HSBC 2002 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Financial Review (continued)

60

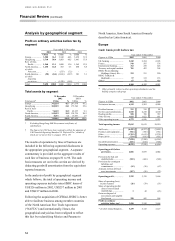

These increases were partly offset by a fall in net

interest income in HSBC Republic Suisse reflecting

a reduction in the benefit of net free funds from

falling interest rates.

CCF’s net interest income of US$889 million

(2000: US$296 million for five months) reflected a

full year trading period including the acquisition of

Banque Hervet. Interest income was proportionally

higher than the previous year due to growth in

customer advances in both CCF’s retail branches and

regional banking subsidiaries. Net interest income

also benefited from a slight improvement in credit

spreads.

In UK Banking, net interest income was 2 per

cent higher than in 2000. Balance sheet growth of 29

per cent was achieved in personal savings products, 8

per cent in personal current accounts and 14 per cent

in business current accounts. The benefit of these

higher deposits was reduced by the impact of HSBC

Bank plc’s product repricing which resulted in

narrower spreads on a number of products,

particularly savings accounts and residential

mortgages. HSBC Bank plc’s mortgage advances

were US$2.5 billion, or 13 per cent, higher than 2000

reflecting an increase in new lending and improved

retention of existing customers.

Net interest income earned in treasury and

capital markets increased strongly compared to 2000.

This increase was primarily due to earnings on

money market business which benefited from

reduced funding costs as short-term lending rates

declined. In addition, the deployment of surplus

liquidity in increasing holdings of investment grade

corporate bonds also benefited net interest income.

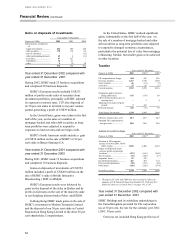

Other operating income at US$6,056 million

was US$370 million, or 7 per cent, higher than in

2000. Excluding CCF, other operating income at

US$4,982 million was US$168 million, or 3 per cent

lower than in 2000 reflecting reduced dealing profits

and lower broking and other securities-related fee

income from investment banking activities. These

were partly offset by increased wealth management

and corporate banking fees particularly in UK

Banking.

CCF’s other operating income was US$1,074

million in 2001 compared with US$536 million for

the five months of 2000. Net fee income at US$781

million, US$415 million higher than the five month

contribution in 2000 reflected a full year trading

period including the acquisition of Banque Hervet.

Net fee income was adversely affected by lower

equity market related activities, and in spite of strong

growth in Commercial and Corporate Banking and

Capital Markets fees. That growth results both from

good customer demand and the synergies allowed by

the integration of CCF within HSBC. This

integration also helped HSBC to strongly improve its

positioning in the eurobond market. In addition,

CCF’s dealing profits of US$190 million, US$105

million higher than the five month contribution in

2000 reflected a full year trading period, good results

in Treasury and Capital Markets and a less

favourable performance in securities trading.

In UK Banking, other operating income at

US$2,976 million was 4 per cent higher than in

2000, notwithstanding the bank’s decision to remove

charges for debit card withdrawals from ATM

machines in the LINK network, on which US$49

million gross income was earned in 2000, and

withdrawal of the loan to valuation fees on

mortgages. The increase reflected growth in wealth

management, higher fee income from cards and

higher corporate banking fees.

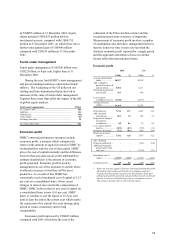

Wealth management income increased by

US$66 million, or 9 per cent, compared with 2000.

Within this, notwithstanding the depressed market

for investment products, income from life, pensions

and investment products increased by US$45

million, or 16 per cent of which US$27 million

related to non-recurring elements in the calculation

of profits on long-term assurance business. General

insurance income increased by 9 per cent primarily

through the sale of income protection products.

Personal account overdraft fees and mortgage

were reduced compared with 2000. Overdraft fees

declined by US$41 million, reflecting a reduction in

unauthorised overdrafts. Mortgage fees were US$7

million lower than 2000, mainly due to the removal

of loan to valuation fees.

Corporate banking fees increased by 7 per cent

benefiting from the bank’s strategy of aligning

Corporate and Investment Banking services. In

addition, increased transaction volumes resulted in a