HSBC 2002 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.59

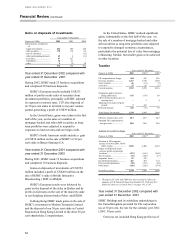

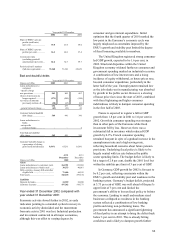

derivatives fell sharply as volatilities increased.

Strict cost control led to a fall in operating

expenses despite one-off costs relating to the

successful implementation of a new securities

system. Staff numbers fell slightly reflecting the

reduction in market activity and lower transaction

numbers.

Year ended 31 December 2001 compared with

year ended 31 December 2000

Economic activity in Europe slowed with industrial

production contracting in all major economies and

job cuts affected consumer spending to varying

degrees in most countries in the Eurozone. There are

increasing signs that the fourth quarter of 2001

marked the low point in the Eurozone’s economic

cycle and there is expected to be a gradual recovery

in 2002 as the cuts in interest rates, made during

2001, take effect and real incomes are boosted by

further declines in inflation.

The United Kingdom continued to register

strong GDP growth, expected to be 2.2 per cent, in

2001. Disparities within the United Kingdom

economy widened as consumer spending boosted by

very low interest rates, high employment levels and

continued strong house price inflation masked an

industrial recession given the global slowdown and

continued high level of sterling.

France is expected to register strong GDP

growth of 2.1 per cent in 2001. France saw

considerable growth in consumer spending and in

fixed investment. The growth in French consumer

spending reflected lower unemployment, as a result

of labour market reforms in the first part of 2001.

Unemployment, after falling to a 17 year low in the

first quarter of 2001 trended higher in the fourth

quarter reflecting the effects of global slowdown on

the French economy. Germany is the only major

European economy to have registered an outright

recession in 2001, albeit a very modest one. GDP

growth for 2001, forecast to be 0.8 per cent, reflected

the effects of over supply in the construction sector

following the post-unification boom and the lagged

impact of higher interest rates in 1999/2000. Despite

the global downturn, German exports held up

reasonably well. The main disappointment was the

weakness in consumer spending, despite large

income tax cuts, and a fall in capital spending, in

both construction and plant and machinery.

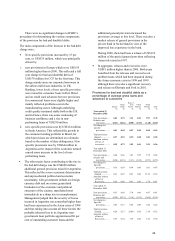

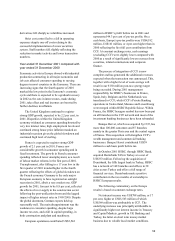

European operations contributed US$3,542

million to HSBC’s profit before tax in 2001 and

represented 44.3 per cent of pre-tax profits. On a

cash basis, Europe’s pre-tax profits were US$4,182

million, US$161 million, or 4 per cent higher than in

2000 reflecting the first full year contribution from

CCF. At constant exchange rates, cash earnings

(excluding CCF) were slightly lower compared with

2000 as a result of significantly lower revenues from

securities, related commissions and corporate

finance.

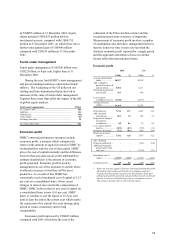

The process of integration of CCF is now

complete and has generated the additional revenues

expected when the transaction was announced. This,

together with a higher level of costs savings will

result in our €150 million post-tax synergy target

being exceeded. During 2001 management

responsibility for HSBC’s businesses in France,

Spain, Italy, Belgium and the Netherlands was

transferred to CCF; whilst CCF’s Private Banking

operations in Switzerland, Monaco and Luxembourg

were merged within HSBC Republic Suisse. Within

France, the HSBC hexagon symbol has now been put

on all branches in the CCF network and most of the

investment banking businesses have been rebranded.

Banque Hervet, which was acquired by CCF, has

more than 100,000 customers and 87 branches

mainly in the greater Paris area and the central region

of France. This acquisition will strengthen CCF’s

wealth management and commercial banking

businesses. Banque Hervet contributed US$39

million to cash basis profit before tax.

In October 2001 HSBC, through HSBC Bank,

acquired Demirbank TAS in Turkey at a cost of

US$353 million. Following the acquisition of

Demirbank, the fifth largest bank in Turkey, HSBC

has a network of 168 branches and offices in 38

cities across Turkey and offers a full range of

financial services. Demirbank made a positive

contribution in the two months of ownership to

HSBC European results.

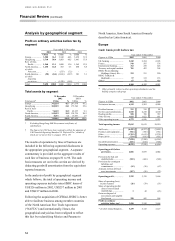

The following commentary on the Europe

results is based on constant exchange rates.

Net interest income was US$788 million, or 17

per cent, higher at US$5,563 million of which

US$569 million was attributable to CCF. The

underlying increase was principally attributable to

significantly higher net interest income in Treasury

and Capital Markets, growth in UK Banking and

Turkey, the latter on short term money market

business due to volatile local market conditions.