Boeing 2005 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis

EETCs in the bankruptcy court, Delta still reserves the right to

reject or return the aircraft.

Northwest Airlines, Inc. At December 31, 2005 and 2004,

Northwest accounted for $494 million and $295 million (5.4%

and 3.0%) of BCC’s total portfolio. At December 31, 2005, the

Northwest portfolio consisted of notes receivable on three 747

aircraft, three 757 aircraft, and three additional notes receiv-

able, as well as an EETC secured by 11 A319 aircraft, three

A330 aircraft and six 757 aircraft and an ETC secured by one

747 aircraft. On September 14, 2005, Northwest filed for

Chapter 11 bankruptcy protection. Northwest retains certain

rights by operating under Chapter 11 bankruptcy protection,

including the right to reject the restructuring terms with its cred-

itors and return aircraft, including BCC aircraft. Northwest has

filed a motion to reject leases or return certain aircraft. Although

Northwest has identified one 747 aircraft financed by an ETC in

which BCC owns an interest as being subject to potential

rejection, this aircraft has not yet been rejected or returned. In

October 2005, Northwest requested a restructuring of certain

obligations and BCC is currently negotiating restructuring

terms. As a result of the current financial difficulties of

Northwest, BCC has deemed the EETC and ETC to be other

than temporarily impaired. During the third quarter of 2005, we

reduced the carrying values of these investments to their esti-

mated fair values of $26 million and recorded an asset impair-

ment charge of $24 million.

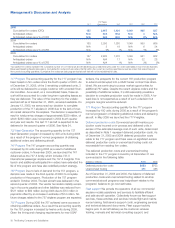

Summary Financial Information

(Dollars in millions) 2005 2004 2003

Revenues $966 $959 $991

% of Total Company Revenues 2% 2% 2%

Operating Earnings $232 $183 $91

Operating Margins 24% 19% 9%

Revenues BCC segment revenues consist principally of interest

from financing receivables and notes, lease income from equip-

ment under operating lease, investment income, and gains on

disposals of investments.

BCC’s revenues were essentially unchanged in 2005. The

decrease in revenue in 2004 compared with 2003 was primarily

attributable to lower new business volume.

Operating Earnings BCC’s operating earnings are presented

net of interest expense, provision for losses, asset impairment

expense, depreciation on leased equipment and other operat-

ing expenses. The increase in 2005 operating earnings was pri-

marily due to a lower asset impairment expense and the

absence of debt redemption costs partially offset by increased

depreciation expense.

As summarized in the following table, during the year ended

December 31, 2005, we recognized pre-tax expenses of $132

million, of which $34 million related to BCC, in response to the

deterioration in the credit worthiness of BCC’s airline cus-

tomers, airline bankruptcy filings and the continued decline in

the commercial aircraft and general equipment asset values.

For the same period in 2004, we recognized pre-tax expenses

of $165 million in response to the deterioration, of which $68

million related to BCC.

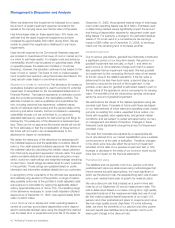

BCC Other

(Dollars in millions) Segment Segment* Consolidated

2005

Provision (recovery) for losses

Asset impairment expense

related to customer financing

Other charges

$(25)

33

26

$«34

$98

$98

$««73

33

26

$132

2004

Provision (recovery) for losses

Asset impairment expense

related to customer financing

Other charges

$(38)

27

79

$68

$82

2

13

$97

$««44

29

92

$165

*For further details, see discussion in Other Segment section.

During 2005, BCC recorded a net recovery through the provi-

sion for losses of $25 million. This amount consisted of a net

benefit of $26 million as a result of Hawaiian Airlines, Inc.’s

(Hawaiian) emergence from bankruptcy (including a partial off-

set by a decline in the collateral value of the 717 aircraft leased

to Hawaiian), a benefit of $16 million as a result of the repay-

ment of certain notes and a net provision of $17 million. During

2004, BCC also recorded a net recovery through the provision

for losses of $38 million. This amount consisted of the mitiga-

tion of collateral exposure with certain customers and a net

benefit due to refinements in the methodology for measuring

collateral values, offset by certain impaired receivables.

During the year ended December 31, 2005, BCC recorded

customer financing-related asset impairment charges of $13

million due to the reduction of estimated future cash flows. In

addition, BCC recorded an impairment charge of $20 million

related to a Commercial Financial Services (CFS) asset, which

was not subject to the purchase and sale agreement with

General Electric Capital Corporation (GECC). During the year

ended December 31, 2005, BCC reduced the carrying value of

certain of its EETCs and an ETC due to an other-than tempo-

rary impairment of $53 million, partially offset by the fair value of

other collateral available to BCC in the amount of $27 million.

During the year ended December 31, 2004, BCC recognized

customer financing-related charges totaling $27 million as a

result of declines in market values and projected future rents for

aircraft and equipment. During the year ended December 31,

2004, BCC also recognized a charge of $79 million which con-

sisted of $47 million related to an other-than-temporary impair-

ment of a held-to-maturity investment in ATA maturing in 2015,

and $32 million related to the impairment of a D tranche EETC

which finances aircraft with Delta. BCC carefully monitors the

relative value of aircraft equipment since we remain at substan-

tial economic risk to significant decreases in the value of air-

craft equipment and their associated lease rates.

The Boeing Company and Subsidiaries 39