HSBC 2002 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.45

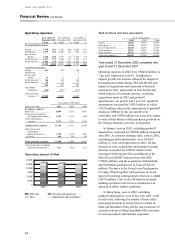

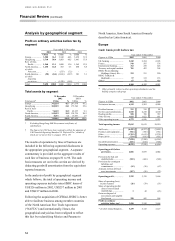

In the rest of Asia-Pacific, costs in 2002,

excluding goodwill amortisation, increased by

US$131 million, or 9 per cent compared with 2001.

This growth in costs primarily reflected a higher staff

complement in Group Service Centres in India and

mainland China and the expansion of business in

several countries in the region, in particular mainland

China, Taiwan, the Middle East and in Australia

through the acquisition of NRMA. During the year

The Hongkong and Shanghai Banking Corporation

opened eight new branches in the Asia Pacific

region.

Operating expenses in North America, excluding

goodwill amortisation, increased by US$135 million,

or 5 per cent, in 2002. This increase was largely

driven by the impact of the acquisition of GFBital

and the costs associated with the establishment of the

WTAS business in the United States. A reduction in

the costs associated with ongoing development of

hsbc.com offset additional costs relating to the

closure of the institutional equity business in Canada

and the restructuring of the merchant banking

business in the United States.

In South America, operating expenses, excluding

goodwill amortisation, fell by US$437 million, or 29

per cent, during 2002. At constant exchange rates

operating expenses, excluding goodwill amortisation,

were 4 per cent higher than in 2001. The increase

related to industry-wide union agreed salary

adjustments in Brazil and costs of severance as

headcount reductions were made in the recessionary

environment.

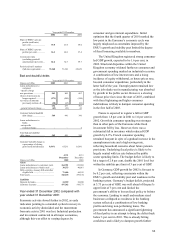

Year ended 31 December 2001 compared with

year ended 31 December 2000

Operating expenses were US$1,317 million higher

than in 2000. This increase was mainly driven by the

recent acquisitions together with a related US$289

million increase in goodwill amortisation.

In Europe, costs, excluding goodwill

amortisation, increased by US$770 million compared

with 2000 and included US$128 million of

restructuring costs. At constant exchange rates, costs

in 2001, excluding goodwill amortisation, were

US$1,023 million, or 16 per cent, higher than in

2000, of which the inclusion of CCF’ s cost base

accounted for US$769 million. Business expansion

and increased information technology-related

expenditure to support business development

projects lay at the heart of the cost increase.

In Hong Kong, costs in 2001, excluding

goodwill amortisation, increased by US$154 million,

or 8 per cent, compared with 2000. Staff costs

increased by 10 per cent mainly to support business

expansion in personal financial services, particularly

in credit card and Mandatory Provident Fund

products. Operating expenses, other than staff costs,

rose by 5 per cent to support wealth management

expansion and the development of e-banking

initiatives.

In the rest of Asia-Pacific, operating expenses,

excluding goodwill amortisation, increased by

US$105 million, or 8 per cent, compared to 2000. At

constant exchange rates, the increase was 16 per

cent. Recent acquisitions accounted for some US$31

million of the cost increase. The remaining growth in

costs reflected higher staff numbers to support

business expansion, particularly in personal financial

services and wealth management initiatives together

with a doubling of complement in our shared service

centres in India and mainland China.

Operating costs, excluding goodwill

amortisation, in North America were US$144

million, or 6 per cent, higher than in 2000. Of this

increase, US$164 million related to development

costs associated with hsbc.com. The underlying

change in operating costs was a decrease of 1 per

cent. This principally reflected a 2 per cent fall in the

domestic cost base of HSBC Bank USA with a

reduced level of restructuring charges offset by

business expansion costs.

In South America, operating expenses at

constant exchange rates were US$133 million, or 10

per cent, higher than in 2001. This mainly reflected

the acquisition of CCF Brazil and restructuring costs.

As economic conditions become less certain in the

region, further cost controls were put in place to

restrain cost growth.

The Group’s global processing initiatives

continue to develop with some 2000 staff employed

at HSBC’s global processing centres in mainland

China and India at 31 December 2001.

HSBC’s cost: income ratio, excluding goodwill

amortisation, was 56.4 per cent in 2001, reflecting

the cost structure of new acquisitions and investment

in the expanding wealth management businesses and

IT.