Boeing 2005 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

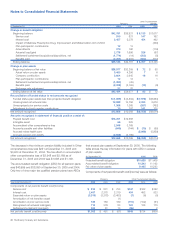

The following tables summarize information about Performance

Shares activity:

December 31, 2005

(Shares in thousands) Shares

Number of Performance Shares:

Outstanding at beginning of year 28,623

Granted 8,134

Transferred 2,266

Dividend 439

Converted or deferred (10,543)

Forfeited (1,148)

Canceled or expired (2,912)

Outstanding at end of year 24,859

Outstanding at end of year not contingent

on future employment 11,392

The above table does not include the maximum number of

shares contingently issuable under the Plans. Additional shares

of 7,335,493 could be transferred in and converted or deferred

if Plan vestings exceed 100%. Additionally, future deferred vest-

ings that are eligible for the 25% matching contribution could

result in the issuance of an additional 1,837,712 shares.

The following table provides additional information regarding

convertible and converted or deferred Performance Shares.

(Shares in thousands)

Shares Total Market

Weighted Shares Converted Value of

Average Convertible at or Deferred Converted

Grant Expiration Grant Date December 31, during or Deferred

Date Date Fair Value 2005 2005 Shares

2/26/2001 2/26/2006 $62.76

2/25/2002 2/25/2007 44.94

2/24/2003 2/24/2008 30.27

2/23/2004 2/23/2009 43.53

2/28/2005 2/28/2010 33.05

5,896

5,625

5,688 $351

5,991 4,855 322

7,347

For years ended December 31, 2005 and 2004, we recorded

an additional $124 and $57 of compensation expense due to

accelerating amortization of compensation cost for those

Performance Shares converted to common stock or deferred

as stock or cash at the employees’ election.

As discussed above, Performance Shares granted in 2005

were measured on the date of grant using a Monte Carlo

model. Additionally, certain Performance Shares that have a

cash settlement feature are remeasured quarterly beginning

September 30, 2005. The key assumptions used for valuing

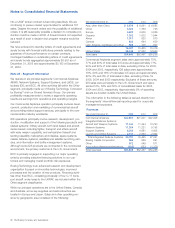

Performance Shares in 2005 follow:

Weighted

Average Expected

Measurement Expected Dividend Risk Free Stock

Grant Year Date Volatility Yield Interest Rate Beta

2001-2005 12/31/2005 23.0% 1.6% 4.38-4.43% 0.98

2001-2005 9/30/2005 27.6% 1.7% 3.93-4.18% 0.92

2005 2/28/2005 27.8% 1.9% 4.00% 1.03

Weighted average expected volatility is based on recent volatil-

ity levels implied by actively traded option contracts on our

common stock and the historical volatility levels on our com-

mon stock. Expected dividend yield is based on historical divi-

dend payments. Risk free interest rate reflects the yield on the

zero coupon U.S. Treasury based on the Performance Shares’

remaining contractual term. Stock beta is a measure of how

our stock price moves relative to the market as a whole. The

fair value of the 2005 Performance Shares is amortized over

the expected term of each award. The expected term of 1 to 4

years for each award granted is derived from the output of the

valuation model and represents the median time required to

satisfy the conditions of the award, adjusted for the effect of

retiree eligible participants. Each price growth target has a dif-

ferent expected term, resulting in the range of values provided.

At December 31, 2005, there was $515 of unrecognized com-

pensation cost related to the Performance Share plan which is

expected to be recognized over a weighted average period of

2.1 years. In connection with Performance Shares that have

not met the market conditions, we reclassified $288 from

Additional paid-in capital to Other liabilities and recognized a

cumulative adjustment to General and administrative expense

of $88 during 2005. Additionally, effective December 31, 2005,

we modified our deferred stock compensation plan to require

all Performance Shares that were unvested and deferred as

stock units to be settled in stock. We also gave participants in

our deferred stock compensation plan a one-time opportunity

to cancel their deferral election for unvested Performance

Shares or to change their deferral election for unvested

Performance Shares to a deferred interest account. As a result,

we reclassified $213 from Other liabilities to Additional paid-in

capital at December 31, 2005, for unvested Performance

Shares deferred as stock units and for unvested Performance

Shares no longer being deferred. These modifications resulted

in no incremental compensation cost. For participants who had

deferred unvested Performance Shares in stock units and can-

celled or changed their deferral election effective December 31,

2005, we reversed $13 of previously recorded compensation

expense related to the 25% matching contribution which was

forfeited. 268 employees were affected by the modification.

Stock options

Options have been granted with an exercise price equal to the

fair market value of our stock on the date of grant and expire

ten years after the date of grant. Vesting is generally over a

five-year service period with portions of a grant becoming exer-

cisable at one year, three years and five years after the date of

grant. In the event an employee has a termination of employ-

ment due to retirement, layoff, disability or death, the employee

(or beneficiary) immediately vests in grants that have been out-

standing for at least one year.

72 The Boeing Company and Subsidiaries