Boeing 2005 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements

Used aircraft purchased by the Commercial Airplanes segment,

commercial spare parts, and general stock materials are stated

at cost not in excess of net realizable value. See ‘Aircraft valua-

tion’ within this Note for our valuation of used aircraft pur-

chased by the Commercial Airplanes segment. We review our

commercial spare parts and general stock materials each quar-

ter to identify impaired inventory, including excess or obsolete

inventory, based on historical sales trends, expected produc-

tion usage, and the size and age of the aircraft fleet using the

part. Impaired inventories are written-off as an expense to Cost

of products in the period identified.

Included in inventory for commercial aircraft programs are

amounts paid or credited in cash, or other consideration to

certain airline customers, that are referred to as early issue

sales consideration. Early issue sales consideration is recog-

nized as a reduction to revenue when the delivery of the aircraft

under contract occurs. In the unlikely situation that an airline

customer was not able to perform and take delivery of the con-

tracted aircraft, we believe that we would have the ability to

recover amounts paid through retaining amounts secured by

advances received on aircraft to be delivered. However, to the

extent early issue sales consideration exceeds advances these

amounts may not be recoverable and would be recognized as

a current period expense.

Precontract costs

We may, from time to time, incur costs to begin fulfilling the

statement of work under a specific anticipated contract that we

are still negotiating with a customer. If we determine it is proba-

ble that we will be awarded the specific anticipated contract,

then we capitalize the precontract costs we incur, excluding

any start-up costs which are expensed as incurred. Capitalized

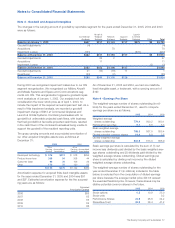

precontract costs of $39 and $70 at December 31, 2005, and

2004, are included in Inventories, net of advances and

progress billings in the accompanying Consolidated Statements

of Financial Position.

Property, plant and equipment

Property, plant and equipment are recorded at cost, including

applicable construction-period interest, less accumulated

depreciation and are depreciated principally over the following

estimated useful lives: new buildings and land improvements,

from 10 to 40 years; and new machinery and equipment, from

3 to 20 years. The principal methods of depreciation are as fol-

lows: buildings and land improvements, 150% declining bal-

ance; and machinery and equipment, sum-of-the-years’ digits.

Capitalized internal use software is included in Other assets

and amortized using the straight line method over five years.

We periodically evaluate the appropriateness of remaining

depreciable lives assigned to long-lived assets subject to a

management plan for disposition.

We review long-lived assets, which includes property, plant and

equipment, for impairment in accordance with SFAS No. 144,

Accounting for the Impairment or Disposal of Long-Lived Assets

(SFAS No. 144). Long-lived assets held for sale are stated at

the lower of cost or fair value less cost to sell. Long-lived

assets held for use are subject to an impairment assessment

whenever events or changes in circumstances indicate that the

carrying amount may not be recoverable. If the carrying value is

no longer recoverable based upon the undiscounted future

cash flows of the asset, the amount of the impairment is the

difference between the carrying amount and the fair value of

the asset.

Asset retirement obligations

On December 31, 2005, we adopted FASB Interpretation No.

47, Accounting for Conditional Asset Retirement Obligations - an

interpretation of FASB Statement No. 143 (FIN 47). FIN 47 clari-

fies the term conditional asset retirement obligation as used in

SFAS No. 143 and requires a liability to be recorded if the fair

value of the obligation can be reasonably estimated. Asset

retirement obligations covered by this Interpretation include

those for which an entity has a legal obligation to perform an

asset retirement activity, however the timing and (or) method of

settling the obligation are conditional on a future event that may

or may not be within the control of the entity. FIN 47 also clari-

fies when an entity would have sufficient information to reason-

ably estimate the fair value of an asset retirement obligation.

In accordance with FIN 47, we record all known asset retire-

ment obligations for which the liability’s fair value can be rea-

sonably estimated, including certain asbestos removal, asset

decommissioning and contractual lease restoration obligations.

As a result of adopting FIN 47, we recorded a cumulative effect

of accounting change of $10 ($6 net of tax) during the fourth

quarter of 2005. In addition, we recorded a liability of $11 rep-

resenting asset retirement obligations and an increase in the

carrying value of the related assets of $1, net of $5 of accumu-

lated depreciation. Had the adoption of FIN 47 occurred at the

beginning of the earliest period presented, our results of opera-

tions and earnings per share would not have been significantly

different from the amounts reported. Accordingly, pro forma

financial information has not been provided.

We also have known conditional asset retirement obligations,

such as certain asbestos remediation and asset decommis-

sioning activities to be performed in the future, that are not rea-

sonably estimable due to insufficient information about the

timing and method of settlement of the obligation. Accordingly,

these obligations have not been recorded in the consolidated

financial statements. A liability for these obligations will be

recorded in the period when sufficient information regarding

timing and method of settlement becomes available to make a

reasonable estimate of the liability’s fair value. In addition, there

may be conditional asset retirement obligations that we have

not yet discovered (e.g. asbestos may exist in certain buildings

but we have not become aware of it through the normal course

of business), and therefore, these obligations also have not

been included in the consolidated financial statements.

Goodwill and other acquired intangibles

Goodwill and other acquired intangible assets with indefinite

lives are not amortized but are tested for impairment annually

on the same date every year, and when an event occurs or cir-

cumstances change such that it is reasonably possible that an

The Boeing Company and Subsidiaries 53