HSBC 2002 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Report of the Directors (continued)

164

conduct of business to avoid reputational risk

are established by the Board of HSBC

Holdings, the Group Executive Committee,

subsidiary company boards, board committees

or senior management. Reputational risks can

arise from social, ethical or environmental

issues, or as a consequence of operational risk

events. As a banking group, HSBC's good

reputation depends upon the way in which it

conducts its business but it can also be affected

by the way in which clients, to which it

provides financial services, conduct their

business.

• The internal audit function, which is centrally

controlled, monitors compliance with policies

and standards and the effectiveness of internal

control structures across the whole of HSBC.

The work of the internal audit function is

focused on areas of greatest risk to HSBC as

determined by a risk management approach.

The head of this function reports to the Group

Chairman and the Group Audit Committee.

The Group Audit Committee has kept under

review the effectiveness of this system of internal

control and has reported regularly to the Board of

Directors. The key processes used by the

Committee in carrying out its reviews include

regular reports from the heads of key risk

functions; the production and regular updating of

summaries of key controls applied by subsidiary

companies measured against HSBC benchmarks

which cover all internal controls, both financial and

non-financial; annual confirmations from chief

executives of principal subsidiary companies that

there have been no material losses, contingencies

or uncertainties caused by weaknesses in internal

controls; internal audit reports; external audit

reports; prudential reviews; and regulatory reports.

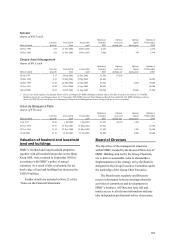

The Directors, through the Group Audit

Committee, have conducted an annual review of

the effectiveness of HSBC’ s system of internal

control covering all controls, including financial,

operational and compliance controls and risk

management.

Reputational, Strategic and

Operational Risk

HSBC regularly updates its policies and procedures

for safeguarding against reputational, strategic and

operational risks. This is an evolutionary process

which now takes account of The Association of

British Insurers’ guidance on best practice when

responding to social, ethical and environmental

(SEE) risks.

The safeguarding of HSBC’ s reputation is of

paramount importance to its continued prosperity

and is the responsibility of every member of staff.

HSBC has always operated to the highest standards

of conduct and, as a matter of routine, takes

account of reputational risks to its business. The

training of Directors on appointment includes

reputational matters.

Reputational risks, including SEE matters, are

considered and assessed by the Board, the Group

Executive Committee, subsidiary company boards,

board committees and/or senior management

during the formulation of policy and the

establishment of HSBC standards. Standards on all

major aspects of business are set for HSBC Group

and for individual subsidiary companies,

businesses and functions. These policies, which

form an integral part of the internal control

systems, and which were strengthened

considerably during 2002, are communicated

through manuals and statements of policy and are

promulgated through internal communications. The

policies include social, ethical and environmental

issues and set out operational procedures in all

areas of reputational risk, including money

laundering deterrence, environment impact, anti-

corruption measures and employee relations. The

policy manuals address risk issues in detail and co-

operation between head office departments and

businesses is required to ensure a strong adherence

to HSBC’ s risk management system and its

corporate social responsibility practices.

Internal controls are an integral part of how

HSBC conducts its business. HSBC’ s manuals and

statements of policy are the foundation of these

internal controls. There is a strong process in place

to ensure controls operate effectively. Any

significant failings are reported through the control

mechanisms, internal audit and compliance

functions to subsidiary company audit committees

and to the Group Audit Committee, which keeps

under review the effectiveness of the system of

internal controls and reports regularly to HSBC

Holdings’ Board. In addition, all Group businesses

and major functions are required to review their

control procedures and to make regular reports