HSBC 2002 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Directors’ Remuneration Report (continued)

174

£000

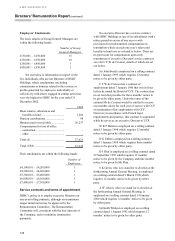

Sir John Bond .......................................... 1,100

W R P Dalton........................................... 750

D G Eldon................................................ 500

D J Flint ................................................... 750

S K Green ................................................ 750

A W Jebson.............................................. 750

Total......................................................... 4,600

No share options will be granted under the HSBC

Holdings Group Share Option Plan in respect of

2002 to the executive Directors listed above; they

have not received share option awards since the

HSBC Holdings Restricted Share Plan was

introduced in 1997.

No award under the HSBC Holdings Restricted

Share Plan 2000 will be made to C F W de Croisset

in respect of 2002. Mr de Croisset will instead

receive an award of options to acquire 206,000

ordinary shares of US$0.50 each under the HSBC

Group Share Option Plan. Taking account of market

practice in France, transitional arrangements will

gradually align share options awards in CCF more

closely with those elsewhere in HSBC. In this

respect only 50 per cent of the above-mentioned

award will be subject to the same TSR performance

conditions set out below for the HSBC Holdings

Restricted Share Plan 2000. Any future share option

awards he may receive will be wholly subject to

these performance conditions. In accordance with

the arrangements agreed at the acquisition of CCF in

2000, the HSBC Group Share Option Plan awards

made to Mr de Croisset in 2001 and 2002 were not

subject to performance conditions.

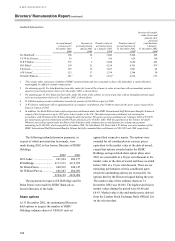

The 1998 Restricted Share Plan awards were

subject to performance conditions of earnings per

share, to be achieved in whole or in part, as follows:

• earnings per share in the year 2001 (the fourth

year of the performance period) to be greater

than earnings per share in 1997 (the base year

for the calculation) by a factor equivalent to the

composite rate of inflation ( a weighted average

of inflation in the UK, USA and Hong Kong)

plus 2 per cent, compounded over each year of

the performance period;

• earnings per share to increase relative to the

previous year in not less than three of the four

years of the performance period; and

• cumulative earnings per share over the four

years of the performance period, 1998 to 2001

inclusive, must exceed an aggregate figure

calculated by compounding 1997 earnings per

share by a factor equivalent to the annual

composite rate of inflation plus 2 per cent for

each year of the performance period.

On meeting all of these three primary tests, 50

per cent of the conditional awards would be

released to each eligible participant. A secondary

test would apply such that, if the cumulative

earnings per share over the performance period

exceeded an aggregate figure calculated by

compounding 1997 earnings per share by a factor

equivalent to the same annual composite rate of

inflation as described above, plus 5 per cent or

more, or 8 per cent or more, for each year of the

performance period, 75 per cent or 100 per cent

respectively of the conditional awards would be

released.

In accordance with the rules of the plan, as these

tests were not satisfied over the years 1998 to 2001,

the same tests are to be applied over the years 1999

to 2002. If the tests are not satisfied, the conditional

share awards will be forfeited.

From 1999, the vesting of awards has been

linked to the attainment of predetermined TSR

targets as set out below.

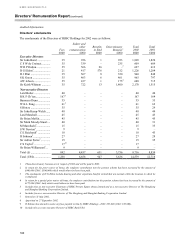

Particulars of executive Directors' interests in

shares held in the Restricted Share Plan are set out

on page 185.

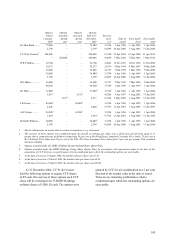

The HSBC Holdings Restricted Share Plan

2000

Purpose

The HSBC Holdings Restricted Share Plan 2000 is

intended to reward the delivery of sustained

financial growth of HSBC Holdings. So as to align

the interests of the Directors and senior employees

more closely with those of shareholders, the HSBC

Holdings Restricted Share Plan 2000 links the

vesting of 2003 awards to the attainment of

predetermined TSR targets.

Total Shareholder Return (TSR) is defined as

the growth in share value and declared dividend

income during the relevant period. In calculating

TSR, dividend income is assumed to be reinvested in

the underlying shares.