HSBC 2002 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

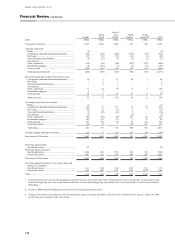

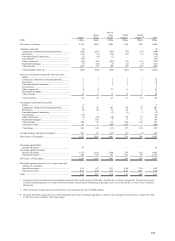

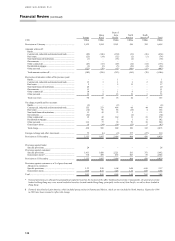

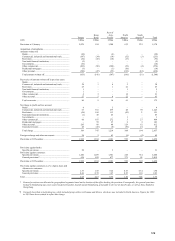

Financial Review (continued)

126

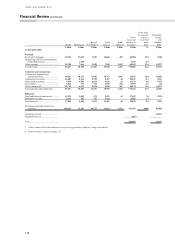

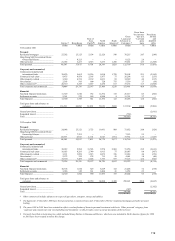

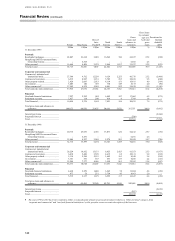

Europe

Hong

Kong

Rest o

f

Asia-

Pacific

Nort

h

America

Sout

h

America

¶

Total

2001 US$

m

US$

m

US$

m

US$

m

US$

m

US$

m

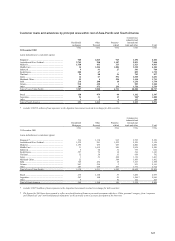

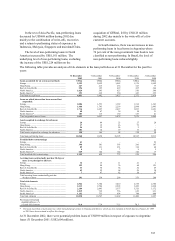

Provisions at 1 Januar

y

..................................................... 3,025 1,802 2,091 739 540 8,197

Amounts written off:

Banks............................................................................ (5)

–

–

–

–

(5)

Commercial, industrial and international trade.............. (123 ) (238) (256) (107) (29) (753)

Real estate .................................................................... (27 ) (29) (18) (10) (4) (88)

Non-bank financial institutions..................................... (5 ) (53) (5) (3) (1) (67)

Governments ................................................................

–

–

–

–

–

–

Other commercial......................................................... (54) (34) (48) (107) (215) (458)

Residential mortgages................................................... (4 ) (121) (7) (2) (13) (147)

Other personal .............................................................. (224 ) (155) (93) (93) (95) (660)

Total amounts written of

f

.............................................. (442 ) (630) (427) (322) (357) (2,178)

Recoveries of amounts written off in previous years:

Commercial, industrial and international trade.............. 12 1 11 18 3 45

Real Estate 1 2 1

–

–

4

Non-bank financial institutions.....................................

–

31

–

–

4

Governments ................................................................

–

–

–

–

–

–

Other commercial......................................................... 17 12 99 11 1 140

Residential mortgages................................................... 1 5

–

–

–

6

Other personal .............................................................. 34 8 26 14 4 86

Total recoveries ............................................................ 65 31 138 43 8 285

Net charge to profit and loss account:

Banks............................................................................ (1)

–

–

–

–

(1)

Commercial, industrial and international trade.............. 164 15 157 93 55 484

Real estate .................................................................... (35 ) 16 (6) 2 7 (16)

Non-bank financial institutions..................................... (2 ) (20) (14) 2

–

(34)

Governments ................................................................ (2)

–

–

(3 )

–

(5)

Other commercial......................................................... 143 (84) (58) 151 90 242

Residential mortgages................................................... (47 ) 111 10 1 17 92

Other personal .............................................................. 257 168 82 70 125 702

General provisions........................................................ (36) (9) 1 (16) 633 573

Total charge.................................................................. 441 197 172 300 927 2,037

Foreign exchange and other movements........................... (22) 8 (22) (37) (85) (158)

Provisions at 31 Decembe

r

............................................... 3,067 1,408 1,952 723 1,033 8,183

Provisions against banks:

Specific provisions ....................................................... 22

–

–

–

–

22

Provisions against customers:

Specific provisions ....................................................... 2,204 856 1,786 289 365 5,500

General provisions*...................................................... 841 552 166 434 668 2,661

Provisions at 31 Decembe

r

............................................... 3,067 1,408 1,952 723 1,033 8,183

Provisions against customers as a % of gross loans and

advances to customers:

Specific provisions ....................................................... 1.61 1.24 5.44 0.39 7.03 1.73

General provisions........................................................ 0.62 0.80 0.51 0.59 12.87#0.84

Total................................................................................. 2.23 2.04 5.95 0.98 19.90 2.57

*General provisions are allocated to geographical segments based on the location of the office booking the provision. Consequently, the general provision

booked in Hong Kong may cover assets booked in branches located outside Hong Kong, principally in the rest of Asia-Pacific, as well as those booked in

Hong Kong.

#Includes US$600 million of additional general provisions held against Argentine loans.

¶ Formerly described as Latin America, which included group entities in Panama and Mexico, which are now included in North America. Figures for 1998

to 2001 have been restated to reflect this change.