Boeing 2005 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

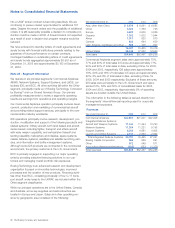

Notes to Consolidated Financial Statements

into a USAF tanker contract is becoming less likely. We are

continuing to pursue market opportunities for additional 767

sales. Despite the recent orders and the possibility of additional

orders, it is still reasonably possible a decision to complete pro-

duction could be made in 2006. A forward loss is not expected

as a result of such a decision but program margins would be

reduced.

We have entered into standby letters of credit agreements and

surety bonds with financial institutions primarily relating to the

guarantee of future performance on certain contracts.

Contingent liabilities on outstanding letters of credit agreements

and surety bonds aggregated approximately $3,957 as of

December 31, 2005 and approximately $3,183 at December

31, 2004.

Note 25 - Segment Information

We operate in six principal segments: Commercial Airplanes;

A&WS, Network Systems, Support Systems, and L&OS, col-

lectively IDS; and BCC. All other activities fall within the Other

segment, principally made up of Boeing Technology, Connexion

by BoeingSM and our Shared Services Group. Our primary

profitability measurements to review a segment’s operating

results are earnings from operations and operating margins.

Our Commercial Airplanes operation principally involves devel-

opment, production and marketing of commercial jet aircraft

and providing related support services, principally to the com-

mercial airline industry worldwide.

IDS operations principally involve research, development, pro-

duction, modification and support of the following products and

related systems: military aircraft, both land-based and aircraft-

carrier-based, including fighter, transport and attack aircraft

with wide mission capability, and vertical/short takeoff and

landing capability; helicopters and missiles, space systems,

missile defense systems, satellites and satellite launching vehi-

cles, and information and battle management systems.

Although some IDS products are contracted in the commercial

environment, the primary customer is the U.S. Government.

BCC is primarily engaged in supporting our major operating

units by providing selective financing solutions to our cus-

tomers and managing overall portfolio risk exposures.

Boeing Technology is an advanced research and development

organization focused on innovative technologies, improved

processes and the creation of new products. Financing activi-

ties other than BCC, consisting principally of four C-17 trans-

port aircraft under lease to the UKRAF, are included within the

Other segment classification.

While our principal operations are in the United States, Canada,

and Australia, some key suppliers and subcontractors are

located in Europe and Japan. Sales and other operating rev-

enue by geographic area consisted of the following:

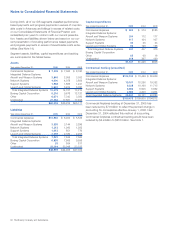

Year ended December 31, 2005 2004 2003

Asia, other than China $ 5,576 $ 6,091 $ 6,885

China 3,324 1,769 745

Europe 3,622 4,506 3,826

Oceania 1,362 1,032 1,944

Africa 1,011 625 670

Canada 833 644 639

Latin America, Caribbean and other 669 738 607

16,397 15,405 15,316

United States 38,448 37,052 34,940

Total sales $54,845 $52,457 $50,256

Commercial Airplanes segment sales were approximately 78%,

77% and 80% of total sales in Europe and approximately 77%,

90% and 90% of total sales in Asia, excluding China, for 2005,

2004 and 2003, respectively. IDS sales were approximately

18%, 20% and 16% of total sales in Europe and approximately

22%, 8% and 8% of total sales in Asia, excluding China, for

2005, 2004 and 2003 respectively. Exclusive of these amounts,

IDS sales were principally to the U.S. Government and repre-

sented 51%, 56% and 50% of consolidated sales for 2005,

2004 and 2003, respectively. Approximately 6% of operating

assets are located outside the United States.

The information in the following tables is derived directly from

the segments’ internal financial reporting used for corporate

management purposes.

Revenues

Year ended December 31, 2005 2004 2003

Commercial Airplanes $22,651 $21,037 $22,408

Integrated Defense Systems:

Aircraft and Weapon Systems 11,444 11,394 10,763

Network Systems 11,264 11,221 9,198

Support Systems 5,342 4,881 4,408

Launch and Orbital Systems 2,741 2,969 2,992

Total Integrated Defense Systems 30,791 30,465 27,361

Boeing Capital Corporation 966 959 991

Other 972 549 871

Accounting differences/eliminations (535) (553) (1,375)

Total revenues $54,845 $52,457 $50,256

82 The Boeing Company and Subsidiaries