Boeing 2005 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

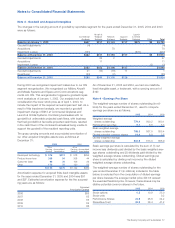

Notes to Consolidated Financial Statements

Note 3 - Goodwill and Acquired Intangibles

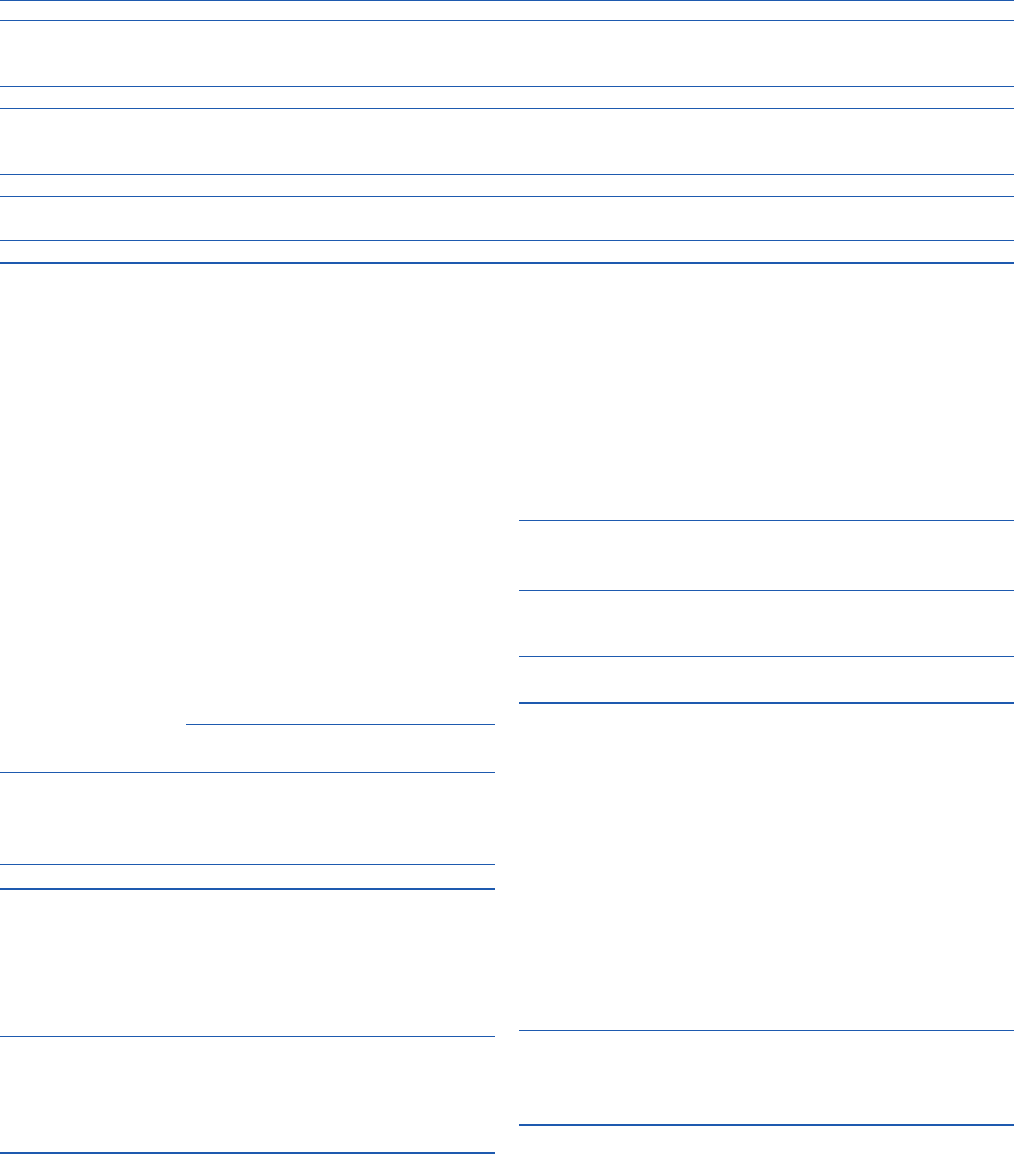

The changes in the carrying amount of goodwill by reportable segment for the years ended December 31, 2005, 2004 and 2003

were as follows:

)

)

Aircraft & Launch

Commercial Weapon Network Support & Orbital

Airplanes Systems Systems Systems Systems Other Total

Balance at January 1, 2003 $627 $317 $1,124 $117 $572 $3 $2,760

Goodwill Adjustments (4) (4

Acquisitions 70 70

Impairment Losses (341) (572) (913

Balance at December 31, 2003 $282 $317 $1,194 $117 $3 $1,913

Goodwill Adjustments 25 2 27

)

Acquisitions 11 11

Impairment Losses (3) (3

Balance at December 31, 2004 $282 $353 $1,196 $117 $1,948

Goodwill Adjustments 21 (13) (18) 11 1

)Divestitures (23) (2) (25

Balance at December 31, 2005 $280 $340 $1,176 $128 $1,924

During 2003 we recognized impairment losses due to our IDS

segment reorganization. We reorganized our Military Aircraft

and Missile Systems and Space and Communications seg-

ments into IDS. This reorganization triggered a goodwill impair-

ment analysis as of January 1, 2003. Our analysis took into

consideration the lower stock price as of April 1, 2003, to

include the impact of the required annual impairment test. As a

result of this impairment analysis, we recorded a goodwill

impairment charge of $913 at Commercial Airplanes and

Launch & Orbital Systems. Combining businesses with no

goodwill but unfavorable projected cash flows, with business

that had goodwill but favorable projected cash flows, resulted

in the cash flows of the combined businesses being unable to

support the goodwill of the resultant reporting units.

The gross carrying amounts and accumulated amortization of

our other acquired intangible assets were as follows at

December 31:

2005 2004

Gross

Carrying Accumulated

Amount Amortization

Gross

Carrying Accumulated

Amount Amortization

Developed technology $ 576

Product know-how 308

Customer base 96

Other 173

$312 $ 578 $256

54 308 44

34 106 29

75 150 55

$1,153 $475 $1,142 $384

Amortization expense for acquired finite-lived intangible assets

for the years ended December 31, 2005 and 2004 was $91

and $97. Estimated amortization expense for the five succeed-

ing years are as follows:

Estimated

Amortization Expense

2006 $85

2007 85

2008 85

2009 84

2010 66

As of December 31, 2005 and 2004, we had one indefinite-

lived intangible asset, a trademark, with a carrying amount of

$197.

Note 4 - Earnings Per Share

The weighted-average number of shares outstanding (in mil-

lions) for the years ended December 31, used to compute

earnings per share are as follows:

2005 2004 2003

Weighted-average

shares outstanding 779.4 800.2 800.1

Participating securities 9.1 6.8 5.3

Basic weighted-average

shares outstanding 788.5 807.0 805.4

Diluted potential common shares 14.4 6.0 3.5

Diluted weighted-average

shares outstanding 802.9 813.0 808.9

Basic earnings per share is calculated by the sum of (1) net

income less dividends paid divided by the basic weighted aver-

age shares outstanding and (2) dividends paid divided by the

weighted average shares outstanding. Diluted earnings per

share is calculated by dividing net income by the diluted

weighted average shares outstanding.

The weighted-average number of shares outstanding for the

year ended December 31 (in millions), included in the table

below, is excluded from the computation of diluted earnings

per share because the average market price did not exceed

the exercise/threshold price. However, these shares may be

dilutive potential common shares in the future.

2005 2004 2003

Stock options 0.2 10.9 25.0

Stock units 0.2

Performance Shares 24.9 28.6 24.2

ShareValue Trust 33.9 38.4 41.2

The Boeing Company and Subsidiaries 57