Boeing 2005 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

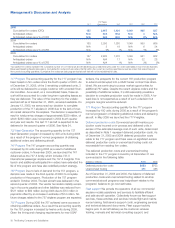

Management’s Discussion and Analysis

and lower volume as a result of the Comanche termination in

2004.

Deliveries of units for new-build production aircraft, excluding

remanufactures and modifications were as follows:

Aircraft and Weapon Systems

2005 2004 2003

C-17 Globemaster 16 16 16

F/A-18E/F Super Hornet 42 48 44

T-45TS Goshawk 10 7 12

F-15E Eagle 6 3 4

C-40A Clipper 2 3 1

AH-64 Apache 12 3 –

Operating Earnings A&WS operating earnings increased 4%

between 2004 and 2005 even though revenues were stable. In

addition to continued strong performance, the 767 Tanker pro-

gram CSR&D effort in 2005 was reduced as compared to 2004

and operating earnings in 2004 were negatively impacted by

the charges discussed above related to the USAF Tanker pro-

gram.

Operating earnings grew 15% from 2003 to 2004 partly due to

the revenue growth mentioned above and partly due to signifi-

cant performance improvements from contract close-out activ-

ity and lean initiatives in 2004, partially offset by the 2004 767

Tanker charges.

Research and Development The A&WS segment continues to

focus its research and development where it can use its cus-

tomer knowledge, technical strength and large-scale integration

capabilities to provide transformational solutions to meet the

war fighter’s enduring needs. Spending has remained consis-

tent over the past three years. Research and development

activities leverage our capabilities in architectures, system-of-

systems integration and weapon systems technologies across

a broad spectrum of capabilities designed to enhance situa-

tional awareness and survivability, increase mission effective-

ness and interoperability, and improve affordability, reliability and

economic ownership. Continued research and development

investments in unmanned systems have enabled the demon-

stration of multi-vehicle coordinated flight and distributed con-

trol of high-performance unmanned combat air vehicles.

Research and development in advanced weapons technologies

emphasizes, among other things, precision guidance and multi-

mode targeting. Research and development investments in the

Global Tanker Transport Aircraft program represent a significant

opportunity to provide state-of-the-art refueling capabilities to

domestic and international customers. Other research and

development efforts include upgrade and technology insertions

to network-enable and enhance the capability and competitive-

ness of current product lines such as the F/A-18E/F Super

Hornet, F-15E Eagle, AH-64 Apache, CH-47 Chinook and C-

17 Globemaster III.

Backlog A&WS total backlog decreased 12% from 2004 to

2005 primarily due to sales on C-17 and F/A-18 from multi-

year contracts awarded in prior years, partially offset by addi-

tional F-15 and Chinook orders.

Total backlog decreased 19% from 2003 to 2004 primarily due

to sales on C-17 and F/A-18 from multi-year contracts

awarded in prior years.

Network Systems

(Dollars in millions) 2005 2004 2003

Revenues $11,264 $11,221 $««9,198

% of Total Company Revenues 21% 21% 18%

Operating Earnings $«««««638 $«««««969 $«««««645

Operating Margins 5.7% 8.6% 7.0%

Research and Development $«««««285 $«««««234 $«««««195

Contractual Backlog $««6,228 $10,190 $11,715

Unobligated Backlog $28,316 $26,097 $22,907

Revenues Network Systems revenues remained stable

between 2004 and 2005 as significant growth in FCS and

Airborne Command and Control programs such as MMA and

737 Airborne Early Warning & Control (AEW&C) was offset by

lower volume in Proprietary, Ground-based Midcourse Defense

(GMD), and the completion of the Homeland Security contract.

Revenues grew 22% from 2003 to 2004 due to strong growth

in FCS, GMD, Proprietary, and Airborne Command and Control

programs, partially offset by lower volume in Homeland

Security.

Operating Earnings Network Systems operating earnings

decreased 34% from 2004 to 2005 primarily due to revised

cost and fee estimates in 2005 resulting from technical and

quality issues on Proprietary, GMD, 737 AEW&C, and a military

satellite program.

Earnings increased 50% from 2003 to 2004 partly due to the

revenue growth mentioned above; improved performance in

Homeland Security and Proprietary partially offset by revised

cost and fee estimates on a military satellite program and GMD

in 2004; and due to a $55 million pre-tax charge taken in 2003

on the Resource 21 joint venture when NASA did not award us

an imagery contract.

Research and Development The Network Systems research

and development funding remains focused on the development

of Communications and Command & Control capabilities that

support a network-centric architecture approach for our various

government customers. We are investing in the communica-

tions market to enable connectivity between existing air/ground

platforms, increase communications availability and bandwidth

through more robust space systems, and leverage innovative

communications concepts. Key programs in this area include

Joint Tactical Radio System, Global Positioning System, and

Transformational Communications System. Investments were

also made to support various Intelligence, Surveillance, and

Reconnaissance business opportunities including MMA,

AEW&C aircraft, and concepts that will lead to the develop-

ment of next-generation space intelligence systems. A major

contributor to our support of these DoD transformation pro-

grams is the investment in the Boeing Integration Center (BIC)

and extended network of modeling, simulation and analysis

capabilities where our Network-Centric Operations concepts

are developed in partnership with our customers. Significant

upgrades were made in 2005 to the Virtual Warfare Center in

The Boeing Company and Subsidiaries 35