HSBC 2002 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

of Household for a consideration of approximately

US$14.2 billion. The agreement remains subject to a

number of conditions including shareholders’

approval and regulatory approvals.

HSBC’s financial performance has also been and

may continue to be affected by both actual changes

in, and speculation about, market exchange rates,

such as the US dollar-pound sterling exchange rate,

and government-established exchange rates, such as

the managed exchange rate between the Hong Kong

dollar and the US dollar. In 2002, the decline in the

value of the US dollar against sterling and the euro

had a significant effect on the results reported in

Europe, while the strengthening of the US dollar

against the Argentine peso and Brazilian real

significantly affected the results reported in South

America.

HSBC has economic, financial market, credit,

legal, political and other specialists who monitor

economic and market conditions and government

policies and actions. However, because of the

difficulty involved in predicting with accuracy

changes in economic or market conditions or in

governmental policies and actions, HSBC cannot

fully anticipate the effects that such changes might

have on its financial performance and business

operations. HSBC believes that the most important

external factors affecting its business in 2003 will be

the impact on the world economy of possible conflict

in the Middle East, and low expected growth rates in

the US and in European economies.

So far during the economic and stock market

downturn consumers and small business customers

have proved surprisingly resilient. Policy initiatives

to maintain economic activity through low interest

rates have been effective. Although equity markets

have fallen, property markets have supported

consumer confidence and have attracted savings and

investment flows. However, this cannot be a long

term solution for repairing world economic growth

prospects. Overcapacity still burdens many of the

world’ s industries, leading to corporate activity

focussed on rationalisation rather than expansion. It

is a period of cost reduction rather than revenue

growth. Demand for investment funding remains

very modest. Pension provision and, in the US

retirement health benefits obligations, entered into by

companies during a more benign economic climate,

are likely to place a severe strain on future corporate

profits. Employment levels remain a key factor in

economic recovery. During the current uncertainties,

HSBC believes completion of the Household

acquisition announced last year will improve its

geographical balance. This will also change the

character of risks within HSBC’ s financial

framework by increasing the proportion of earnings

from the personal sector which, long term, has more

predictable revenue and cost characteristics.

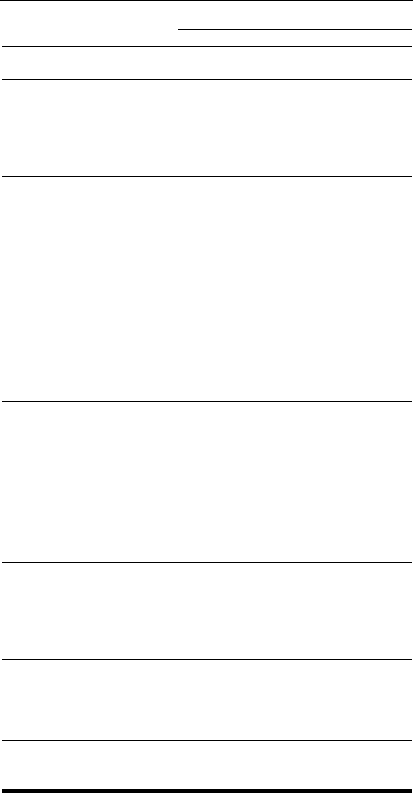

Summary

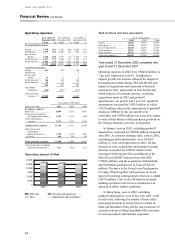

Year ended 31 December

Figures in US$m 2002 2001

†

2000†

Net interest income .............. 15,460 14,725 13,723

Other operating income........ 11,135 11,163 10,850

Total operating income ...... 26,595 25,888 24,573

Operating expenses excluding

goodwill amortisation...... (14,954 ) (14,605) (13,577 )

Goodwill amortisation.......... (854 ) (799) (510)

Operating profit before

provisions ....................... 10,787 10,484 10,486

Provisions for bad and

doubtful debts.................. (1,321 ) (2,037) (932 )

Provisions for contingent

liabilities and

commitments................... (39 ) (649) (71 )

Loss from foreign currency

redenomination in

Argentina......................... (68 ) (520)

–

Amounts written off fixed

asset investments............. (324 ) (125) (36)

Operating profit ................. 9,035 7,153 9,447

Share of operating loss in join

t

ventures........................... (28 ) (91 ) (51)

Share of operating profit in

associates ........................ 135 164 75

Gains/(losses) on disposal of:

- investments ...................... 532 754 302

- tangible fixed assets......... (24 ) 20 2

Profit on ordinary activities

before tax ....................... 9,650 8,000 9,775

Tax on profit on ordinary

activities .......................... (2,534 ) (1,988) (2,409)

Profit on ordinary activities

after tax.......................... 7,116 6,012 7,366

Minority interests................. (877 ) (1,020 ) (909)

Profit attributable to

shareholders................... 6,239 4,992 6,457

Cash basis profit before tax* 10,513 8,807 10,300

Cash basis profit attributable to

shareholders*................... 7,102 5,799 6,982

* Cash based measurements are after excluding the impact of

goodwill amortisation.

†The figures for 2001 and 2000 have been restated to reflect the

adoption of UK Financial Reporting Standard 19 ‘Deferred Tax’,

details of which are set out in Note 1 on pages 195 to 197.