Boeing 2005 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

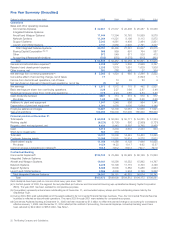

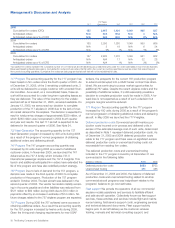

Management’s Discussion and Analysis

The decline in revenue of $1.4 billion in 2004 compared to

2003 was primarily due to new airplane model mix of $1.2 bil-

lion and net reductions of $132 million in other products.

Commercial jet aircraft deliveries as of December 31, including

deliveries under operating lease, which are identified by paren-

theses, were as follows:

Model 2005 2004 2003

717 13(5) 12(6) 12(11)

737 Next-Generation 212* 202* 173*

747 13 15 19(1)

757 2 11 14

767 10* 9(1) 24(5)

777 40 36 39

Total 290 285 281

*Intracompany deliveries were two 767 aircraft and two 737 Next Generation air-

craft in 2005, three 737 Next-Generation aircraft in 2004 and three 737 Next-

Generation aircraft in 2003

The cumulative number of commercial jet aircraft deliveries as

of December 31 were as follows:

Model 2005 2004 2003

717 150 137 125

737 Next-Generation 1,834 1,622 1,420

747 1,366 1,353 1,338

757 1,049 1,047 1,036

767 935 925 916

777 539 499 463

The undelivered units under firm order* as of December 31

were as follows:

Model 2005 2004 2003

717 5 18 22

737 Next-Generation 1,123 771 800

747 58 27 32

757 2 13

767 30 25 25

777 288 167 159

787 287 52

*Firm orders represent new aircraft purchase agreements where the customers’

rights to cancel without penalty have expired. Typically customer rights to cancel

without penalty include the customer receiving approval from its Board of

Directors, shareholders, government and completing financing arrangements. All

such cancellation rights must be satisfied or expired prior to recording a firm

order even if satisfying such conditions are highly certain. Firm orders exclude

option aircraft and aircraft with cancellation rights.

Operating earnings The $679 million increase in operating earn-

ings in 2005 over the comparable period of 2004 was primarily

attributable to earnings on increased revenue from new aircraft

deliveries of $265 million and increased revenue from aircraft

modification and other of $128 million. In addition, margin

improved $414 million mainly due to improved cost perform-

ance, which was offset by increased research and develop-

ment costs of $361 million and other period costs of $174

million, and a loss on the sale of Wichita, Tulsa and McAlester

operations of $68 million. In 2004, we also had charges of

$280 million resulting from the decision to complete production

of the 717 program and $195 million of 767 USAF Tanker pro-

gram charge. Refer to IDS Discussion on page 33.

The increase of $46 million in operating earnings in 2004 from

2003 was primarily attributable to $466 million from improved

program margins due to cost reduction initiatives and

decreased period costs offset by lower earnings from the

change in model mix of $205 million, 717 program termination

charge of $280 million, 767 USAF Tanker program charge of

$195 million and increased research and development expense

of $265 million. Additionally, in 2003 we had a goodwill impair-

ment charge of $341 million and a charge of $184 million

resulting from the decision to complete production of the 757

program.

Backlog The increase in backlog in 2005 compared to 2004

primarily relates to new orders for the 737, 777 and 787. The

increase in backlog in 2004 compared to 2003 was primarily

related to new orders for 777 and 787.

Accounting Quantity For each airplane program, we estimate

the quantity of airplanes that will be produced for delivery under

existing and anticipated contracts. We refer to this estimate as

the “accounting quantity.” The accounting quantity for each

program is a key determinant of gross margins we recognize

on sales of individual airplanes throughout the life of a program.

See “Application of Critical Accounting Policies-Program

accounting.” Estimation of the accounting quantity for each

program takes into account several factors that are indicative

of the demand for the particular program, such as firm orders,

letters of intent from prospective customers, and market stud-

ies. We review and reassess our program accounting quantities

on a quarterly basis in compliance with relevant program

accounting guidance.

Commercial aircraft production costs include a significant

amount of infrastructure costs, a portion of which do not vary

with production rates. As the amount of time needed to pro-

duce the accounting quantity decreases, the average cost of

the accounting quantity also decreases as these infrastructure

costs are included in the total cost estimates, thus increasing

the gross margin and related earnings provided other factors

do not change.

The estimate of total program accounting quantities and

changes, if any, as of December 31 were:

737 Next-

717 Generation 747 757 767 777

2005 156 2,800 1,424 1,050 971 800

Additions 400 24 12 100

2004 156 2,400 1,400 1,050 959 700

Additions/(deletions) 8 200 12 (16) 50

2003 148 2,200 1,388 1,050 975 650

The accounting quantity for each program may include units

that have been delivered, undelivered units under contract, and

units anticipated to be under contract in the future (anticipated

orders). In developing total program estimates all of these items

within the accounting quantity must be addressed. The per-

centage of anticipated orders included in the program account-

ing estimates as compared to the number of cumulative firm

orders* as of December 31 were as follows:

The Boeing Company and Subsidiaries 29