Boeing 2005 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis

forecast to push the industry into losses of $6 billion in 2005,

the many airlines that are profitably growing to meet increased

demand are acquiring new capacity from manufacturers.

The pace of air traffic rights liberalization between countries has

been brisk during the past year with many new air service

agreements having been signed or announced. High growth

markets including China and India announced multiple new

agreements spurring the opening of new routes. In addition,

the United States and European Union made significant

advances towards “open skies” late in 2005. Continued liberal-

ization is an important factor in the growth and network devel-

opment of commercial aviation.

Looking forward, our 20-year forecast is for a long-term aver-

age growth rate of 5% per year for passenger traffic, and 6%

per year for cargo traffic based on projected average annual

worldwide real economic growth of 3%. Based on long-term

global economic growth projections, and factoring in the

increasingly competitive environment, increasing utilization lev-

els of the worldwide airplane fleet and requirements to replace

older airplanes, we project a $2.1 trillion market for 25,700 new

airplanes over the next 20 years. While factors such as terror-

ism and increased ticket charges for security have had signifi-

cant impact over the span of several years, they have not

historically affected the longer-term macro trends in the world

economy, and therefore, our long-term market outlook.

Industry Competitiveness The commercial jet aircraft market

and the airline industry remain extremely competitive. We

expect the existing long-term downward trend in passenger

revenue yields worldwide (measured in real terms) to continue

into the foreseeable future. Market liberalization in Europe and

Asia has continued to enable low-cost airlines to gain market

share. These airlines have increased the downward pressure on

airfares. This results in continued cost pressures for all airlines

and price pressure on our products. Major productivity gains

are essential to ensure a favorable market position at accept-

able profit margins.

Continued access to global markets remains vital to our ability

to fully realize our sales potential and long-term investment

returns. Approximately two-thirds of Commercial Airplanes’

third-party sales and contractual backlog are from customers

based outside the United States.

We face aggressive international competitors that are intent on

increasing their market share. They offer competitive products

and have access to most of the same customers and suppli-

ers. Airbus has historically invested heavily to create a family of

products to compete with ours. Regional jet makers Embraer

and Bombardier, coming from the less than 100-seat commer-

cial jet market, continue to develop larger and more capable

airplanes. This market environment has resulted in intense

pressures on pricing and other competitive factors.

Worldwide, airplane sales are generally conducted in U.S. dol-

lars. Fluctuating exchange rates affect the profit potential of our

major competitors, all of whom have significant costs in other

currencies. The decline of the U.S. dollar relative to their local

currencies in 2004 put pressure on competitors’ revenues and

profits. Competitors often respond by aggressively reducing

costs, thereby improving their longer-term competitive posture.

Airbus is implementing such initiatives targeting more than 10%

reduction in costs by 2006. If the U.S. dollar continues to

strengthen as it has in 2005, Airbus can use the extra efficiency

to develop new products and gain market share.

We are focused on improving our processes and continuing

cost-reduction efforts. We continue to leverage our extensive

customer support services network for airlines throughout the

world to provide a higher level of customer satisfaction and

productivity. These efforts enhance our ability to pursue pricing

strategies that enable us to price competitively and maintain

satisfactory margins. While we are focused on improving our

processes and continuing cost reduction activities, events may

occur that will prevent us from achieving planned results.

We continue to explore strategic options related to our opera-

tions at various sites to focus on large-scale systems integra-

tion, which is where we are most competitive and can add the

most value to our airplanes and services.

Production Disruption Caused by Labor Strike

We delivered 29 fewer than expected airplanes due to the IAM

strike, during 2005. This reduced revenue by approximately $2

billion for the twelve months ended December 31, 2005.

New Airline Bankruptcies

Northwest Airlines, Inc. (Northwest) and Delta Air Lines, Inc.

(Delta) filed for Chapter 11 bankruptcy protection on

September 14, 2005. Commercial Airplanes does not expect a

material impact on revenues or operating results due to these

bankruptcy filings. (See Note 10).

Divestitures

On June 16, 2005 we completed the sale of substantially all of

the assets at our Commercial Airplanes facilities in Wichita,

Kansas and Tulsa and McAlester, Oklahoma under an asset

purchase agreement to a new entity, which was subsequently

named Spirit Aerosystems, Inc. (Spirit) and is owned by Onex

Partners LP. (See Note 8).

Operating Results

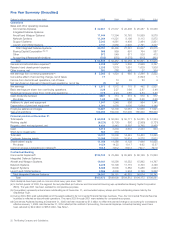

(Dollars in millions) 2005 2004 2003

Revenues $««22,651 $21,037 $22,408

% of Total Company Revenues 41% 40% 44%

Operating Earnings $««««1,432 $«««««753 $«««««707

Operating Margins 6.3% 3.6% 3.2%

Research and Development $««««1,302 $«««««941 $«««««676

Contractual Backlog* $124,132 $70,449 $63,929

*Note: Commercial Airplanes backlog at December 31, 2005 has been reduced

by $7.8 billion to reflect the planned change in accounting for concessions

effective January 1, 2006. Had December 31, 2004 reflected this method of

accounting, Commercial Airplanes contractual backlog would have been reduced

by $4.9 billion to $65.5 billion. See Note 1.

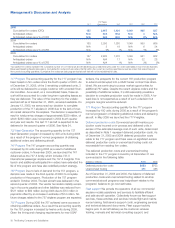

Revenues The increase in revenue of approximately $1.6 billion

in 2005 from 2004 was primarily attributable to higher new air-

plane deliveries including model mix changes of $1.0 billion,

used airplane sales of $302 million and aircraft modification,

spares and other of $300 million.

28 The Boeing Company and Subsidiaries