HSBC 2002 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

performance-related bonuses on improved trading

revenues together with additional headcount building

on the successful trading platform in place.

Operating expenses in the domestic operations of

HSBC Bank USA were 2 per cent lower compared to

2000. A reduced level of acquisition related

restructuring charges in 2001 was offset by business

expansion in treasury, wealth management and e-

commerce, and increased marketing expenses.

Higher depreciation expense resulting from

infrastructure improvements represents a delayed

restructuring charge. In Canada, excluding HSBC

Invest Direct Inc’s costs in 2000, operating expenses

were US$29 million lower, or 6 per cent, of which

US$24 million related to lower staff costs mainly

lower performance related bonuses as a result of

lower levels of trading revenues in the scaled back

equity operations. Lower volumes of transaction-

driven costs and continuing efforts to improve

operational efficiencies reduced other operating

expenses by US$5 million.

Credit quality deteriorated modestly during

2001. In the United States new specific provisions of

US$313 million, were US$25 million lower than in

2001 and took into account requirements against an

exposure to a corporate customer in the energy

sector. An increase in new specific provisions in

Canada of US$40 million related to the deterioration

of a small number of commercial facilities, notably

in the telecommunications sector. Releases and

recoveries were consistent with 2000 and the net

increase in the bad and doubtful debt charge of

US$143 million reflects the release of general

provision in the United States in 2000 not repeated in

2001.

In terms of non-performing loans overall credit

quality remained stable in 2001 with non-performing

loans at 31 December 2001 at US$671 million

compared with US$684 million at 31 December

2000. It was early to determine the medium to

longer-term effect that the events of 11 September,

the impact on market liquidity of the Enron collapse

and the general economic slowdown may have on

the overall credit portfolio.

Gains on disposal of investments amounted to

US$132 million, an increase of US$97 million

compared with 2000. During the year, but

substantially in the first half, HSBC’s operations in

the United States sold mortgage-backed securities to

reduce exposure to refinancing mortgages in a

declining interest rate environment.

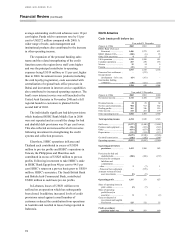

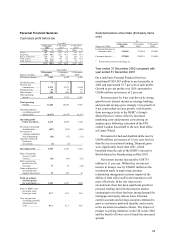

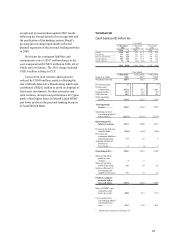

South America

Cash basis profit before tax

Year ended 31 December

Figures in US$m 2002 2001 2000

Brazil .................................... 127 136 208

Argentina .............................. (210) (1,152 ) 112

Chile .................................... 72 17 8

Othe

r

.................................... (23 ) (3 ) (15)

(34 ) (1,002 ) 313

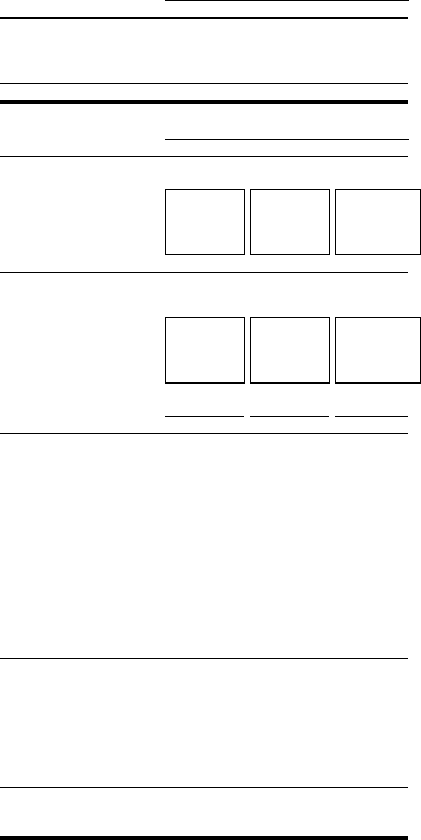

Year ended 31 December

Figures in US$m 2002 2001 2000

Net interest income ............... 645 1,065 1,186

Dividend income................... 15 12 8

Net fees and commissions ..... 324 494 471

Dealing profits ...................... 147 18 57

Other income......................... 110 356 396

Other operating income......... 596 880 932

Total operating income 1,241 1,945 2,118

Staff costs ............................. (572) (836) (890 )

Premises and equipmen

t

........ (113) (153) (162 )

Othe

r

.................................... (330) (435) (486 )

Depreciatio

n

.......................... (45 ) (73 ) (64)

(1,060) (1,497 ) (1,602)

Goodwill amortisatio

n

........... (24 ) (14 ) (12)

Operating expenses ............... (1,084 ) (1,511) (1,614)

Operating profit before

provisions ........................ 157 434 504

Provisions for bad and

doubtful debts................... (117 ) (927) (194)

Loss from foreign currency

redenomination in

Argentina..........................

(

68)(520)

–

Provisions for contingent

liabilities and

commitments.................... (31 )

–

–

Amounts written off fixed

asset investments.............. (36) (1 ) (1)

Operating (loss)/profit......... (95 ) (1,014) 309

Share of operating profit in

associated undertakings .... –11

Gains/(losses) on disposal o

f

investments and tangible

fixed assets....................... 37 (3) (9 )

(Loss)/profit on ordinary

activities before ta

x

......... (58 ) (1,016 ) 301

Share of HSBC’ s pre-tax

profits (cash basis) (per

cent) ................................. (0.3) (11.4 ) 3.1

Share of HSBC’ s pre-tax

p

rofits (per cent)............... (0.6 ) (12.7) 3.1

Cost:income ratio

(excluding goodwill

amortisation) (per cent) 85.4 77.0 75.6

Period-end staff numbers

(full-time equivalent)........ 25,522 27,519 25,671