Boeing 2005 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

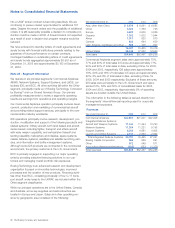

Quarterly Financial Data (Unaudited)

2005 2004

4th 3rd 2nd 1st 4th 3rd 2nd 1st

Sales and other operating revenues

Earnings from continuing operations

Net earnings from continuing operations

Cumulative effect of accounting change,

net of taxes

(Loss) income from discontinued operations,

net of taxes

Net (loss) gain of disposal of discontinued

operations, net of taxes

Net earnings

$14,204

544

464

(4)

460

$12,629

763

1,013

(2)

1,011

$15,025

818

571

(5)

566

$12,987

687

514

21

535

$13,314

28

182

(5)

9

186

$13,152 $

511

438

(1)

19

456

13,088 $

644

586

7

14

607

12,903

824

614

9

623

Basic earnings per share

Cumulative effect of accounting change,

net of taxes

(Loss) income from discontinued operations,

net of taxes

Net gain of disposal of discontinued operations,

net of taxes

0.61

(0.01)

1.28 0.72 0.65

0.02

0.24

(0.01)

0.01

0.54

0.02

0.72

0.01

0.02

0.77

0.01

Basic earnings per share 0.60 1.28 0.72 0.67 0.24 0.56 0.75 0.78

Diluted earnings per share

Cumulative effect of accounting change,

net of taxes

(Loss) income from discontinued operations,

net of taxes

Net gain of disposal of discontinued operations,

net of taxes

0.59

(0.01)

1.26 0.70 0.64

0.02

0.23

(0.01)

0.01

0.54

0.02

0.72

0.01

0.02

0.76

0.01

Diluted earnings per share 0.58 1.26 0.70 0.66 0.23 0.56 0.75 0.77

Cash dividends paid per share 0.25 0.25 0.25 0.25 0.20 0.20 0.20 0.17

Market price:

High

Low

Quarter end

72.40

63.70

70.24

68.38

62.01

67.95

66.85

56.22

66.00

58.94

49.52

58.46

55.48

48.10

51.77

55.24

46.40

51.62

51.49

40.31

51.09

45.10

38.04

41.07

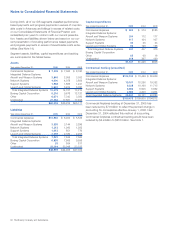

During the fourth quarter of 2005 as a result of our sale of our

Rocketdyne business we recognized a net loss of $200 com-

prised of a $228 pension curtailment/settlement loss and other

post retirement benefit curtailment gain of $28.

During the third quarter of 2005, we recognized a net loss of

$184 comprised of a $250 loss on pension curtailment/settle-

ment and other postretirement benefit curtailment gain of $66

relating to the Wichita, Tulsa and McAlester sale. We also com-

pleted the sale of our Rocketdyne business to United

Technologies and recorded a net-pretax gain of $578. We also

received a tax refund of $537, which resulted in an increase to

net income of $406.

During the second quarter of 2005, Commercial Airplanes

completed the sale of its Wichita and Tulsa operations to Spirit

for approximately $900 cash. The sale resulted in a pre-tax, pri-

marily non-cash, charge of $103.

During the first quarter of 2005, we completed the stock sale

of Electron Dynamic Devices Inc. (EDD) to L-3 Communications

and we recorded a $25 gain and in addition recorded a pre-tax

loss of $68 in Accounting differences/eliminations for net pen-

sion and other post retirement benefit curtailments and settle-

ments.

During the fourth quarter of 2004, we recognized expenses

relating to the USAF 767 Tanker Program of $275 as well as for

the termination of the 717 program of $280.

During the third quarter of 2004, BCC exercised its right to

redeem $1 billion face value of its outstanding senior notes,

which had a carrying value of $999. BCC recognized a loss of

$42 related to this early debt redemption which consisted of a

$52 prepayment penalty for early redemption recognized during

the third quarter of 2004, partially offset by $10 related to the

amount by which the fair value of its hedged redeemed debt

exceeded the carrying value of its hedged redeemed debt rec-

ognized during the fourth quarter of 2004.

During the second quarter of 2004, BCC’s Commercial

Financial Services business was sold to GECC which resulted

in a net gain on disposal of discontinued operations of $14.

During the first quarter of 2004, we received notice of

approved federal income tax refunds totaling $222 related to a

settlement of the 1983 through 1987 tax years.

The Boeing Company and Subsidiaries 85