HSBC 2002 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.199

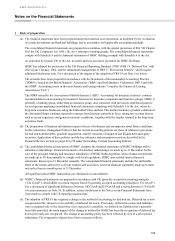

advances. The asset acquired is recorded at the carrying value of the advance disposed of at the date of the

exchange and provisions are based on any subsequent deterioration in its value.

(c) Treasury bills, debt securities and equity shares

Treasury bills, debt securities and equity shares intended to be held on a continuing basis are disclosed as

investment securities and are included in the balance sheet at cost less provision for any permanent diminution

in value.

Where dated investment securities have been purchased at a premium or discount, these premiums and discounts

are amortised through the profit and loss account over the period from the date of purchase to the date of

maturity so as to give a constant rate of return. If the maturity is at the borrowers’ option within a specified

range of years, the maturity date which gives the more conservative result is adopted. These securities are

included in the balance sheet at cost adjusted for the amortisation of premiums and discounts arising on

acquisition. The amortisation of premiums and discounts is included in ‘Interest receivable’ . Any profit or loss

on realisation of these securities is recognised in the profit and loss account as it arises and included in ‘Gains

on disposal of investments’ .

Other treasury bills, debt securities, equity shares and short positions in securities are included in the balance

sheet at market value. Changes in the market value of such assets and liabilities are recognised in the profit and

loss account as ‘Dealing profits’ as they arise. For liquid portfolios market values are determined by reference to

independently sourced mid-market prices. In certain less liquid portfolios securities are valued by reference to

bid or offer prices as appropriate. Where independent prices are not available, market values may be determined

by discounting the expected future cash flows using an appropriate interest rate adjusted for the credit risk of the

counterparty. In addition, adjustments are made for illiquid positions where appropriate.

Where securities are sold subject to a commitment to repurchase them at a predetermined price, they remain on

the balance sheet and a liability is recorded in respect of the consideration received. Conversely, securities

purchased under analogous commitments to resell are not recognised on the balance sheet and the consideration

paid is recorded in ‘Loans and advances to banks’ or ‘Loans and advances to customers’ .

(d) Subsidiary undertakings, joint ventures, associates and other participating interests

(i) HSBC Holdings’ investments in subsidiary undertakings are stated at net asset values, including attributable

goodwill. Changes in net assets of subsidiary undertakings are accounted for as movements in the

revaluation reserve.

(ii) Interests in joint ventures are stated at HSBC’ s share of gross assets, including attributable goodwill, less

HSBC’ s share of gross liabilities.

(iii) Interests in associates are stated at HSBC’ s share of net assets, including attributable goodwill.

(iv) Other participating interests are investments in the shares of undertakings which are held on a long-term

basis for the purpose of securing a contribution to HSBC’ s business, other than subsidiary undertakings,

joint ventures or associates. Other participating interests are stated at cost less any permanent diminution in

value.

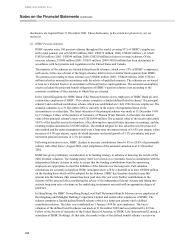

(v) Goodwill arises on the acquisition of subsidiary undertakings, joint ventures or associates when the cost of

acquisition exceeds the fair value of HSBC’ s share of separable net assets acquired. Negative goodwill

arises on the acquisition of subsidiary undertakings, joint ventures and associates when the fair value of

HSBC’ s share of separable net assets acquired exceeds the cost of acquisition. For acquisitions made on or

after 1 January 1998, goodwill is included in the balance sheet in ‘Intangible fixed assets’ in respect of

subsidiary undertakings, in ‘Interests in joint ventures’ in respect of joint ventures and in ‘Interests in

associates’ in respect of associates. Capitalised goodwill is amortised over its estimated life on a straight-

line basis. For acquisitions prior to 1 January 1998, goodwill was charged against reserves in the year of

acquisition. Capitalised goodwill is tested for impairment when necessary by comparing the present value

of the expected future cash flows from an entity with the carrying value of its net assets, including