Boeing 2005 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

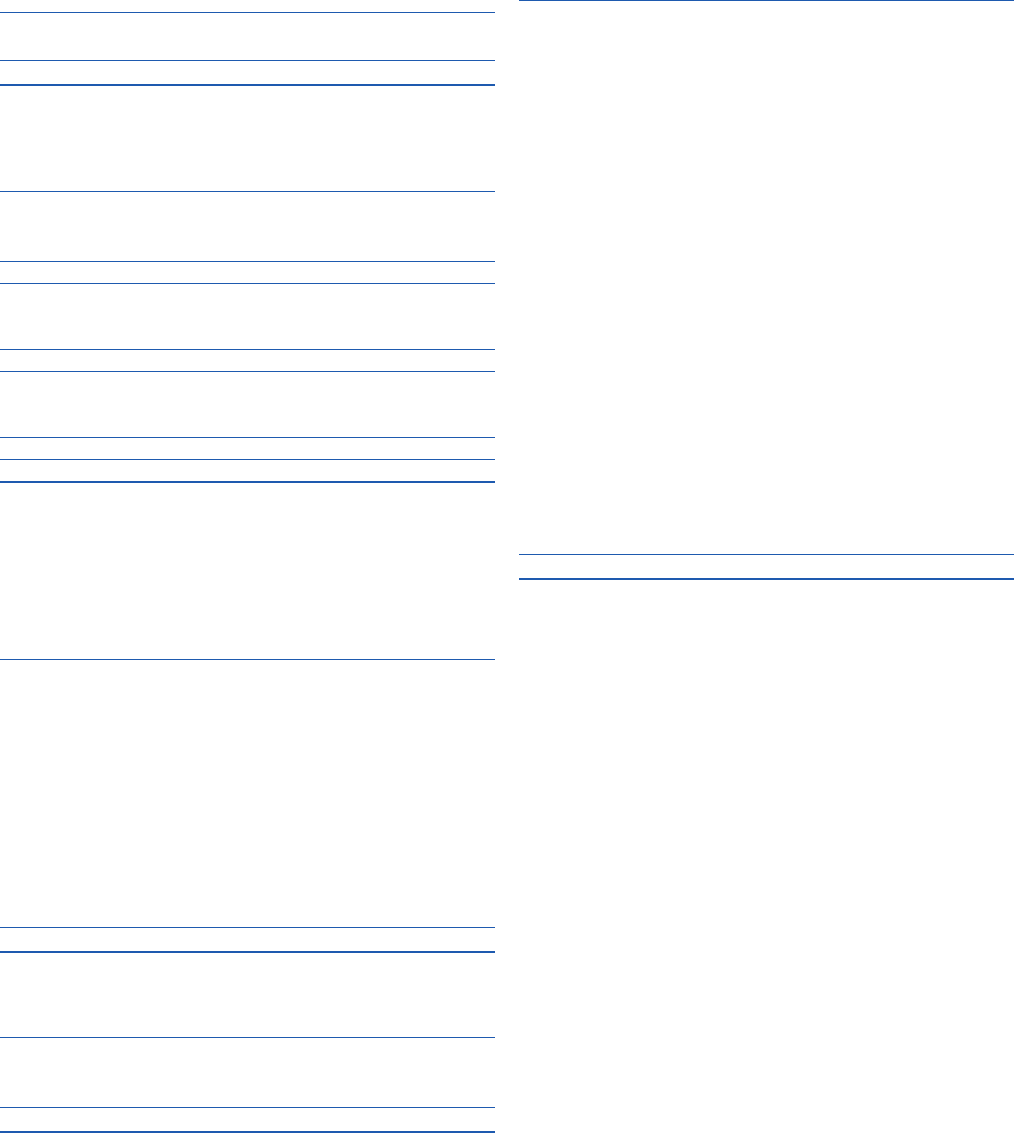

Notes to Consolidated Financial Statements

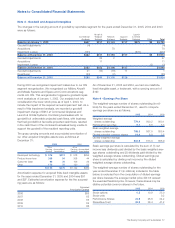

Note 5 - Income Taxes

The components of earnings before income taxes were:

Year ended December 31, 2005 2004 2003

U.S. $2,605 $1,960 $500

Foriegn 214

$2,819 $1,960 $500

Note: The 2004 and 2003 foreign earnings before income tax amounts are not

significant and as such are reflected in the U.S. numbers shown above.

Income tax expense/(benefit) consisted of the following:

Year ended December 31, 2005 2004 2003

U.S.

Taxes paid or currently payable $(276) $(435) $(1,923)

Change in deferred taxes 547 787 1,707

271 352 (216)

Foriegn

Taxes paid or currently payable 58

Change in deferred taxes (120)

(62)

State

Taxes paid or currently payable (86) (58) (33)

Change in deferred taxes 134 (154) 64

48 (212) 31

Income tax expense/(benefit) $(257 $(140 $1,(185)

Note: The 2004 and 2003 foreign income tax expense/(benefit) amounts are not

significant and as such are reflected in the U.S. numbers shown above.

The following is a reconciliation of the tax derived by applying

the U.S. federal statutory tax rate of 35% to the earnings

before income taxes and comparing that to the recorded

income tax expense/(benefit):

Year ended December 31, 2005 2004 2003

U.S. federal statutory tax 35.0% 35.0% 35.0%

Foreign Sales Corporation/

Extraterritorial Income tax benefit (5.6) (8.6) (23.0))

Research benefit (1.2) (1.4)) (7.4))

Non-deductibility of goodwill 0.3 0.1 45.8

Federal audit settlement (13.1) (7.5) (91.2)

Charitable contributions (0.5) (2.6)

Tax-deductible dividends (0.8) (0.9) (2.8)

State income tax provision,

net of effect on U.S. federal tax 1.1 (7.0) 4.2

Reversal of valuation allowances (3.2)

Other provision adjustments (3.4) (2.1) 5.0

Income tax expense/(benefit) 9.1% 7.1% (37.0)%

The components of net deferred tax assets at December 31

were as follows:

2005 2004

Deferred tax assets $«8,168 $8,664

Deferred tax liabilities (7,646) (7,519)

Valuation allowance (90)

Net deferred tax assets $«8,522 $1,055

Significant components of our deferred tax assets, net of

deferred tax liabilities, at December 31 were as follows:

2005 2004

Other comprehensive income

(net of valuation allowances

of $0 and $12) $«1,119 $1,150

Retiree health care accruals 2,314 2,212

Inventory and long-term contract

methods of income recognition

(net of valuation allowance

of $0 and $19) 1,368 1,188

Other employee benefits accruals

(net of valuation allowance

of $0 and $5) 1,363 1,276

In-process research and development

related to acquisitions 137 142

Net operating loss, credit, and

charitable contribution carryovers

(net of valuation allowance

of $0 and $48) 494 587

Pension benefit accruals

(net of valuation allowance

of $0 and $5) (4,799) (4,332)

Customer and commercial financing

(net of valuation allowance

of $0 and $1) (1,442) (1,168)

Unremitted earnings of

non-U.S. subsidiaries (32)

Net deferred tax assets $« 522 $1,055

Of the deferred tax asset for net operating loss, credit, and

charitable contribution carryovers, $152 expires in years ending

from December 31, 2006 through December 31, 2025 and

$342 may be carried over indefinitely.

Within the Consolidated Statements of Operations is Other

income, of which $100 relates to interest income received from

federal tax refunds during 2005 and the remaining amounts pri-

marily relate to interest income on marketable securities. During

2004 and 2003, Other income consisted primarily of interest

income received from tax refunds.

Net income tax refunds were $344, $903 and $507 in 2005,

2004 and 2003, respectively.

During 2005, we repatriated $426 in extraordinary dividends,

as defined in the American Jobs Creation Act of 2004, and

recorded a tax liability of $23. We have provided for U.S.

deferred income taxes and foreign withholding tax in the

amount of $32 on undistributed earnings not considered per-

manently reinvested in our non-U.S. subsidiaries. We have not

provided for U.S. deferred income taxes or foreign withholding

tax on the remainder of undistributed earnings from our non-

U.S. subsidiaries because such earnings are considered to be

permanently reinvested and it is not practicable to estimate the

amount of tax that may be payable upon distribution.

58 The Boeing Company and Subsidiaries