Boeing 2005 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion and Analysis

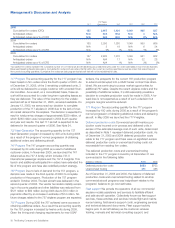

unit was created by combining six pre-existing reporting units.

The carrying value of one of these reporting units, Boeing

Satellite Systems, exceeded its fair value resulting in the good-

will balances at this reporting unit being fully impaired during

2002. However, the carrying values of the other five reporting

units were less than their fair values, so the goodwill balances

at these reporting units were not impaired during 2002. In addi-

tion, the Board of Directors in early 2003 approved our long

range business plan which included downward revisions to

cash flow projections for the L&OS reporting unit. The combi-

nation of these factors resulted in the newly created L&OS

reporting unit having a carrying value that exceeded its fair

value, prompting recognition of the goodwill impairment charge.

In addition, 2003 earnings were further impacted by a second

quarter charge of $1,030 million, of which $835 million was

attributable to the Delta IV program caused by a combination

of factors. The most significant driver was the requirement to

spread fixed costs of the Delta IV program over a reduced

number of anticipated launches as a result of continued weak-

ness in the commercial space launch market, resulting in an

earnings impact of $412 million. Secondly, the program experi-

enced cost growth of $360 million primarily related to payload

integration and launch support costs. In each of these cases,

the additional costs were not billable under the respective con-

tracts. In addition, the remaining $63 million of the charge

resulted from our determination that it was no longer probable

that our U.S. Government customer would agree to price

increases for change orders in connection with existing con-

tracted and awarded Delta IV launches. The remaining $195

million of the 2003 charge related to Boeing Satellite Systems

incurring additional costs as a result of satellite program com-

plexities. These complexities caused technical and quality

issues resulting in schedule delays, cost impacts, and late

delivery penalties which were not billable under the respective

contract. The 2003 results also include the adjustments made

to equity investments in Ellipso, SkyBridge and Teledesic result-

ing in a net write-down of $27 million.

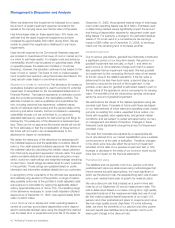

Divestitures On February 28, 2005, we completed the stock

sale of EDD to L-3 Communications. On August 2, 2005, we

completed the sale of the Rocketdyne business to United

Technologies Corporation (UTC). See Note 8.

Investments We are a 50/50 partner with Lockheed in a joint

venture called United Space Alliance, which is responsible for

all ground processing of the Space Shuttle fleet and for space-

related operations with the USAF. United Space Alliance also

performs modifications, testing and checkout operations that

are required to ready the Space Shuttle for launch. United

Space Alliance operations are performed under cost-plus type

contracts. Our proportionate share of joint venture earnings is

recognized as income from operating investments in the con-

solidated statements of operations. The operating earnings

resulting from this venture for 2005, 2004, and 2003 were $72

million, $70 million, and $52 million, respectively.

We have also entered into an agreement with Lockheed to cre-

ate a 50/50 joint venture named United Launch Alliance (ULA).

ULA will combine the production, engineering, test and launch

operations associated with U.S. government launches of

Boeing Delta and Lockheed Martin Atlas rockets. It is expected

that ULA will reduce the cost of meeting the critical national

security and NASA expendable launch vehicle needs of the

United States. The closing of the ULA transaction is subject to

certain closing conditions including government and regulatory

approval in the United States and internationally. On August 9,

2005, Boeing and Lockheed received clearance regarding the

formation of ULA from the European Commission. On October

24, 2005, the Federal Trade Commission (FTC) requested addi-

tional information from us and Lockheed related to ULA in

response to the pre-merger notice under the Hart-Scott-

Rodino Antitrust Improvements Act of 1976 (HSR) submitted

by the parties. The FTC’s “second request” extends the period

that the FTC is permitted to review the transaction under the

HSR Act. Upon completion of the transaction, ULA would be

reported as an equity method investment. We do not expect

this agreement to have a material impact to our earnings, cash

flows and/or financial position for 2006. If the conditions to

closing are not satisfied and the ULA transaction is not con-

summated by March 31, 2006, either we or Lockheed Martin

may terminate the joint venture agreement.

Research and Development The L&OS research and develop-

ment investment is currently focused on the development of

key technologies and systems solutions to support our NASA

customer in the development of new space exploration sys-

tems. We also continue to make prudent investments of

research and development resources in the satellite manufac-

turing business to enhance existing designs to meet evolving

customer requirements. Finally, continued research and devel-

opment investment was used to complete anomaly resolution

on the Delta IV vehicle.

Backlog L&OS total backlog decreased 27% from 2004 to

2005 primarily due to reduced orders for satellites and Space

Shuttle Return to Flight activity.

Total backlog increased 8% from 2003 to 2004 primarily due to

large orders for DIRECTV commercial satellites and additional

NASA activity, partially offset by sales throughout the segment.

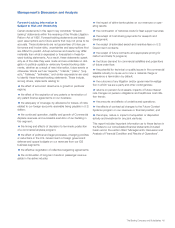

Boeing Capital Corporation

Business Environment and Trends

In the commercial aircraft market, BCC provides selective

financing solutions to our Commercial Airplanes segment cus-

tomers. In the space and defense markets, BCC primarily

structures financing solutions for our IDS segment customers.

BCC’s customer financing and investment portfolio at

December 31, 2005 totaled $9.2 billion, which was substan-

tially all our commercial aircraft. While worldwide traffic levels

are well above traffic levels carried by the airlines in the recent

past, the effects of higher fuel prices on the airline industry

continue to impact commercial aircraft values. Recently pub-

lished sources and market transactions indicate that passenger

load factors are at record high levels, the supply of economi-

cally viable used aircraft is limited and, lease rates for aircraft

are increasing. However, despite these positive environmental

The Boeing Company and Subsidiaries 37