Boeing 2005 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Note 7 - Inventories

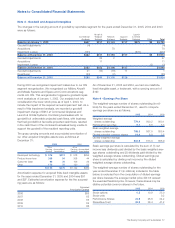

Inventories at December 31 consisted of the following:

2005 2004

Long-term contracts in progress $«14,194 $«12,999

Commercial aircraft programs 7,745 6,072

Commercial spare parts, used aircraft,

general stock materials and other,

net of reserves 2,235 1,890

24,174 20,961

Less advances and progress billings (16,234) (14,453)

$«««7,940 $««6,508

As of December 31, 2004 we reclassified performance based

payments and payments in excess of inventoriable costs con-

sisting of ($3,044) of long-term contracts in progress and $783

of advances and progress billings from Inventories to Advances

and billings in excess of related costs on our Consolidated

Statements of Financial Position. (See Note 14)

Included in long-term contracts in progress inventories at

December 31, 2005, and 2004, are Delta program inventories

of $1,000 and $900, respectively, that are not currently recov-

erable from existing orders; however, based on the Mission

Manifest (estimated quantities and timing of launch missions for

existing and anticipated contracts), we believe we will recover

these costs. These costs include deferred production costs

and unamortized tooling described below.

As a normal course of our Commercial Airplanes segment pro-

duction process, our inventory may include a small quantity of

airplanes that are completed but unsold. As of December 31,

2005 and 2004, the value of completed but unsold aircraft in

inventory was insignificant. Inventory balances included $234

subject to claims or other uncertainties primarily relating to the

A-12 program as of December 31, 2005 and 2004. See Note

24.

Included in commercial aircraft program inventory and directly

related to the sales contracts for the production of aircraft are

amounts paid or credited in cash or other consideration (early

issued sales consideration), to airline customers totaling $1,080

and $665 as of December 31, 2005 and 2004. As of

December 31, 2005 and 2004, the amount of early issue sales

consideration, net of advance of deposits, included in commer-

cial aircraft program inventory amounted to $194 and $123,

which related to one financially troubled customer; however, we

believe these amounts are fully recoverable as of December 31,

2005.

Deferred production costs represent commercial aircraft pro-

grams and integrated defense programs inventory production

costs incurred on in-process and delivered units in excess of

the estimated average cost of such units. As of December 31,

2005 and 2004, all significant excess deferred production costs

or unamortized tooling costs are recoverable from existing firm

orders for the 777 program. The Delta program costs are not

currently recoverable from existing orders; however based on

the Mission Manifest (estimated quantities and timing of launch

missions for existing and anticipated contracts) we believe we

will recover these costs. The deferred production costs and

unamortized tooling included in Commercial Airplane’s 777 pro-

gram and IDS’ Delta program inventory are summarized in the

following table:

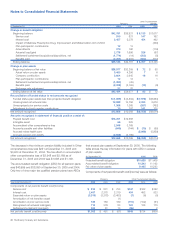

2005 2004

Deferred production costs:

777 Program $683 $703

Delta II & IV Programs 271 221

Unamortized tooling:

777 Program 411 485

Delta II & IV Programs 194 257

As of December 31, 2005 and 2004, the balance of deferred

production costs and unamortized tooling related to commer-

cial aircraft programs, except the 777 program, was insignifi-

cant relative to the programs’ balance-to-go cost estimates.

During the years ended December 31, 2005 and 2004,

Commercial Airplanes purchased $102 and $298 of used air-

craft. Used aircraft in inventories totaled $66 and $162 as of

December 31, 2005 and 2004.

When our Commercial Airplanes segment is unable to immedi-

ately sell used aircraft, it may place the aircraft under an oper-

ating lease. It may also finance the sale of new or used aircraft

with a short-term note receivable. The carrying amount of the

Commercial Airplanes segment used aircraft under operating

leases and aircraft sales financed with note receivables

included as a component of Customer Financing totaled $640

and $958 as of December 31, 2005 and 2004.

During 2002 we were selected by the US Air Force (USAF) to

supply 100 767 Tankers and entered into a preliminary agree-

ment with the USAF for the procurement of the 100 Tankers.

On January 14, 2005 we announced our plan to recognize pre-

tax charges totaling $275 related to the USAF 767 Tanker pro-

gram. The charge, which was a result of our quarter and

year-end reviews, reflected our updated assessment of secur-

ing the specific USAF 767 Tanker contract that was being

negotiated, given the continued delay and then likely re-com-

petition of the contract. As a result, as of December 31, 2004,

we expensed $179 (Commercial Airplanes) and $47 (IDS)

related to the USAF 767 Tanker contract for Commercial air-

craft programs and Long-term contracts in progress, which

was included in Cost of products. As of December 31, 2005,

there were no additional costs incurred related to the 767

United States Air Force Tanker program.

Note 8 - Divestitures

On February 28, 2005 we completed the stock sale of Electron

Dynamic Devices Inc. (EDD) to L-3 Communications. EDD was

a separate legal entity wholly owned by us. The corresponding

net assets of the entity were $45 and a net pre-tax gain of $25

was recorded in the Launch and Orbital Systems (L&OS) seg-

ment of IDS from the sale of the net assets. In addition, there

was a related pre-tax loss of $68 recorded in Accounting differ-

ences/eliminations for net pension and other postretirement

benefit curtailments and settlements.

On August 2, 2005 we completed the sale of the Rocketdyne

Propulsion and Power (Rocketdyne) business to United

60 The Boeing Company and Subsidiaries