;

• HSBC Guyerzeller, a traditional Swiss private

bank focusing on discretionary management and

trustee services;

• CCF Private Banking, with its strong presence

in the euro zone; and

• HSBC Trinkaus & Burkhardt, providing

banking and fund services in Germany,

Luxembourg and Hong Kong.

As part of HSBC’s strategic objectives, the

onshore and offshore businesses have now been

unified in the UK and the process of alignment is

under way in the US. Private Banking works closely

with HSBC’s retail, commercial and corporate and

investment banking networks to generate and

maintain ‘two-way’ client referrals.

Client services include deposits and funds

transfer, tax and trustee structures, asset and trust

management, mutual funds, currency and securities

transactions, lending, letters of credit, guarantees and

other extensions of credit on a collateralised basis.

The high net worth client requires a highly

differentiated service, provided through a

combination of geographical presence and

specialised bankers. Working in collaboration with

other members of HSBC, Private Banking is able to

provide its clients with not just private banking, trust,

and wealth management services, but a

comprehensive range of financial services, including

corporate banking, investment banking and

insurance.

In 2002, Private Banking launched WTAS and

several successful product offerings, particularly in

the area of alternative investments and tax-efficient

insurance wrapper products. The trust business has

been expanded in the US, Asia and the Channel

Islands and, building on its success in Asia, internet

banking services were rolled out to the US, UK and

Switzerland.

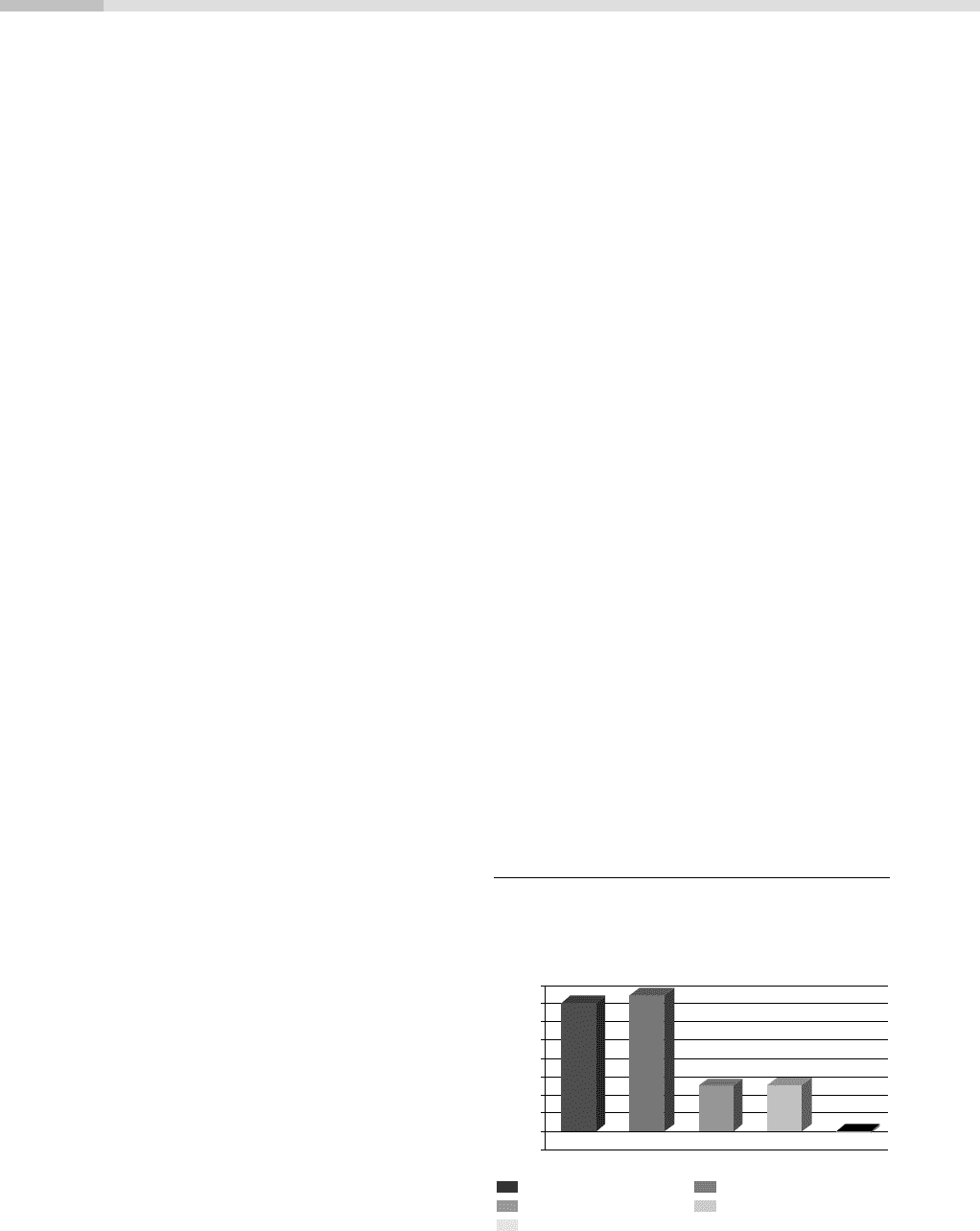

Geographical Regions

Profit before tax split by geographical region

Year ended 31 December 2002

Europe Hong Kong

North America Rest of Asia-Pacific

South America

3,500 3,710

1,238 1,260

-58

-500

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

12345